Auto Insurance Complaint Rankings

In his Insurance Law column, Jonathan A. Dachs reports upon the State of New York Department of Financial Services' recently-published 2018 Automobile Insurance Complaint Ranking.

March 19, 2019 at 02:35 PM

5 minute read

Jonathan A. Dachs

Jonathan A. Dachs

I am privileged once again to report upon the State of New York Department of Financial Services' recently-published 2018 Automobile Insurance Complaint Ranking.

The 2018 “Annual Ranking,” based upon data for the calendar year 2017, ranks all 159 automobile insurance companies actively doing business in New York state. As in the past, this report ranks the individual companies themselves, rather than just the corporate groups of which those companies may be members. This method of listing is intended to give consumers a more accurate picture of their insurer's performance. Also, as in the past, insurers are ranked based upon a complaint ratio, which is determined by the number of private passenger automobile insurance complaints upheld against them and closed by the Department of Financial Services, as a percentage of their average total private passenger automobile premium volume in New York State over a two-year period.

In 2017, the Department received a total of 3,367 private passenger auto insurance complaints (down from 3,872 in 2014), of which 394 (down from 444 in 2014) were upheld. Neither commercial auto complaints nor complaints made directly to the insurer are included in determining the complaint ratios. Complaints either not upheld by the Department or withdrawn by the consumer are also not included in the calculations of the ratios. An upheld complaint occurs when the Department agrees with a consumer that an auto insurer made an inappropriate decision. Typical complaints are those involving such issues as delays in the payment of no-fault claims, and nonrenewals of policies. Complaints about the value of monetary settlements and policy terminations are also common.

The 2017 average complaint ratio for all companies was 0.0305 per $1 million in premiums (down from 0.03473 in 2014). This average ratio was derived by dividing the number of complaints upheld against all companies in 2017 (394) by the average premium for 2017 for all companies ($12,938,319 million, or $12.93 billion) (up from $11,016,405 or $11.01 billion in 2014). The average number of upheld complaints per company was 2.5 (down from 2.6 in 2014).

