Rapper DMX Receives 1-Year Prison Sentence for Tax Evasion

DMX, 47, was convicted of not paying $1.7 million in taxes between 2002 and 2005.

March 28, 2018 at 07:06 PM

4 minute read

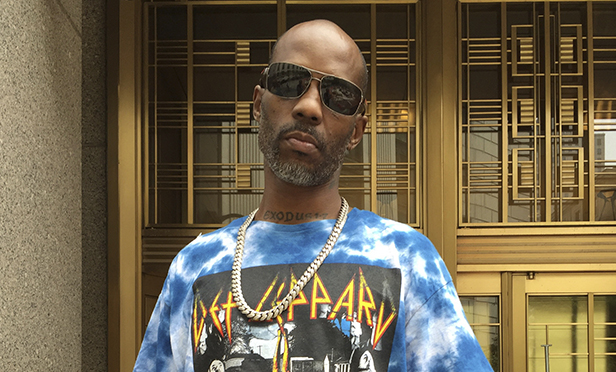

DMX, the rapper also known as Earl Simmons, leaves Manhattan federal court in August 2017 after an appearance in his tax fraud case. Photo: AP/Larry Neumeister.

DMX, the rapper also known as Earl Simmons, leaves Manhattan federal court in August 2017 after an appearance in his tax fraud case. Photo: AP/Larry Neumeister. Playing the music video for one of his own hit songs for a federal judge at a sentencing Wednesday did not spare rapper Earl Simmons, better known as DMX, from receiving a one-year prison term for tax evasion.

But Simmons' defense team said playing the video for DMX's 1998 song “Slippin',” in which the rapper describes his struggles early in life and his desire to improve himself, may have been a factor in swaying U.S. District Judge Jed Rakoff of the Southern District of New York from taking the government's recommendation of up to five years in prison.

“I think the judge saw visually just the type of life he lived,” said defense attorney Murray Richman, who told reporters that he was not pleased but “not totally dissatisfied” with the sentence.

Simmons, 47, was convicted of not paying $1.7 million in taxes between 2002 and 2005.

Simmons pleaded not guilty after he was arrested and indicted in July and, at the time, Richman said his client had relied on hired hands to take care of his tax obligations while he focused on his work in music and film.

Simmons later changed his tune and, on Nov. 30, pleaded guilty to one count of tax evasion. Simmons' bail was revoked in January for violating the terms, and he has been incarcerated since.

Simmons appeared in the courtroom in a blue jail uniform and occasionally turned to family sitting in the courtroom. While he addressed the court, Simmons took responsibility for not paying his taxes, saying he did not willingly plot to cheat the government “like a criminal in a comic book,” and briefly choked back tears when he mentioned his youngest child, who was in the courtroom.

“I hired people and I didn't follow up, and I knew that I should have,” Simmons said.

In a statement issued after the sentence, interim Southern District U.S. Attorney Geoffrey Berman said Simmons “stole from the American taxpayers when he earned millions of dollars but failed to pay any taxes on his income.”

“Today's sentence shows that star power does not entitle people to a free pass,” Berman said.

In a sentencing memo filed last week, Assistant U.S. Attorney Richard Cooper urged Rakoff to use Simmons' sentencing to “send a message” that “star power does not entitle someone to a free pass,” noting Simmons earned a substantial income after the subject period and that his songs still get played.

“The defendant's crime was a brazen one,” prosecutors said in the memo. “He earned millions of dollars in recent years, including personally receiving stacks of cash at the end of musical performances.”

Additionally, Simmons' criminal history is both long and varied, prosecutors argued, containing 29 different offenses spanning three decades, including jumping turn styles and firearm charges.

But Simmons' defense team, which also included Stacey Richman and Renee Hill of Richman Hill & Associates, emphasized in court filings and at the sentencing the challenges that their client faced during his upbringing. Simmons grew up with an abusive mother and without a father in the household. He was first arrested when he was 15 years old.

Probation and Pretrial Services recommended that Simmons receive a three-year sentence while his defense team pushed for no jail time.

In imposing the sentence, Rakoff agreed with the government that Simmons' case was a “brazen and blatant” example of tax evasion, but said he also considered Simmons' hardscrabble background in his calculation, saying that the “sins of the parents are visited on the child.”

“Mr. Simmons is a good man but a far from perfect man,” Rakoff said. “In many ways, as he has said, he's his own worst enemy.”

In addition to the prison term, Simmons was sentenced to three years of supervised release. Rakoff imposed no fines for Simmons, but imposed $2.2 million in restitution.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Justice 'Weaponization Working Group' Will Examine Officials Who Investigated Trump, US AG Bondi Says

Lawyers Across Political Spectrum Launch Public Interest Team to Litigate Against Antisemitism

4 minute read

'Landmark' New York Commission Set to Study Overburdened, Under-Resourced Family Courts

Trending Stories

- 1Former NY City Hall Official Tied to Adams Corruption Probe to Plead Guilty

- 2Wilmer, White & Case, Crowell Among the Latest to Add DC Lateral Partners

- 3Advance Auto Parts Hires GC Who Climbed From Bottom to Top of Lowe's Legal Department

- 4Judge Rules Georgia Railroad Can Seize Land as Landowners Vow to Fight

- 5On the Move and After Hours: Einhorn Barbarito; Gibbons; Greenbaum Rowe; Pro Bono Partnership

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250