The Tax Cuts and Jobs Act—Qualified Opportunity Zones

In his Real Estate Securities column, Peter M. Fass writes: The qualified opportunity zone can provide significant tax savings to taxpayers selling appreciated property, including both real property and other asset classes, as well as provide investment capital to spur economic development in distressed areas.

October 02, 2018 at 02:45 PM

9 minute read

Peter M. Fass

Peter M. Fass

The Tax Cuts and Jobs Act, P.L. 115-97 (Dec. 22, 2017) (Tax Act), created a new economic development vehicle with tax deferral and tax abatement (“qualified opportunity zones or QOZ”). QOZ provides a deferral mechanism for short- and long-term capital gains for current investments in nearly all asset classes. A QOZ provides (1) the ability to invest only the gain rather than the principal of a current investment; (2) a broad range of investments eligible for the deferral; (3) a potential basis step-up of 15 percent or substantially more of the initial deferred amount of investment; and (4) an opportunity to eliminate taxation on capital gains post-investment.

A QOZ generally must be a population census tract within a state that qualifies as a low income community as defined under Section 45D(e) of the Internal Revenue Code (Code). To qualify as a low income community (LIC), a population census tract must have a poverty rate of no less than 20 percent, or a median family income not to exceed 80 percent of either the statewide or metropolitan area income, depending on the tract's location. A tract that is not an LIC but is contiguous to an LIC that is designated as a QOZ (even if not in the same state) and has a median family income not exceeding 125 percent of the median family income of such LIC may also be designated as a QOZ. The total number of non-LIC tracts that are designated as QOZs in a state cannot exceed five percent of the total number of designated QOZs in such state.

Requirements to be a QOZ. A QOZ business is any trade or business that meets the following requirements:

• Substantially all the tangible property owned or leased by the business must be purchased by the QOZ business after 2017. The QOZ business must be the first person to use the property in the QOZ, or it must substantially improve the property (capital expenditures on the property in the 30 months after the QOZ business acquires it must equal or exceed the property's adjusted basis at the beginning of that 30-month period). The property must be used in the QOZ during substantially all of the QOZ business's holding period. Finally, the property must not be acquired from a related person or a member of a 20-percent-controlled group of which the taxpayer is a member.

• At least 50 percent of the QOZ's total gross income is derived from the active conduct of business in the QOZ.

• A substantial portion of the business's intangible property is used in the active conduct of business in the QOZ.

• Less than 5 percent of the average of the aggregate adjusted bases of the property of the business is attributable to nonqualified financial property (i.e., debt instruments, stock, partnership interests, annuities, and derivative financial instruments), other than (1) reasonable amounts of working capital held in cash, cash equivalents, or debt instruments with a term of no more than 18 months, and (2) accounts or notes receivable acquired in the ordinary course of a trade or business for services rendered or from the sale of inventory property.

• The business cannot be a country club, massage parlor, hot tub facility, racetrack, health club, or store whose principal business is the sale of alcoholic beverages for consumption off premises.

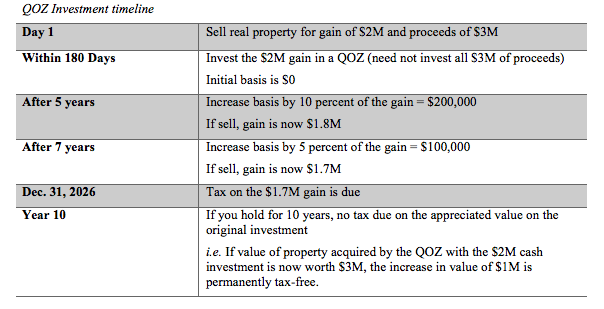

Tax Benefits. An investor may obtain three types of federal income tax benefits as a result of its investment of cash in a QOZ transaction (“QOZ Fund”). Such benefits are available only to the extent the cash the investor invests in the QOZ Fund does not exceed the gains (whether short-term or long-term) the investor has realized from a sale to, or exchange with, an unrelated party of any property held by the investor. Further, in order to be eligible for such benefits, the investor's sale or exchange must occur (x) not later than Dec. 31, 2026 and (y) not more than 180 days prior to its investment in the QOZ Fund (“Recent Sales or Exchanges”). There are no individual or aggregate limitations on the amount of gains that can be deferred or eliminated under the QOZ program.

