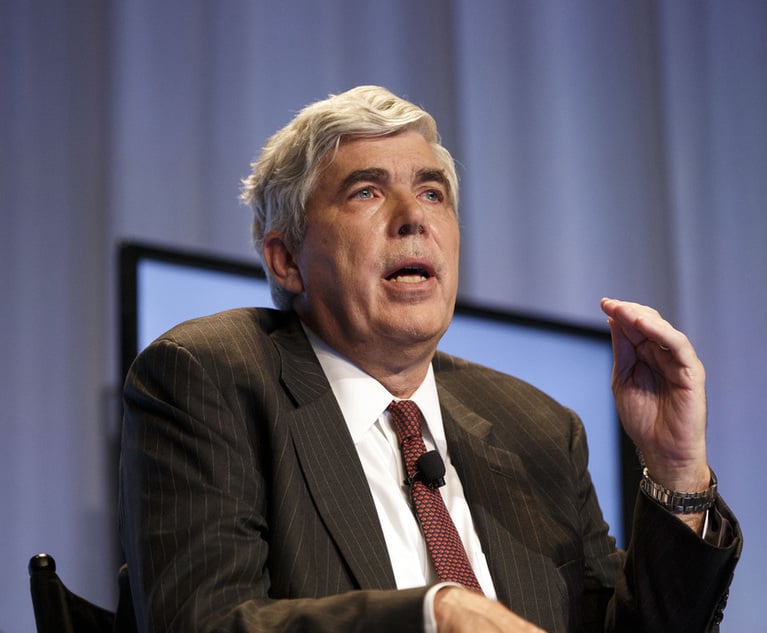

Jon Feigelson of NY's iCapital on His Move From Big Finance to Fintech

Feigelson, the GC of iCapital, says he's faced challenges unique to smaller, growing legal departments and taken on responsibilities in human resources since joining the company in October 2017.

May 30, 2018 at 12:24 PM

9 minute read

The original version of this story was published on Corporate Counsel

After spending more than a decade in-house at large financial service companies, Jon Feigelson joined fintech platform iCapital as general counsel in October 2017.

As GC of iCapital, which currently manages $5.2 billion in platform assets, Feigelson has faced challenges unique to smaller, growing legal departments and taken on responsibilities in human resources. He's also brought in skills from previous in-house roles at TIAA, ABN AMRO Bank and Goldman Sachs.

Corporate Counsel spoke with Feigelson about his new role, iCapital's growing legal team and fintech regulations. This interview has been edited for clarity and length.

What drew you to iCapital?

I spent most of my career at large financial services firms, 10 years at TIAA as the general counsel, a few years as general counsel at ABN North America, Goldman Sachs before that. While I had great experiences at all those companies, for a long time I had a hankering to move to a much more entrepreneurial environment, where I felt like my impact would have a much broader reach. So I spent a couple years looking for a position that would sort of meet the criteria. Ultimately I came upon iCapital.

What attracted me to iCapital was a number of things. The most important, aside from the tremendous business opportunity I thought the company had, was the quality of the leadership, management, staff across the board. I was very surprised and impressed to find leadership in a variety of positions from Goldman Sachs and Credit Suisse, BlackRock and Morgan Stanley, all the major financial services companies, people who had very long and distinguished track records at these companies. It reminded me a little bit of the quality of the people I worked with during my time at Goldman. So that and the business opportunity were the two main draws.

You've spent most of your career at large, traditional financial service firms. How is your in-house role different at iCapital? How is it similar?

The day to day is really different. For example, at TIAA I had a staff of roughly 100 people. Eighty of them were lawyers, give or take. I spent most of my time there managing direct reports and diving into big issues that could potentially affect the company across the board, dealing with board members and the executive team. But it was not as much time getting your hands dirty, so to speak. Rolling up your sleeves. Being at iCapital is very different in that regard. I have a team of about four, maybe five depending on how you count them, and we're bursting at the seams in terms of the new funds we're launching all the time, the new relationships we're forming.

I spend a lot of my time negotiating deals, working on deals and developing the language in our documents, especially the really important provisions, much more so than I used to. It's much less time managing a team, because it's a much smaller team.

Those are the differences. The similarities, I think, are the way you think about solving problems and risk issues is really, at least for me, not that different for a small firm as it is at a big firm. And whether it's a company of roughly 100, which we are, or a company of 12,000, which TIAA was, a FINRA question is a FINRA question. A litigation question is a litigation question. An employee HR question is an employee HR question. That's where the size difference becomes not significant.

