Profits Spike at Milbank as Firm Exceeds $1 Billion Revenue Mark

While 2018 was another banner financial year for Milbank, the firm is less enthusiastic about the lack of diversity in its all-male new partner class last month.

February 27, 2019 at 03:18 PM

5 minute read

Milbank chairman Scott Edelman (Courtesy photo)

Milbank chairman Scott Edelman (Courtesy photo)

Milbank's name change and move to a new headquarters this month come after a spike in revenue and profits.

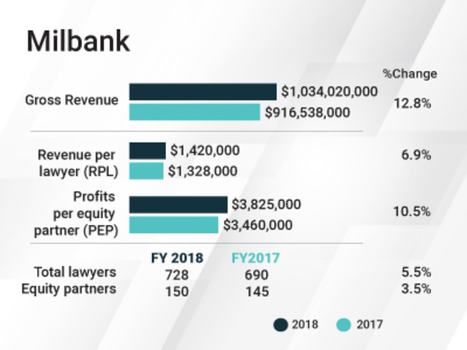

The firm's gross revenue has surpassed the $1 billion mark for the first time, growing by 12.8 percent to $1.034 billion in 2018.

Milbank has been on a growth streak for nearly a decade, with nine years of successive revenue increases, according to ALM data.

Profits per equity partner surged 10.5 percent to $3.825 million last year. Even as total lawyer head count grew more than 5 percent to 728 lawyers, the firm's revenue per lawyer rose by 6.9 percent to $1.42 million.

Profits per equity partner surged 10.5 percent to $3.825 million last year. Even as total lawyer head count grew more than 5 percent to 728 lawyers, the firm's revenue per lawyer rose by 6.9 percent to $1.42 million.

Scott Edelman, Milbank chairman, speaks proudly about the firm's complex work across litigation, transactional and restructuring practices. Demand was up “across the whole firm,” Edelman said.

Still, he said he's “not happy” about another aspect of the practice: diversity of new partners.

Milbank elected eight lawyers to partner last month, all of them men. “It happens that this year, we did not have a diverse class,” Edelman said. The new partners have not been listed in a firm press release this year, unlike new partner classes in other years.

Diversity of partner promotions are under more scrutiny, as firms in the last few months have faced open criticism from corporate counsel for partnership classes that are predominantly white and male.

“I know the pipeline in future years will be more diverse,” Edelman said in an interview this month. “We're very proud of the individuals in our class but … we're not happy about the lack of diversity.”

Still, in the prior two years, five of the firm's 12 new partners were women, Edelman said, as were several of its lateral partners last year. Meanwhile, partner Stacey Rappaport joined the firm's five-person executive committee last year—the firm's first woman on the committee in its history.

When asked if the lack of gender diversity led the firm to avoid a press release on the promotions, Edelman said the firm was focused on announcing the rebrand and move first. But he also acknowledged that “it's not something we want to go out and proudly tell everybody we made a non-diverse partner class.”

“It's something we talked a lot about internally and we take very seriously,” he said, noting the firm has various initiatives to commit to diversity. “We're very focused” on mentoring and promoting diverse senior associates, he added.

'Out in Front'

Some of the female lateral partners last year arrived with two high-profile groups in London, including a capital markets team from Shearman & Sterling and a restructuring group from Cadwalader, Wickersham & Taft.

The firm's European business grew 25 percent last year, Edelman said, including in London, where the firm generated $155.84 million in 2018, up from $124.9 million in 2017.

It wasn't only London seeing more activity.

Milbank was busy in all departments, Edelman said, from its litigation work on behalf of Rabobank over the London Interbank Offered Rate (Libor) to its patent litigation victories for Tris Pharma and Orexo. The firm was retained to represent the creditor's committee in the FirstEnergy Solutions bankruptcy, while its project finance team last year advised on one of the largest cross-border energy-related transactions in Brazil in recent years.

Net income, rising nearly 14 percent last year to $572.15 million, grew faster than revenue. Edelman said the firm increased its leverage and has started to see “some of the benefits you get with economies of sale.”

Milbank last year sparked the most recent industrywide salary increase for associates, announcing in June that its first-year associate base salaries were rising to $190,000 and it was increasing associate salaries across the board by $10,000 or $15,000. (Ultimately, the firm matched the pay scale that Cravath, Swaine & Moore soon after established for associates.) Since Milbank has over 500 associates, the firmwide raises likely meant an immediate overhead increase in the mid-seven-figure range, The American Lawyer reported at the time.

“Clearly, we would have made more money if the industry hadn't raised associate salaries,” Edelman said in the interview this month, but he added that the industry was doing well and “we were very busy.”

“We could see that trend, so we knew it was going to be a profitable year for the industry and for Milbank,” he said. “That's why we decided to get out in front and share some of the wealth.”

Despite the high revenue growth, the number of equity partners at Milbank has stayed relatively steady the past four years. (Last year, it increased by five to 150 partners). Meanwhile, total nonequity compensation last year increased by nearly 40 percent, as the number of nonequity partners increased by five to 19. Edelman said the increase reflected some lateral partners whose initial compensation isn't directly tied to profits.

In the long term, Milbank wants to move away from the nonequity partnership, he said, for use in “rare situations.”

Milbank's lawyers and staff in the last week have been settling into their new office at 55 Hudson Yards, a move coinciding with a name change that drops Tweed, Hadley and McCloy from the letterhead. The firm had operated under Milbank Tweed Hadley & McCloy for more than 50 years.

“Frankly we're not in touch with any of their family members at this point,” Edelman said about the former name partners. “It's been so long since they were associated with the firm.”

Read More

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250