Who Is Linda Lacewell, Cuomo's Rumored Replacement to Head DFS?

Before her career working in state government, Lacewell was known as a tenacious federal prosecutor in Brooklyn, where she worked for a decade.

December 31, 2018 at 06:21 AM

5 minute read

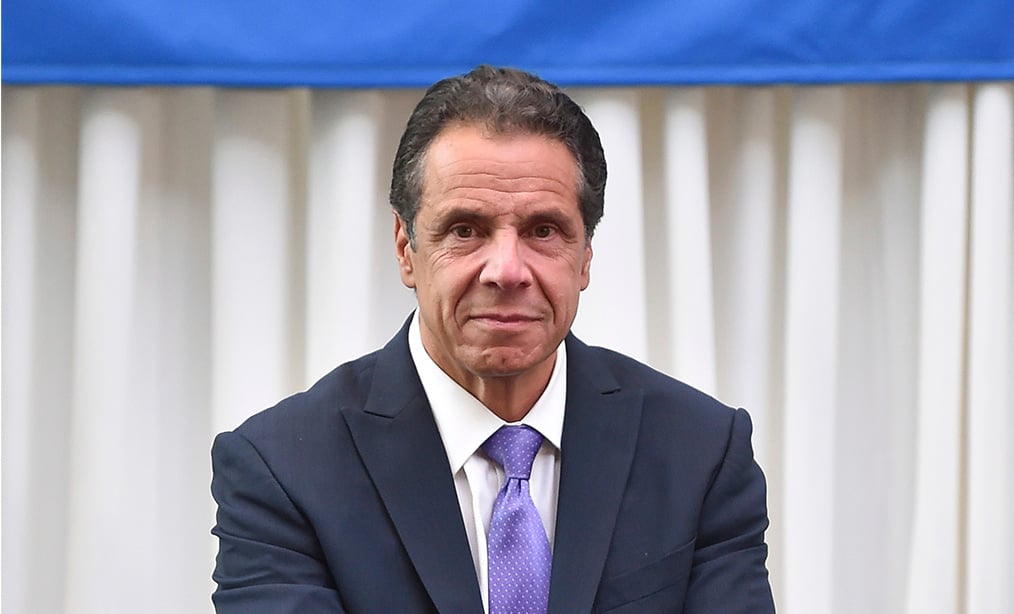

New York Gov. Andrew Cuomo. Photo: Evan Agostini/Invision/AP

New York Gov. Andrew Cuomo. Photo: Evan Agostini/Invision/AP

Before Linda Lacewell was a top aide to Gov. Andrew Cuomo and his rumored replacement to head the state's financial regulatory agency, she was a fierce federal prosecutor with the U.S. Attorney's Office in Brooklyn.

Lacewell spent nearly a decade working for the U.S. Department of Justice before transitioning to become a longtime—and loyal—part of Cuomo's administration, where she's worked almost exclusively since he first took office as New York attorney general in 2007.

That commitment could pay off in the near future. Reports have suggested that Lacewell will soon replace Maria Vullo, who is leaving in February as superintendent of the state Department of Financial Services, one of the most powerful financial regulatory agencies in the country. The Cuomo administration has not confirmed the move.

Lacewell has served under Cuomo in several different capacities over the last decade. She was most recently elevated to Cuomo's chief of staff in 2017 after a short stint outside of his administration leading a nonprofit cancer research organization. She was brought on to fill the role after the departure of Cuomo's former chief of staff, Maria Comella, a former aide to former New Jersey Gov. Chris Christie.

The position is different from the secretary to the governor, an often public, advisory role currently held by Melissa DeRosa, another longtime member of Cuomo's inner circle. Lacewell has, instead, been responsible for managing the day-to-day operations of the administration, a task that has not gone unrecognized by other officials within Cuomo's orbit.

She was previously the state's first chief risk officer, as appointed by Cuomo in 2015. In that position, she helped create and implement the state's first system for ethics, risk and compliance in state agencies and authorities. She left the position to become executive director of the Cancer Breakthroughs 2020 Foundation, which is part of the Chan Soon-Shiong NantHealth Foundation in California.

