Weinstein Co. Bidder Weighs Offer in Wake of Studio's Bankruptcy

Details of Lantern Capital Partners' stalking-horse bid to buy Bob and Harvey Weinstein's namesake film studio came into focus early Tuesday, just hours after The Weinstein Co. filed for Chapter 11 bankruptcy protection in Delaware.

March 20, 2018 at 05:23 PM

4 minute read

The original version of this story was published on Delaware Business Court Insider

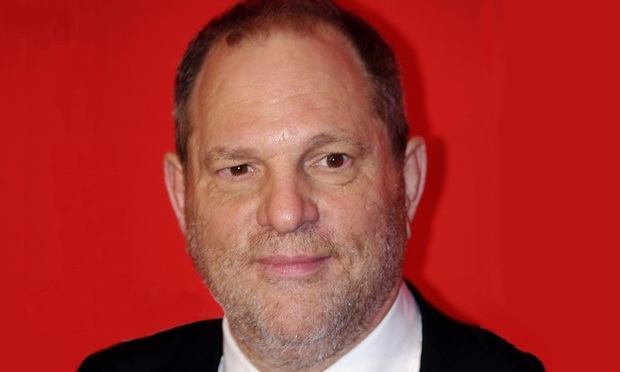

Harvey Weinstein. Photo credit: David Shankbone

Harvey Weinstein. Photo credit: David Shankbone Details of Lantern Capital Partners' stalking-horse bid to buy Bob and Harvey Weinstein's namesake film studio came into focus early Tuesday, just hours after The Weinstein Co. filed for Chapter 11 bankruptcy protection in Delaware.

According to court documents, the Dallas-based private equity firm is offering to take on some of the debt left by the production company—which was plunged into dire financial straits in the wake of serial revelations about Harvey Weinstein's sexual misconduct—and pay $310 million in cash to acquire its legacy assets, which include a television business and library of 277 films. The studio said in the filings that it expects to see $151 million in net cash flows for its catalog of movies in 2018, and revenue for its TV division is projected to hit $255 million.

But the filings also revealed the extent to which allegations of sexual misconduct by Harvey Weinstein have crippled The Weinstein Co.'s bottom line, raising doubts about whether a better offer exists and calling into question an effort by New York's attorney general to ensure that Weinstein's victims are compensated for the alleged abuses they suffered at the hands of the disgraced film producer.

In a Chapter 11 petition filed just before midnight Monday night, The Weinstein Co. listed both assets and liabilities between $500,000 and $1 billion. But filings early Tuesday painted a grim financial picture, as attorneys asked a judge to approve orders that would allow the New York-based debtor to pay its employees and its bills, as the formal 363 process unfolds in the U.S. Bankruptcy Court for the District of Delaware.

According to the documents, The Weinstein Co. has lost 25 percent of its workforce since accusations of sexual assault and harassment began to surface against Harvey Weinstein in early October. The defections also included five members of The Weinstein Co. board, leaving just four directors—including Harvey's brother, Bob Weinstein—currently in place.

Harvey Weinstein, who has denied allegations of engaging in nonconsensual sex, was fired from the company last October and has since been expelled from the Academy of Motion Picture Arts and Sciences in the wake of the scandal.

The company has meanwhile lost millions in production and distribution agreements amid the backlash, which has sparked the nationwide #MeToo movement. As of Monday, The Weinstein Co. attorneys said the company had less than $500,000 in cash on hand.

A hearing was scheduled for 4 p.m. Tuesday on The Weinstein Co.'s requests that it be allowed to meet its immediate obligations to continue as a going concern.

Monday's filing followed a breakdown in negotiations earlier this month between New York Attorney General Eric Schneiderman and a group of investors, spearheaded by Maria Contreras-Sweet, which had offered to assume $225 million in The Weinstein Co. debt and contribute $275 million to launch a new woman-led company. According to media reports, the talks included a settlement fund of up to $90 million to pay Weinstein's victims.

Under the agreement with Lantern, lawsuits pending against The Weinstein Co. would be halted, though the women who have sued the studio over Harvey Weinstein's alleged misconduct would be able to pursue their interests on a committee of unsecured creditors in bankruptcy.

However, the compensation claims of accusers, as unsecured creditors, would have priority behind those of banks and other institutions that loaned money to the company. It was unclear on Tuesday whether Lantern's offer would provide enough funds to cover victims' claims, or if the studio could obtain a better offer.

Under The Weinstein Co.'s proposed schedule, bids would be due by 5 p.m. EST on April 30.

The Weinstein Co. also said Monday that it has agreed to void all of its nondisclosure agreements as part of its negotiations with Schneiderman, whose office sued the company and its two founders, brothers Harvey and Bob Weinstein, under a broad provision of New York law that authorizes the state to file suit against a company for “fraudulent or illegal acts” perpetrated against its citizens.

In a statement, Schneiderman called the deal a “watershed moment” for addressing sexual misconduct in the workplace and said his office would continue to ”engage with all parties, including The Weinstein Co. and Lantern.”

Schneiderman's lawsuit and related investigations would remain open and ongoing, he said.

The Weinstein Co. is represented by lawyers from the New York office of Cravath, Swaine & Moore and Delaware's Richards, Layton & Finger in the bankruptcy proceedings.

The case has been assigned to Mary F. Walrath, who joined the court in 1998 and served as chief judge from 2003 to 2008.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

New York Court of Appeals Blocks Trump Attempt to Stay Friday Sentencing

Balancing Judicial Authority: Understanding Sanctions, Severance, and Interferences

8 minute read

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250