Protect Your SIM Card: Hackers Are Targeting Your Cellphone

The Manhattan District Attorney Office announced on Feb. 1 the first prosecution of SIM swapping in New York state when it indicted a 20-year-old Ohio man for allegedly stealing roughly $10,000 in cryptocurrency from three victims.

February 08, 2019 at 11:00 AM

4 minute read

The original version of this story was published on Legal Tech News

Experts say that swapping SIM cards is on the rise as hackers try to gain access to a phone user's finances, unbeknownst to those users.

SIM (subscriber identity module or subscriber identification module) cards are the small smart cards that contain information identifying a specific phone network that allows the user to use most functions on their device. Hackers are contacting a target's cellphone carrier, answering simple security questions and swapping the phone number associated to a SIM card they control.

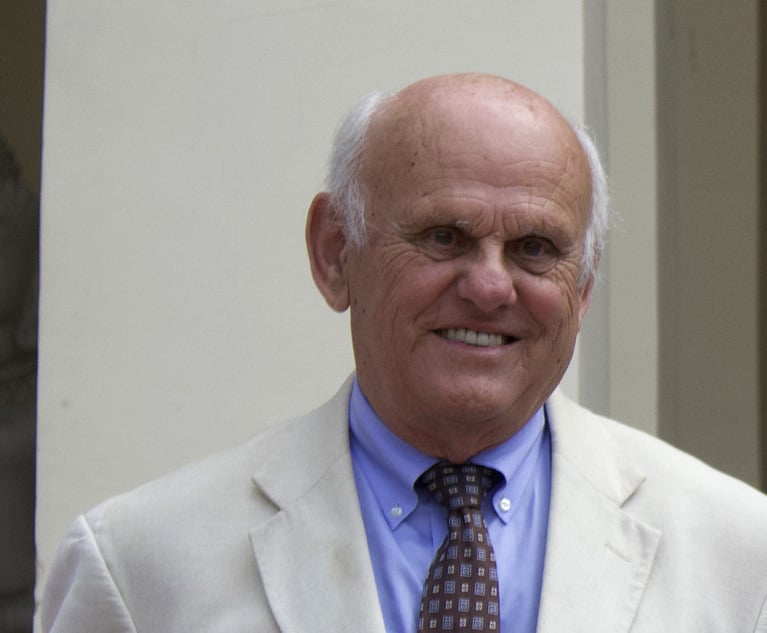

“Then the perpetrator has control of that phone number for however long it takes the victim to realize their phone number has been hijacked,” explained Scott Greene, founder of Evidence Solutions Inc., a digital forensics firm.

The rise in SIM swapping is in response to many organizations requiring multifactor authentication to access accounts, experts said. For instance, along with requiring a password, a bank may also require sending a temporary passcode or hyperlink to a phone number or email address to verify the user.

“More companies have been adding multifactor; now the attackers have to find a way to bypass that,” said Joshua Crumbaugh, CEO of PeopleSec. “The path of least resistance is SIM swapping and getting their hands on that code and getting into your account.”

As companies attempt to strengthen their cybersecurity, hackers' methods will evolve, Crumbaugh added. Likewise, prosecutors across the nation have responded and announced the arrest of alleged SIM hackers.

In San Francisco, the U.S. Department of Justice indicted two men accused of SIM swapping executives of cryptocurrency-related companies and cryptocurrency investors. In January, Santa Clara County, California, law enforcement were the first in the U.S. to convict a SIM swapper after a Boston-area man pleaded no contest to using SIM swapping to allegedly steal $1 million worth of bitcoin, according to media reports.

The Manhattan District Attorney Office announced on Feb. 1 the first prosecution of SIM swapping in New York state when it indicted a 20-year-old Ohio man for allegedly stealing roughly $10,000 in cryptocurrency from three victims. Manhattan District Attorney Cyrus Vance Jr. noted in the press release announcing the indictment, “We're also asking wireless carriers to wake up to the new reality that by quickly porting [transferring] SIMs—in order to ease new activations and provide speedy customer service—you are exposing unwitting, law-abiding customers to massive identify theft and fraud.”

Indeed, the multifactor authentication process required by most companies usually only entails answering personal questions that may be easily gleaned from social media or requires access to a phone number.

“That's why they are targeting telecommunication providers,” PeopleSec co-founder Crumbaugh said. “They will allow you access to the account, with minimal information about the person.”

SIM swapping targeting cryptocurrency has made the news recently, but those contacted by Legaltech News said anyone with access to finances or sensitive data can be targets, including those in high-profile occupations such as lawyers.

“Two trends I've seen here are people who are more financially affluent, either perceived or actual, are heavily targeted,” Crumbaugh noted. “They are already a target in that regard and on top of that, it tends to be people active on social media.”

As organizations find new ways to protect users' data and hackers find loopholes for those safeguards, the cybersecurity professionals suggested using voice over IP (VoIP) or Google Voice for accounts so those accounts aren't associated with a SIM.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Bankruptcy Judge Clears Path for Recovery in High-Profile Crypto Failure

3 minute read

US Judge Dismisses Lawsuit Brought Under NYC Gender Violence Law, Ruling Claims Barred Under State Measure

In Resolved Lawsuit, Jim Walden Alleged 'Retaliatory' Silencing by X of His Personal Social Media Account

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute readTrending Stories

- 1New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 2No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 3Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 4Meet the New President of NY's Association of Trial Court Jurists

- 5Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250