Lacewell stayed at the foundation for less than two years before she was asked to come back to the Cuomo administration, which is when she became chief of staff.

But before her career working in state government, Lacewell was known as a tenacious federal prosecutor in Brooklyn, where she worked for a decade. Her career with the U.S. Attorney's Office of the Eastern District of New York featured several high-profile cases that often made the news.

One was the prosecution of Salvatore “Sammy the Bull” Gravano, a former underboss of the Gambino crime family in New York City. Years after the government moved him to Arizona for informing federal prosecutors on other members of the crime family, Gravano was charged with running an ecstasy ring in Arizona, with the drugs also flowing into New York.

Lacewell was on the team that prosecuted Gravano in the scheme, for which he was sentenced to two decades in prison. He was released from prison last year.

She also worked on at least one other case involving the Gambino crime family that involved three men who allegedly billed internet users $230 million by creating a pornography website and collecting the credit card numbers of its users. One of the defendants was Richard Martino, who prosecutors alleged was connected to the crime family. He allegedly funneled millions of dollars to the family as part of the scheme.

The matter was said, at the time, to be one of the largest consumer fraud cases ever prosecuted. It ended in a plea deal with the defendants, who agreed to pay millions of dollars in fines.

During her time at the U.S. Attorney's Office, Lacewell was also a member of the Enron Task Force, which was a panel of federal prosecutors and investigators created to get to the bottom of what caused the Enron Corp., an American energy company, to file for bankruptcy in 2001. The task force ended up bringing fraud, money laundering, and other charges against more than two dozen officials at the company, including its former chief executive officer.

Lacewell led a settlement in the Enron scandal with the Canadian Imperial Bank of Commerce, which was used by the company to raise its stock price without actually raising profits by obtaining assets and loans from the bank.

”C.I.B.C. was one of the engines that Enron used to manufacture earnings and pump up its stock price,” Lacewell said at the time, according to a report in the New York Times. ”And they did it over and over again.”

Now, if selected to lead the state's financial regulatory agency, Lacewell will be tasked with handling many cases of a similar nature. The agency is responsible for investigating and regulating the state's financial institutions, including banks and insurers. It was created in the last decade as a consolidation of the state's banking and insurance departments.

Insiders within the Cuomo administration have called Lacewell a brilliant legal mind in her own right, having served in several different roles as an attorney over the past two decades.

If she's to be nominated as the next superintendent of DFS, an announcement will have to be made by the Cuomo administration in the coming weeks. The position, unlike others in the governor's cabinet, requires the approval of the State Senate and Vullo is scheduled to depart the office at the end of January.

Lacewell was not immediately available for an interview on the possible nomination.

READ MORE:

Maria Vullo Confirms She's Leaving DFS in February

Report: Cuomo Considering Replacing NY's Top Financial Regulator

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Why Wait? Arbitrate! The Value of Consenting to Arbitrate Your SUM Cases at NAM

5 minute read

Bipartisan Lawmakers to Hochul Urge Greater Student Loan Forgiveness for Public-Interest Lawyers

Testing The Limits of “I Agree”: Court of Appeals Examines Clickwrap Arbitration Agreements

13 minute read

Antitrust Yearly Recap: Aggressive Changes By The Biden Administration Precede President Trump’s Return

14 minute readTrending Stories

- 1'A Death Sentence for TikTok'?: Litigators and Experts Weigh Impact of Potential Ban on Creators and Data Privacy

- 2Bribery Case Against Former Lt. Gov. Brian Benjamin Is Dropped

- 3‘Extremely Disturbing’: AI Firms Face Class Action by ‘Taskers’ Exposed to Traumatic Content

- 4State Appeals Court Revives BraunHagey Lawsuit Alleging $4.2M Unlawful Wire to China

- 5Invoking Trump, AG Bonta Reminds Lawyers of Duties to Noncitizens in Plea Dealing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250