Charts

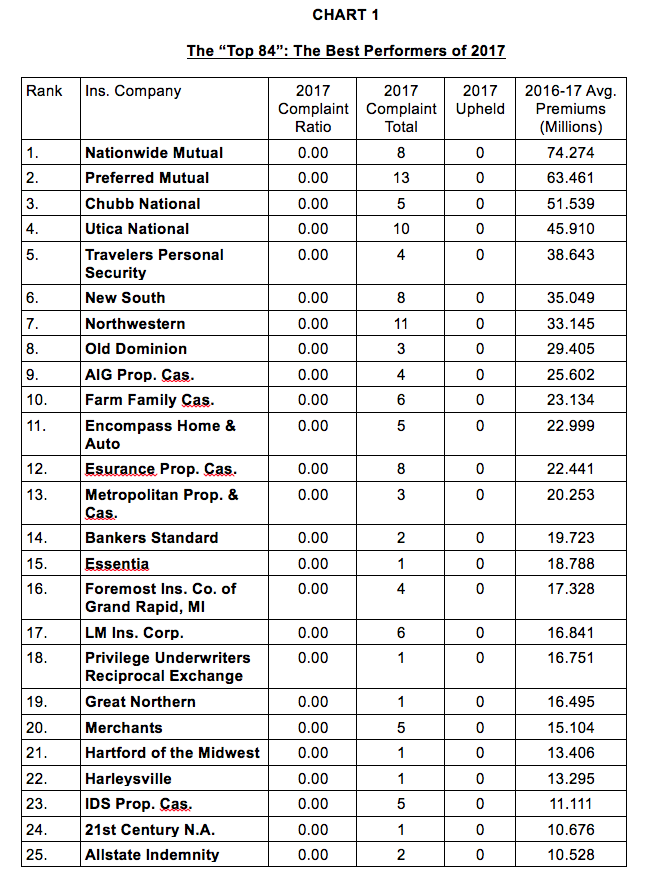

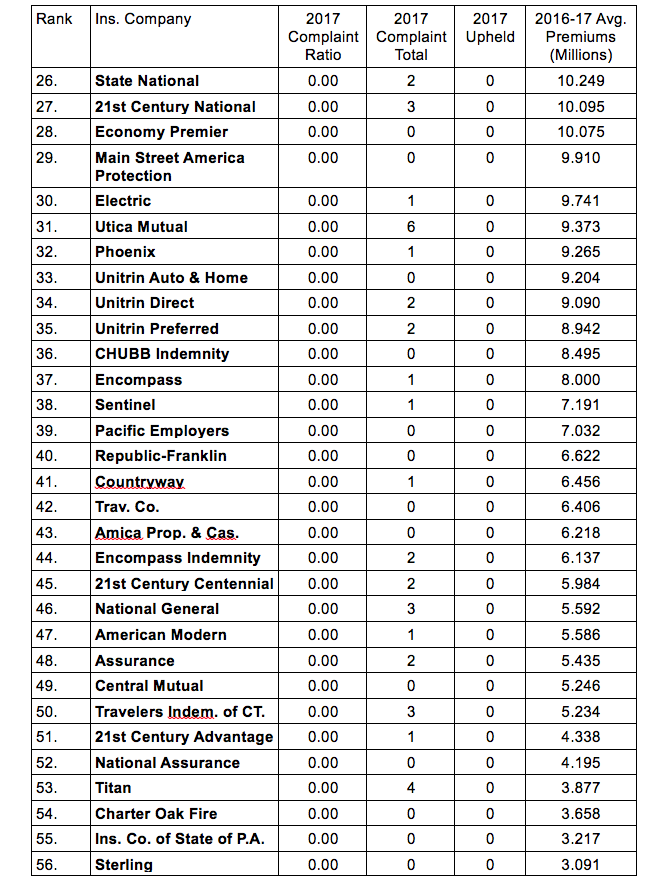

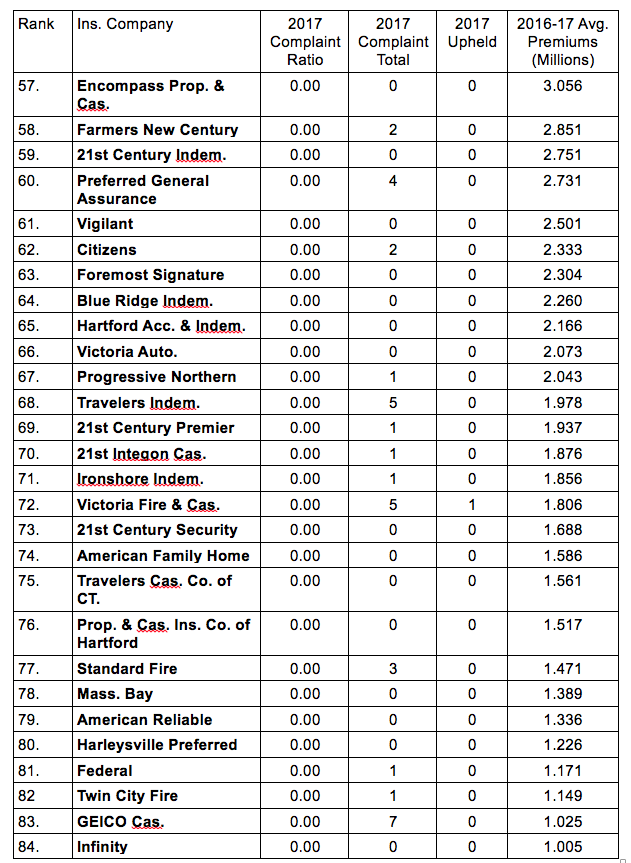

The first chart lists the “Top 84,” i.e., the 84 companies with the fewest upheld complaints against them, or, the best performers of 2017—each of which achieved a complaint ratio of 0.00. Although these companies all have the same complaint ratio, they are ranked differently because of the differences in their average annual premiums.