If an investor makes an investment in a QOZ Fund in excess of the gains realized from Recent Sales or Exchanges, the investment in the QOZ Fund is treated as two separate investments, one investment relating to the investors Recent Sales or Exchanges, which may qualify for the QOZ tax benefits, and a separate investment, consisting of the excess amount, which will not qualify for QOZ tax benefits.

Deferral of Gains From Recent Sales or Exchanges. Upon investing in a QOZ Fund, the investor receives a temporary deferral of any reinvested gains that it realized from Recent Sales or Exchanges. The deferral will extend until the earlier of (1) the investor's disposition of its interest in the QOZ Fund, or (2) Dec. 31, 2026. It is unclear whether the long-term v. short-term character of gains (or, potentially, the ordinary income character of gains, in the case of gains characterized as ordinary income if such gains are deferrable) that are recognized after their deferral under the QOZ program will be the same as the character such gains would have had if they had not been deferred. Like Section 1031 exchanges, a QOZ investment provides a deferral benefit, with one important difference that only the gains an investor seeks to defer need to be reinvested in the QOZ Fund, whereas in Section 1031 exchanges the entire value of the relinquished property must be reinvested in like-kind property. Note that the deferral benefit of a Section 1031 exchange is indefinite, whereas any gain deferred under the QOZ program must be recognized no later than Dec. 31, 2026.

Elimination of a Portion of Gains From Recent Sales or Exchanges Reinvested in a QOZ Fund Upon Fifth and Seventh Anniversaries. Up to 15 percent of the gain realized from a Recent Sale or Exchange and reinvested in a QOZ Fund can be eliminated, depending on the investor's holding period with respect to its interest in the QOZ Fund. The initial tax basis of an interest in the QOZ Fund acquired with reinvested gain from a Recent Sale or Exchange is the amount of the gain invested. If the investor holds the QOZ Fund interest for at least five years, the tax basis of the QOZ Fund interest is increased on the fifth anniversary of the investment by 10 percent of the amount of gain initially reinvested in such QOZ Fund. If the investor holds the QOZ Fund interest for at least seven years, the tax basis of the QOZ Fund interest is increased on the seventh anniversary of the investment by an additional 5 percent of the amount of gain initially reinvested in such QOZ Fund interest. For example, if the investor acquires its QOZ Fund interest on June 30, 2019, for $5 million of reinvested gain from a Recent Sale or Exchange and holds such Fund interest into 2027, on Dec. 31, 2026, the investor will recognize gains previously deferred in an amount equal to the amount by which the lesser of $5 million and the fair market value of the QOZ Fund interest exceeds $750,000.

No Gain Upon Sale or Exchange of QOZ Interest After Tenth Anniversary of the Investment. If the investor holds its interest in the QOZ Fund for 10 years or more, for purposes of determining the gain or loss the investor recognizes from the sale or exchange of such QOZ Fund interest, the investor may elect for the basis of such QOZ Fund interest to be equal to its fair market value on the date such QOZ interest is sold or exchanged (“FMV Basis Election”). As a result, the investor will not recognize gain and will not owe tax on the sale or exchange of its QOZ Fund interest 10 years or more after it acquired the QOZ Fund interest.

Investors who are not seeking to defer gain may still invest in a QOZ Fund. However, if an investor is not reinvesting gains from a Recent Sale or Exchange, or an investor that is otherwise seeking deferral of gain invests funds in excess of such gain in a QOZ Fund, the tax benefits described above will not apply, even if the investor holds its QOZ Fund interest for at least 10 years.

Calculating Basis in the QOZ Fund Investment. An investor's basis in the QOZ Fund starts out at zero, given that the investor is only required to invest recognized gain in the QOZ Fund. Any additional amounts contributed to the QOZ Fund above the net gain will also be included in basis. In addition, an investor's basis will be increased by 10 percent of the original deferred gain if the investor holds the QOZ Fund investment for five years, and by another 5 percent of the original deferred gain if the investment is held for a total of seven years. As a result, the investor will only need to recognize 85 percent of the deferred gain if held the full seven years.

Conclusion. The QOZ can provide significant tax savings to taxpayers selling appreciated property, including both real property and other asset classes, as well as provide investment capital to spur economic development in distressed areas.

Peter M. Fass is a partner at Proskauer Rose.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

The Unraveling of Sean Combs: How Legislation from the #MeToo Movement Brought Diddy Down

When It Comes to Local Law 97 Compliance, You’ve Gotta Have (Good) Faith

8 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250