Speaking of HR, you're also iCapital's head of human resources. How does that role overlap with GC?

It doesn't overlap so much, other than when there's a legal issue that comes up, running HR. HR is a lot of policy and culture issues if you will, and to a lesser extent legal issues or regulatory issues, so they don't overlap that much. I think the reason I was asked to be responsible for HR here was based on my experience having been general counsel at a large company for such a long period of time. I had a familiarity with what a good HR function looks like, how to do a gap analysis and look at what we need to have in place, and what would be appropriate for a smaller company. We have a terrific head of HR here who reports to me and essentially runs it day to day. I'm more there in the background to supervise and give general guidance and oversight.

I've seen quite a few GCs take on HR responsibilities in recent months. What advice would you have for in-house lawyers taking on this added role?

Unless they have substantial experience dealing with the wide variety of HR issues from their current or previous roles that they ought not do it because it's a very different animal than being a general counsel. But to the extent that they do, I would generally advise them to do the same thing that I do in the legal context, which is know what [the HR] program should look like. The best way to start is to do a gap analysis of what you have and what you don't have and then plan for putting in place what's not there, starting with the highest priorities and working your way down the list.

iCapital is growing fast. Is the legal department growing with it?

We are growing. We are about to bring on a new lawyer in two or three weeks. Very excited about that. I anticipate in the next three to six months we will hire another lawyer, maybe another compliance officer. So I think we're growing at the right rate.

One of the most important things that I can do for the company is make sure we're growing at the right rate. You need to be able to comfortably conduct business at the [company] at a sufficiently brisk pace, and also make sure that your compliance function can handle the growth and complexity of the business and staff, but at the same time not overdo it because expenses are something we keep an eye on as a growing company.

You're one of the company's first GCs. How are you shaping the GC role at iCapital and the legal department more broadly?

The most effective GCs are the GCs who are highly involved with the business or at least have a deep and comprehensive idea of what the business is trying to achieve. I don't think you can give the best advice unless you have a refined understanding of what the business is and what it's trying to be. So I made it a point from the day I joined to immerse myself in understanding all that in every department, from IT to distribution.

That doesn't mean I spend most of my days doing deals or selling products, but it means that I can have a pretty sophisticated conversation with everyone in the company about their needs and what the risks of those needs are from a legal compliance perspective.

In terms of managing the function overall, I see my role as making sure that we have just the right number of lawyers and compliance officers to support an incredibly fast-growing company but not to over or under do it.

The fintech market is also relatively young, and doesn't always have clear regulations. How do you navigate that?

People consider us a fintech company, and we are, in a lot of ways. Our technology is a big driver of our business success and the technology we're able to provide to our clients is a lot of the reason we have those clients. But we're not the typical fintech company, in terms of generally people think of companies in the banking industry providing payment systems or processing systems for payments.

We still fit in some ways into the traditional regulatory environment, where the rules are pretty clear. We are a broker-dealer. The broker-dealer rules are pretty clear in our space. We're a registered investment adviser and the rules around what an investment adviser can or can't do and its duties and obligations are pretty clear in the security space where we operate.

What's different about us and where the creatively comes in is how we keep our business model as low risk as possible, operating within that regulatory construct. And we are unique in that regard, in that while we're an investment adviser and broker-dealer, our business model doesn't really require us to give business advice. It doesn't require us to have company assets, it doesn't require us to have customer accounts on our broker-dealer and it doesn't require us to use investment discretion in advising our clients.

Being able to maintain that operating model allows us to grow at a much faster rate than we otherwise would without worrying about the additional risks we would be taking on because those areas that we're not responsible for are the areas that the SEC and FINRA are most focused on. The regulations are actually pretty clear, they're not that opaque or gray, but our business model is unique and allows us to operate in that regulatory environment without taking on much of the risk that most broker-dealers and investment advisers do.

Anything else you'd like to add?

It's going to be really interesting to see what [the hedge fund] industry looks like in the upcoming years. I think you're going to see in a year from now a very different model. Two years ago, it was still an entirely paper-based industry. It's on the way to becoming an entirely web-based industry and we're leading the charge. That's our leading edge and that's why we're continuing to grow at the rate we grow. We're bringing [the] private equity and hedge fund world into the 21st century.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'A World of Credit': Ex-FTX Executive Gary Wang Sentenced to Time Served Following Cooperation

Trump's SEC Likely to Halt 'Off-Channel' Texting Probe That's Led to Billions in Fines

US Judge Told Archegos Founder Can't Afford What Defense Says Is 'Unjustified' $10 Billion Restitution

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250