Latham Breaks Records Again as Revenue Soars, Profit Jumps

The firm in January hired David Beller, a private equity and M&A lawyer, from Paul Weiss Rifkind Wharton & Garrison in New York. Latham also lured Alexander Johnson, former head of the M&A practice in the Manhattan offices of Hogan Lovells.

March 01, 2019 at 10:00 AM

6 minute read

The original version of this story was published on The American Lawyer

Richard Trobman of Latham & Watkins. (Courtesy photo)

Richard Trobman of Latham & Watkins. (Courtesy photo)

One year after becoming the first law firm ever to crack the $3 billion revenue mark, Latham & Watkins in 2018 had its strongest financial performance in nearly a half-decade.

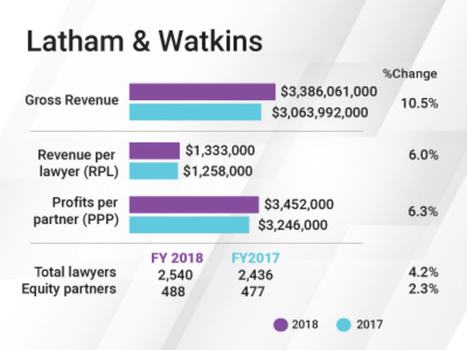

The world's second-largest firm by revenue last year, Latham saw revenue in 2018 spike 10.5 percent to a new high of $3.386 billion, according to preliminary reporting for The American Lawyer's annual Am Law 100 rankings. Profits per equity partner rose 6.4 percent to $3.45 million, and revenue per lawyer increased 6 percent to $1.33 million.

Each of those yearly growth rates was the highest the firm has experienced since 2013 to 2014, according to historical ALM data.

Latham's headcount last year grew 4.2 percent to 2,540 lawyers, and its equity partnership expanded 2.3 percent to 488 partners. The year marked the firm's 10th consecutive year of revenue growth.

Latham's headcount last year grew 4.2 percent to 2,540 lawyers, and its equity partnership expanded 2.3 percent to 488 partners. The year marked the firm's 10th consecutive year of revenue growth.

Richard Trobman, the firm's London-based chair and managing partner, said end-of-year work that did not result in collected fees by the end of the firm's fiscal year would have put the firm on pace to generate nearly $4 billion in hours billed for 2018.

The results, Trobman said, were driven in large part by clients' increasing demands for a law firm that provides high-quality services in practices stretching across the world's major cities. The firm's 25 largest clients worked last year, on average, with lawyers in 22 of the firm's 30 offices, Trobman said.

“We had little to no softness in overall demand across the business throughout the year,” Trobman said. “We view a key competitive advantage is our ability to assemble teams across practices, across products and across geographies that deliver real value for our clients.”

Latham's financial performance last year is likely to stand out even among what was widely regarded as one of the healthiest 12-month stretches for Big Law services in nearly a decade. Citi Private Bank's Law Firm Group said Am Law 50 firms like Latham saw 7.7 percent revenue growth on average last year.

The firm's transactional department was among the most active around the globe last year, according to Mergermarket, which tracks M&A advisory work. The firm handled 360 deals, and the value of those deals Latham grew nearly 34 percent from the prior year, compared to industry-wide growth of 19.4 percent, Mergermarket said. The firm's private equity practice remained one of the busiest in 2018, as well, according to Mergermarket.

In a separate ranking of transaction values, Thomson Reuters said the value of deals on which Latham advised in 2018 rose year-over-year by nearly 60 percent, outpacing a market that grew at 19 percent.

Notable transactions included advising Carlyle Group on its $11.5 billion acquisition of Akzonobel's Specialty Chemicals business, which was the largest European buyout in 2018; advising Hong Kong-based internet provider HKBN Ltd. on its acquisition of WTT Holding Corp. from buyout firms MBK Partners Ltd. and TPG Capital Management in a deal valued at $1.34 billion; and representing Energy Transfer Equity in its $62 billion acquisition of Energy Transfer Partners, a natural gas operator, in one of the biggest M&A deals of 2018.

Latham's capital markets practice handled the highest value of global deals representing issuers of equity and bonds last year among any law firm, according to data from Bloomberg LP.

The firm's litigation practice also handled a number of high-profile engagements, including representing Apple Inc. in an antitrust matter before the U.S. Supreme Court; successfully defending Janssen Biotech Inc. in a patent challenge to a blood cancer drug worth more than $2 billion annually; and defeating a San Francisco-based effort to put warnings labels on soda on behalf of the American Beverage Association.

“It was really a year about strong, balanced growth across the platform in our transactional, litigation and regulatory practices,” said Trobman, who was named the firm's chairman in June following the unexpected departure of former chair William Voge in March 2018.

Trobman and LeeAnn Black, the firm's chief operating officer, said that 2019 had been off to a strong start—especially considering the billing inventory the firm had lined up to start the year. They added that they plan to continue to invest in talented lawyers, something the firm has already kept up early in the year.

The firm in January hired David Beller, a private equity and M&A lawyer, from Paul Weiss Rifkind Wharton & Garrison in New York. Latham also lured Alexander Johnson, former head of the M&A practice in the Manhattan offices of Hogan Lovells.

The firm also this year invested in a legal tech start-up, Reynen Court, which is looking to make it easier for law firms to adopt cloud-based technologies. Black said the investment signaled the firm's belief that the legal market is changing and that Latham needs to stay at the forefront of those changes to remain atop the legal services market.

“It is more about being in the forefront and working with these folks that are thinking about how legal services will be performed three, five and 10 years from now,” Black said.

Trobman said that by investing in technologies now, the firm can not only defend against any competition from technology firms but also use new services as a competitive advantage.

“There is no doubt that at certain levels of the legal market you are seeing more impact right now from either new entrants into the legal market or technological solutions,” Trobman said. “But, inevitably, that could impact the very highest level of the legal market as well.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Alston & Bird Adds M&A, Private Equity Team From McDermott in New York

4 minute read

Deal Watch: Private Equity Dealmakers Make 2025 Predictions Amid Deal Resurgence

12 minute read

Weil Lures DOJ Antitrust Lawyer, As Government Lateral Moves Pick Up Before Inauguration Day

5 minute readTrending Stories

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250