Carl Icahn Ordered to Resume Deposition in Wachtell Malpractice Case

Wachtell said questioning the investor and former President Donald Trump adviser about energy policy is relevant to his credibility, arguing Icahn-controlled CVR Energy sued the firm because "he does not like Wachtell. It was brought as payback."

August 09, 2018 at 02:57 PM

5 minute read

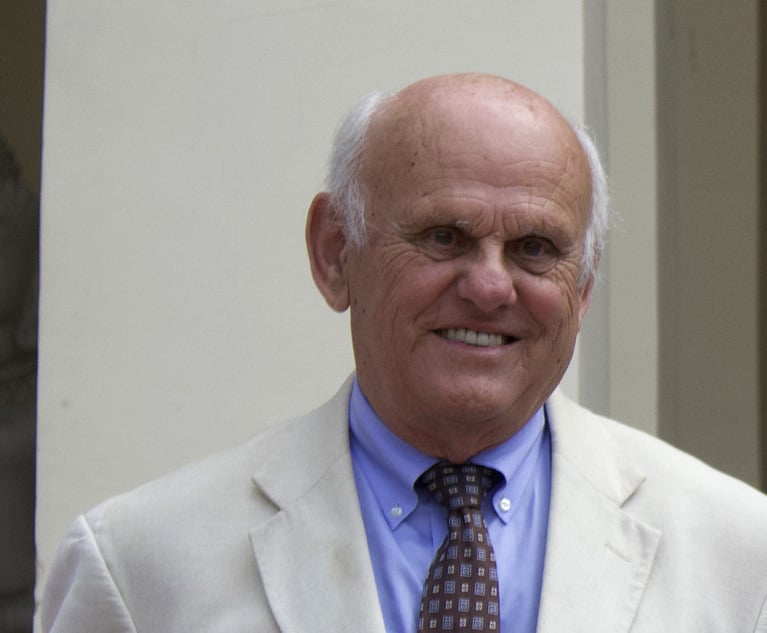

Billionaire activist investor Carl Icahn speaks with attendees during a charity event in New York on May 19, 2015. Photo: Victor J. Blue/Bloomberg LP

Billionaire activist investor Carl Icahn speaks with attendees during a charity event in New York on May 19, 2015. Photo: Victor J. Blue/Bloomberg LP

After Carl Icahn bristled at a deposition last month by Wachtell, Lipton, Rosen & Katz that touched on renewable energy policy—a controversial subject due to Icahn's former adviser role to President Donald Trump—a federal judge on Thursday said there was no basis to terminate it and ordered the activist investor to resume the deposition.

“You don't just get to terminate on relevance grounds and make additional arguments after the fact,” U.S. District Judge Richard Sullivan of the Southern District of New York told Herbert Beigel, CVR Energy's attorney.

CVR Energy, a refining and fertilizer business controlled by Icahn, is suing Wachtell for malpractice, alleging the firm failed to advise that CVR would face claims by Deutsche Bank AG and The Goldman Sachs Group Inc. for $36 million under the terms of engagement letters with the banks. CVR hired the banks as financial advisers in an unsuccessful attempt to fend off a 2012 acquisition by Icahn. CVR is also alleging that the U.S. Securities and Exchange Commission initiated an investigation of the company about certain disclosures that Wachtell negligently prepared.

CVR's counsel ended a deposition of Icahn by Wachtell last month when the law firm began to ask Icahn questions about renewable energy standard regulations that require refiners to either blend renewable fuels into their transportation fuels or purchase renewable fuel credits, known as RINs, in lieu of blending.

Icahn, who has personally argued for overhauling the program, was a special adviser to Trump on regulatory reform. (He ended that role in August 2017, amid controversy surrounding ethical conflicts.). Last year, eight U.S. senators reportedly called for a federal investigation, suggesting that CVR timed its buying and selling of credits based on information that Icahn had about upcoming policy changes. Icahn has been subpoenaed by Southern District prosecutors, according to press reports.

'Payback' to Wachtell

After Sullivan ordered the parties to appear in court about Icahn's terminated deposition, Beigel, CVR's lawyer, told the judge on Thursday that the RINs concerned a lobbying effort by Icahn as a “private citizen” to help CVR and it has become “a subject of a criminal investigation” by the U.S. Attorney's Office that led to a subpoena.

Beigel said CVR, with separate counsel, has cooperated with the request and the U.S. Attorney's Office has made no claims.

Beigel told Sullivan there could be no good faith basis for Wachtell to ask Icahn about RINs and it could only be meant to harass or oppress him.

But Michael Shuster, Wachtell's counsel and a partner at Holwell Shuster & Goldberg, told Sullivan that Wachtell takes its case and the claims “very seriously” and that everything the firm is doing is meant to defend itself. Part of defending the claims is addressing the credibility of witnesses, Shuster said.

“The credibility of Icahn is directly relevant” to the malpractice case, Shuster said.

Noting the letter from some senators, Shuster said there is an allegation that Icahn abused his position to achieve a certain outcome. Shuster said the RIN issue goes to Icahn's “credibility and honesty” and ability to abuse his position to achieve his own ends.

Wachtell thinks Icahn brought the case out of animosity, Shuster said. “He does not like Wachtell. It was brought as payback,” Shuster said, noting Wachtell's previous interaction with Icahn in other matters.

(Lions Gate Entertainment Corp., like CVR, was represented by Wachtell and investigated by the SEC in connection with his takeover attempt, Shuster has said in court documents.)

“We want to defend this case on the merits” and “attack the credibility of the witness,” Shuster said. “We're entitled to ask questions that go to his credibility.”

The parties also tussled before Sullivan over whether Icahn is a witness and whether he would be called at trial. Beigel said he isn't a fact witness, but Shuster said he has seen records showing Icahn was directly involved in the matters at issue in the malpractice case.

Sullivan told Beigel that the fact that he didn't discuss the subject matter with Icahn before the deposition or didn't know about the subject matter was not a basis to terminate a deposition. Sullivan also told him it appeared he was conflating harassment and relevance, and the judge wasn't persuaded the standard for terminating the deposition was met.

He ordered the deposition to be resumed on a timely basis. The judged said that the issues may not necessarily show up at trial, but there wasn't a case to foreclose certain inquiries.

Beigel said he would try to schedule a deposition this month and Icahn may have separate counsel present.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Bankruptcy Judge Clears Path for Recovery in High-Profile Crypto Failure

3 minute read

US Judge Dismisses Lawsuit Brought Under NYC Gender Violence Law, Ruling Claims Barred Under State Measure

In Resolved Lawsuit, Jim Walden Alleged 'Retaliatory' Silencing by X of His Personal Social Media Account

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute readTrending Stories

- 1No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 2Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 3Meet the New President of NY's Association of Trial Court Jurists

- 4Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

- 5Freshfields Hires Ex-SEC Corporate Finance Director in Silicon Valley

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250