Willkie Farr Grows Partner Bench After Record 2017

Willkie boasted its best-ever performance across all key financial metrics in 2017.

March 29, 2018 at 03:10 PM

4 minute read

Photo Credit: Diego M. Radzinschi/ALM

Photo Credit: Diego M. Radzinschi/ALM Fresh off a record financial year, Willkie Farr & Gallagher has added a string of partners in the first quarter in New York, London and Houston.

In one of its latest additions, Willkie Farr said this week that it had hired Mark Proctor, who advises fund managers on structuring, establishing and operating private investment funds.

Proctor, who was most recently leader of the fund formation practice at Vinson & Elkins, previously served as a vice president and associate general counsel at Goldman Sachs & Co.

Willkie also added New York tax partner Russell Pinilis, who joined from KPMG in early March; Houston-based energy transactions lawyer Steven Torello in February, arriving from DLA Piper; and Simon Osborn-King in London, who joined this month from Slaughter and May.

“When you have tremendous financial success,” said Willkie co-chairman Steven Gartner, “you become a more attractive venue.” Gartner added Willkie is on the radar of more laterals and has seen more inquiries about potential moves.

“When you have tremendous financial success,” said Willkie co-chairman Steven Gartner, “you become a more attractive venue.” Gartner added Willkie is on the radar of more laterals and has seen more inquiries about potential moves.

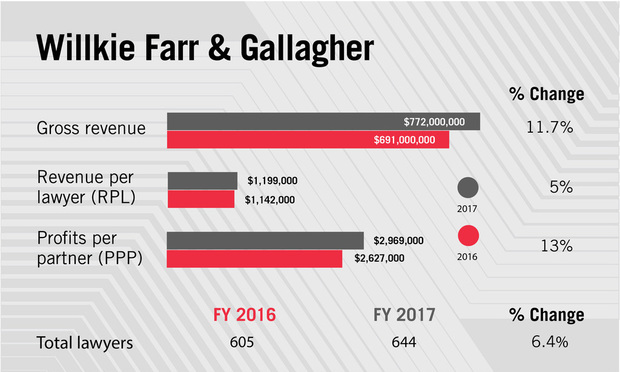

The firm said it beat its prior performance across all key metrics in 2017. Gross revenue rose nearly 12 percent to $772 million; profits per partner rose 13 percent to $2.969 million, and revenue per lawyer rose 5 percent to $1.199 million, according to preliminary ALM reporting.

The firm increased its profitability even as it boosted its size, with total attorney head count rising 6 percent to 644 lawyers. The firm's equity partners ranks increased by 3 partners, to 145.

Gartner said private equity and mergers and acquisitions work were key drivers of the growth, but litigation, restructuring and asset management were also “big contributors.” He said there was substantial contribution from the firm's London, Frankfurt and Paris offices.

In particular, the firm's London office generated $53 million in revenue, up from $36 million in 2016, the firm said. The London office has more than 50 lawyers focused on compliance and enforcement, insurance, asset management, restructuring, private equity and antitrust.

While sharp billing rate increases are a strong driver of revenue growth for many New York firms, Gartner said Willkie's rate increases were “a small part” of the revenue rise, as the firm saw total hours billed increase.

Co-chairman Tom Cerabino said in a statement that the firm had a very busy fourth quarter, “which bodes reasonably well for 2018.”

In 2017, Willkie represented private equity clients including Aquiline Capital Partners, Centerbridge Partners, FFL Partners, Genstar Capital, Insight Venture Partners, The Sterling Group, Warburg Pincus, Ardian, IK Investment Partners and PAI Partners in many transactions.

Willkie's M&A team advised internet provider Level 3 Communications when it was acquired for $34 billion by telecommunications company CenturyLink, while the firm's restructuring group represented Brookfield Business Partners in its pending acquisition of Westinghouse Electric Co., the bankrupt nuclear services company, for $4.6 billion.

On the litigation side, the U.S. Court of Appeals for the Second Circuit in July reversed the convictions of Willkie client Anthony Allen and Anthony Conti, former Rabobank traders, in a LIBOR manipulation case. And Willkie dove into pro bono work related to some of President Donald Trump's executive orders, including representing an Iranian child traveling to the United States for eye surgery and filing an amicus brief to enjoin enforcement of Trump's amended travel ban.

Gartner said the firm is in discussions with other potential laterals, but has no other imminent additions to announce. In the long run, Willkie has become more receptive to group additions, Gartner said, after hiring a 12-partner insurance sector transactional team from Dewey & LeBoeuf in 2012. Gartner laid out the benefits of group hires: “You get cohesiveness, a client base, not leaving behind people who will compete with you, it's easier to bolt on,” he said.

Gartner said some of the firm's hiring in the last two years was replenishing the firm's ranks after retirements, but most of the additions have been aimed at “adding strength.”

Meanwhile, Gartner brushes off questions about potential merger talks with other firms. “I would never say never,” he said, but there's very little interest in a merger, given our recent and anticipated financial success.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

AI and Social Media Fakes: Are You Protecting Your Brand?

Big Law Sidelined as Asian IPOs in New York Are Dominated by Small Cap Listings

Sullivan & Cromwell Signals 5-Day RTO Expectation as Law Firms Remain Split on Optimal Attendance

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250