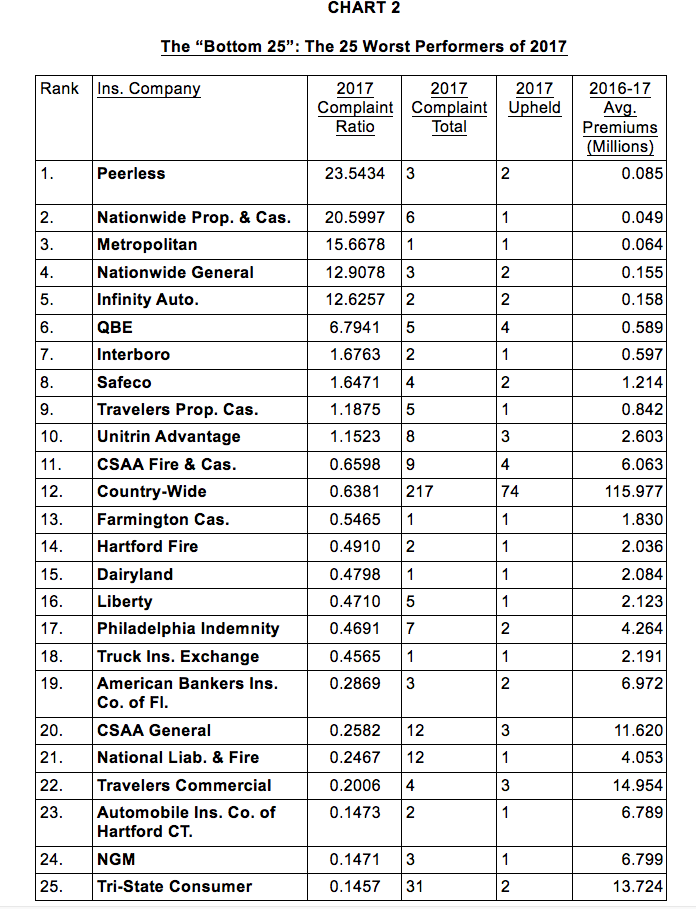

The second chart reveals the opposite side of the spectrum; it lists the “Bottom 25,” the 25 auto insurers with the worst performance record for the calendar year 2017. In that chart, the company with the highest (worst) ratio is listed first; the company with the lowest ratio is listed last.

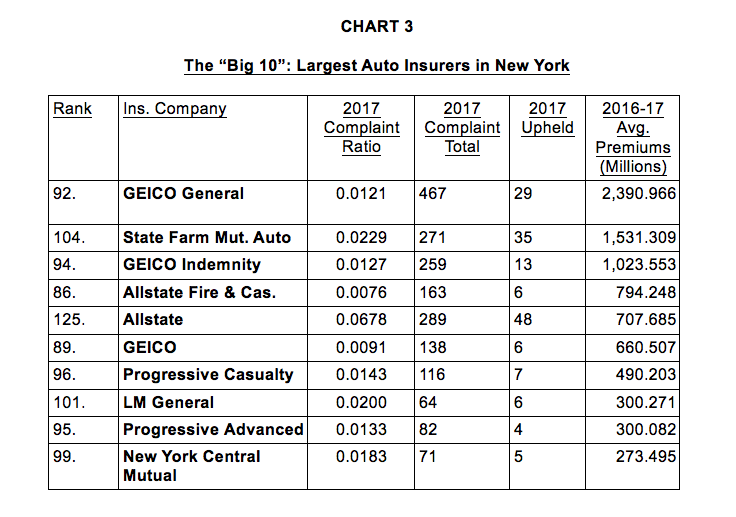

The third, and last, chart, denominated “The 'Big Ten',” separately lists the performance of the 10 largest auto insurers in New York, as measured by their premiums written.

It should be noted that the Department urges readers or users of its ranking to consider that “large insurance companies doing a lot of business typically generate more complaints than smaller companies, so while ratios may allow you to compare small companies with large companies by looking at complaints as a percentage of premiums written, only one or two additional upheld complaints per year can have a significant impact on a smaller insurer.” The Department also notes that “Because the ranking includes all of the auto insurers in New York, some must be at the bottom of each year's list even if every company is performing well.” Finally, the Department advises consumers that “While this ranking might provide information to consider when choosing an insurance company, it should not be your only consideration,” and suggests that the consumer visit the “Automobile Owners Resource Center” of its website for more information on shopping for auto insurance.

With those caveats in mind, I present here the pertinent charts:

Copies of the Department of Financial Services' annual rankings may be obtained free of charge by calling the Department's toll-free telephone number: (800) 342-3736. In addition, the annual rankings are accessible on the Department's website. Complaints against insurance companies may be filed on-line at https://www.dfs.ny.gov.

Jonathan A. Dachs is a partner at Shayne, Dachs, Sauer & Dachs in Mineola. He is the author of New York Uninsured and Underinsured Motorist Law & Practice (LexisNexis/Matthew Bender 2016, 2017, 2018).

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

New York Top Court Says Clickwrap Assent Binds Plaintiff's Personal-Injury Claim to Arbitration in Uber Case

New York Sues Charter Bus Operators for $708 Million Over Migrant Transport

Ex-Nikola CEO Sentenced to 4 Years for Securities and Wire Fraud in SDNY

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250