Katten, on Hiring Spree, Adds IP Litigator From Alston & Bird

Other Alston & Bird lawyers may join Deepro Mukerjee in his move to Katten Muchin Rosenman, which has already hired about 30 lateral partners firmwide this year.

April 18, 2018 at 04:13 PM

4 minute read

Continuing a spate of group hires in 2018, Katten Muchin Rosenman has brought on a prominent IP litigator in New York, Deepro Mukerjee, from Alston & Bird, and could be adding other attorneys as part of his team.

Other attorneys from Alston could join him. Mukerjee, who has a strong litigation record representing Mylan Pharmaceuticals and other pharmaceutical companies, was a leader of Alston's life sciences and pharmaceutical patent litigation practice. While the firm has yet to announce his move, Katten CEO Noah Heller confirmed Mukerjee's hiring on Wednesday. Mukerjee was not immediately available to comment.

The hiring from Alston is the latest partner expansion for Katten, which has been on a recruiting spree in 2018. A five-partner restructuring team from Curtis, Mallet-Prevost, Colt & Mosle, including Steven Reisman, joined Katten in the last month. And Katten hired seven partners from Andrews Kurth Kenyon to launch a Dallas office in February.

Altogether Katten has already hired about 30 partners firmwide this year, the firm said, up from 16 in all of 2017. But Heller said the large group moves have been in the works for a while, noting it can take more than a year for the firm to develop relationships with potential laterals and to make sure both sides are comfortable.

“I view it as fortuitous that these things are coming together on a similar timing,” Heller said of the firm's 2018 hires.

According to his former Alston profile, Mukerjee specializes in Hatch-Waxman litigation and has handled patent and other IP disputes related to pharmaceutical compounds, biotechnology processes, computer software and other technologies. Clients include several pharmaceutical, life sciences and technology companies, diagnostic laboratories, medical device companies and metropolitan universities.

Heller said Katten anticipates “Deepro to generate significant revenue for the firm in the pharmaceutical space,” where the firm tends to represent generic manufacturers.

In a statement, Keith Broyles, co-chair of Alston's IP group, suggested the firm was not upset to see Mukerjee go.

“We concluded that it would be best to part ways with Mr. Mukerjee. We bid him farewell,” the statement said. Broyles did not elaborate, and Mukerjee was not immediately available to comment.

Heller said that Katten is dedicated to expanding its New York office, above all other markets. He said the restructuring and IP litigation hiring in New York feeds into the firm's focus on transactional matters and high-stakes litigation.

According to preliminary American Lawyer reporting, Katten's gross revenue grew about 3.7 percent to $574 million and average profits per equity partner stayed flat around $1.57 million in 2017.

In common with other firms such as Cozen O'Connor and Winston & Strawn, Katten generally prefers group hires. “It makes clients much more comfortable making the move to a new firm when the group of lawyers is intact,” Heller said.

Heller acknowledged a “certain amount of ramp-up time” for group hires to be effective, but the groups “are investments” for medium and long-term growth, he said. “All of these additions are intended to broaden and deepen the actual expertise of the firm, which over time we expect to have a material benefit to both our revenue and profit,” he added.

While not equivalent in volume to its partner hiring, Katten has also seen some partner departures in 2018. For instance, Angela Batterson, a banking and finance partner, left for Jones Day in January and Darius Goldman, who was head of distressed debt and claims trading, left Katten to launch an investment shop.

While Katten's hiring has attracted attention in the legal industry, the firm has also been in the headlines in the last year due to the criminal trial of former partner Evan Greebel. He was convicted in December of conspiracy to commit wire fraud and conspiracy to commit securities fraud while advising ex-pharmaceutical CEO Martin Shkreli, who was found guilty of securities fraud. Brooklyn federal prosecutors argued that Greebel, who at one point was the highest-paid income partner at Katten, saw Shkreli as his “meal ticket” for money and advancement at Katten. Greebel joined Kaye Scholer in 2015, before his indictment.

Heller declined to comment on Greebel's case, citing the pending litigation and the possibility of an appeal. However, he said, “as a law firm leader, you learn lessons from every experience you have” and one of his top responsibilities is managing risk.

“To be best of breed when it relates to management of risk, that's essential for the long-term performance of Katten,” Heller said. Any “bad experience” is a learning opportunity, he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

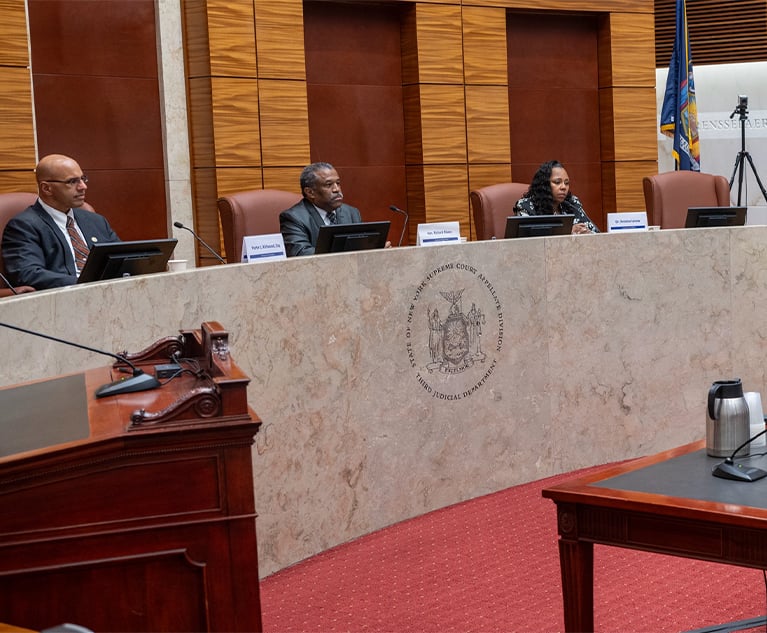

'Reluctant to Trust'?: NY Courts Continue to Grapple With Complexities of Jury Diversity

Trending Stories

- 1How Some Elite Law Firms Are Growing Equity Partner Ranks Faster Than Others

- 2Fried Frank Partner Leaves for Paul Hastings to Start Tech Transactions Practice

- 3Stradley Ronon Welcomes Insurance Team From Mintz

- 4Weil Adds Acting Director of SEC Enforcement, Continuing Government Hiring Streak

- 5Monday Newspaper

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250