Judge Pauley Refuses to Allow New Breach Claim in Contract Dispute

The plaintiffs sought another shot at the claims after allegedly finding evidence during discovery that undermined a key fact that led to the collapse of a revenue sharing agreement.

August 13, 2018 at 05:36 PM

4 minute read

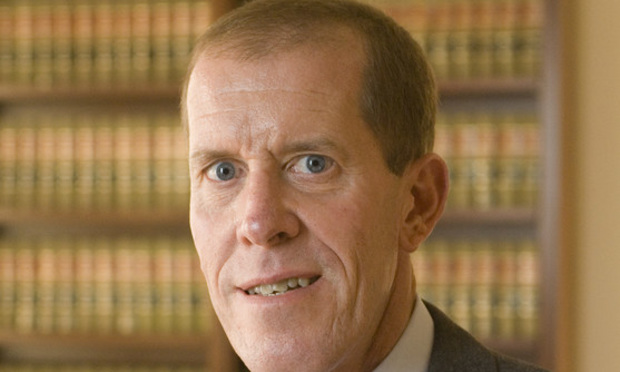

Judge William Pauley III.

Judge William Pauley III.

U.S. District Judge William Pauley III of the Southern District of New York declined Monday to allow the plaintiff in an ongoing negligent misrepresentation suit another shot at a breach of contract claim, after already substantially pruning the original complaint down to a single count.

Despite the plaintiff, Kortright Capital Partners, claiming to uncover critical information during the tail end of discovery, Pauley ruled that, under relevant state contract law, the language the parties previously agreed to related to conditions precedent to the formation of the contract itself. Since the performance at issue—the closing of a separate third-party deal—never occurred, the unambiguous contract language meant the contract can't be enforced, providing nowhere for a new breach of contract claim to arise.

Kortright sued Investcorp Investment Advisers in September 2016, claiming an initial breach of contract, covenant of good faith and other claims over the collapse of an investment deal between the two firms. The crux of the suit goes to the impact of Investcorp's pulling out of funds Kortright depended on in a separate transaction involving another party not involved in the lawsuit, Man Group.

Investcorp claimed it had not received the consent of its clients to keep their money in the deal with the third party—a condition Kortright had with Man Group to keep their new deal in place.

To add another but critical layer of complexity, Kortright and Investcorp had a separate revenue sharing agreement in place as part of a legacy investment deal that evolved into the Man Group agreement. In that agreement was a provision that made the revenue sharing agreement conditional on the closing of the Man deal by the end of September 2016.

After Pauley winnowed Kortright's claims down to the single negligent misrepresentation claim over Investcorp's failure to disclose needing client consent, discovery took place. During the process, Kortright claims to have found new information that showed Investcorp didn't actually need its clients' consent at all.

Kortright then sought the court's permission to file a breach of contract claim over the revenue sharing agreement, as they'd believed Investcorp clients, not the company managers themselves, were the reason for the failure of a condition precedent.

Pauley noted that the core of the dispute was which type of contractual condition precedent, either based on some kind of performance or on a formation. Investcorp argued for the former, but, as the judge noted, the argument created a “circular result.” The performance required would be Investcorp's clients' funds staying in for the Man deal to close, which could only incur if the clients' funds were invested until the deal was done.

The bigger issue, Pauley noted, was that the language is concrete in the agreement, which necessarily unravels the revenue sharing agreement because the Man deal fell through, making the contract not valid and enforceable. The language bound the parties only to the condition specified, not to their ultimate intent in the deal. The judge also declined to apply the prevention rule, as a party is under no implied obligation to scuttle something when there is no contract in effect.

“Because this court concludes that [the contract language] creates a condition precedent to the validity and enforceability of the [revenue sharing agreement] that did not occur, Kortright's motion to amend is denied as futile,” Pauley wrote.

Pauley also appeared to show little patience with dueling sanctions motions in the bitter battle over contract language, dismissing both quickly. He also declined Investcorp's attempt to nullify jury waiver language in the contract.

Kortright's legal team was led by Cadwalader, Wickersham & Taft partner Jason Halper. Investcorp was represented by counsel Gibson, Dunn & Crutcher, led by Christopher Joralemon. Neither responded to a request for comment.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

'Reluctant to Trust'?: NY Courts Continue to Grapple With Complexities of Jury Diversity

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250