As NY Regulator Considered Title Insurance Rules, Industry Lobbying Spending Rose

As the Department of Financial Services finalized new title insurance regulations in 2017, title and property insurers spent roughly $658,0000 lobbying the legislature, Gov. Andrew Cuomo and DFS itself, disclosures on file with the Joint Commission on Public Ethics show.

March 06, 2018 at 02:44 PM

6 minute read

ALBANY — As the New York Department of Financial Services sought to regulate “unscrupulous practices” in the title insurance industry, title insurers increased their lobbying in the state, official disclosures reviewed by the New York Law Journal show.

As DFS finalized new title insurance regulations in 2017, title and property insurers spent roughly $658,000 lobbying the legislature, Gov. Andrew Cuomo and the Department of Financial Services itself, disclosures on file with the Joint Commission on Public Ethics show, a 57 percent increase from a year earlier. In 2016, the industry had spent just $419,000 on lobbying efforts, according to public records.

California-based First American Title Insurance Co. spent $156,000 on lobbying last year, hiring longtime Democratic strategist Hank Sheinkopf and Empire Advisors, whose managing director, George Haggerty, was the deputy secretary for financial services for Cuomo between 2012 and 2015. Haggerty is a real estate attorney based in Jericho, New York, and a name partner in Haggerty Munz. Fidelity National Title Group and its parent company, Fidelity National Financial Group based in Jacksonville, Florida, spent a combined $150,000 in lobbying, records show, hiring two firms with deep ties to the Legislature.

By comparison, title insurance organizations spent $393,000 on lobbying in 2015 and $269,000 in 2014, disclosures filed with the Joint Commission on Public Ethics show.

In a statement to the New York Law Journal on Tuesday afternoon, DFS Superintendent Maria Vullo knocked the title insurance industry, saying the regulations protect prospective homeowners from higher closing costs.

“Missing from the industry's massive lobbying efforts are all of the future homebuyers and homeowners who need to refinance their mortgages and who do not have the means to hire high-powered lobbyists and attorneys to represent their interests. If all homebuyers had lobbyists working on their behalf, their numbers would significantly outweigh the industry's efforts. Consumers are the beneficiaries of DFS's Regulation 208 and they will benefit from lower closing costs. DFS has balanced all interests and has taken into consideration the comments of all interested stakeholders to accomplish important reforms to promote a level playing field in the industry and eliminate unlawful expenses that have gratuitously driven up rates,” Vullo said.

But Bob Treuber, executive director of the New York State Land Title Association, an industry trade group, said the increase in lobbying expenses shows how dire the new regulations are for the industry.

“The New York State Land Title Association has been truly focused on explaining to lawmakers and stakeholders about the devastating impact of these regulations. We are not exaggerating when we say that for many companies across New York, this is a matter of survival, and, unfortunately, we are seeing more pink slips as well as more 'Going Out of Business' announcements,” Treuber told the New York Law Journal.

The increase in spending came as Cuomo and Vullo introduced new regulations in May to limit ancillary fees that title agents or title insurers may charge customers at closing, and said the new rules would help trim closing costs. The regulations were born from a 2015 investigation by the department, which found that title insurance companies, real estate agents and others who order title insurance on behalf of clients spent millions of dollars on incentives to attorneys and real estate agents that officials charged to consumers as marketing costs.

Numerous consumer groups advocated on behalf of regulating the title insurance industry in state legislature and in Congress. In 2013, J. Robert Hunter, insurance director of the Consumer Federation of America, testified before then-DFS Superintendent Benjamin Lawsky in favor of more regulation, arguing that New York consumers were paying excessive premiums to offset ”marketing costs.”

The regulations were finalized in late October and provided a list of prohibited expenditures, which include tickets to sporting events, concerts, as well as gifts and outings. Another title insurance regulation finalized at the same time requires title insurance companies and agents that generate a portion of their business from affiliations to function separately and independently from any other affiliates. Title insurance companies and agents must be able to accept business from other sources as well.

Days before the regulations were slated to go into effect in mid-December, a trio of lawmakers asked DFS to delay the new rules for six months, arguing that the new rules “will significantly destabilize an industry that has stability, reliability and predictability at its very core.”

Vullo later agreed to delay implementation of a portion of the regulation that deals with prohibition on inducements for future title insurance business and permitted expenses on Feb. 1, 2018, rather than the scheduled date of Dec. 18, 2017.

The effects of the new regulations have been “dramatic and immediate,” Treuber said. A survey by the New York State Land Title Association of their members found that revenues have decreased between 10 percent and 30 percent and prompted layoffs.

“Many mom-and-pop shops say they are trying to figure out how to survive. They are making drastic decisions, like being forced to enact pay cuts, asking staff to adsorb increases in health care premiums and eliminating 401(k) matches. For New York consumers, this will lead to less competition, the loss of experienced professionals, and the potential for delayed home closings. All in all, not a positive move for New York's housing market,” Treuber said.

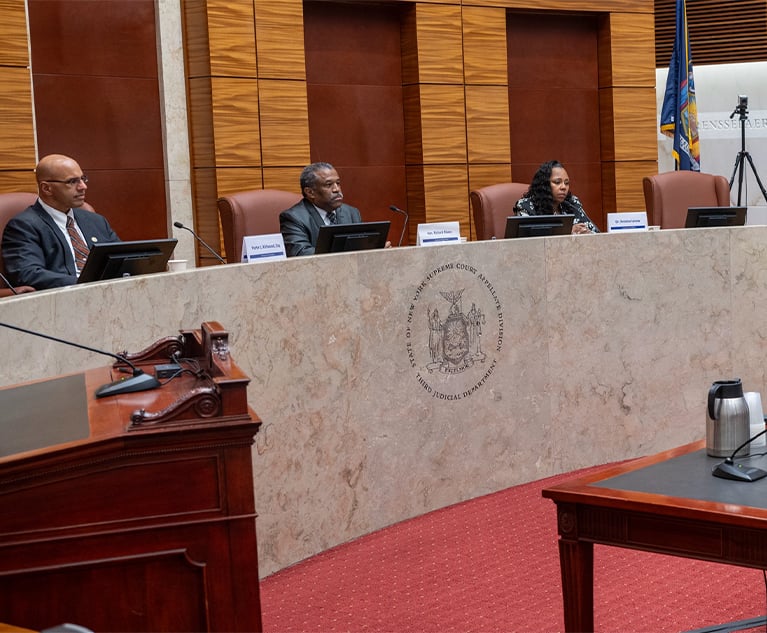

The regulations have become so contentious that the New York State Land Title Association and two other title insurance organizations asked the State Supreme Court last month to strike down the regulations because it “wreak[s] havoc on title insurance corporations, title insurance agents, and title closers across the state of New York.”

Michael Harrison, who runs the Hamlet Title Agency in Lake Ronkonkoma on Long Island, said the regulations have been “devastating” to his business. Initially, his title insurance agency had seven full-time working employees, Harrison told the New York Law Journal on Tuesday. That number has gone down to three full-time and two part-time employees due to the DFS regulations, he added.

“I can't see us being in business for three more months at this point,” Harrison said, saying that the regulations were a “slow death” for the industry. “If that's the real intent, then just do it. If you want to dictate to us that you don't want us to be in business, just do it,” he added.

This story has been updated with comment from the Department of Financial Services.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

'Reluctant to Trust'?: NY Courts Continue to Grapple With Complexities of Jury Diversity

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250