Morrison & Foerster Changes Lead to Equity Partner Drop, PEP Surge

Morrison & Foerster said it modified its partnership compensation structure at the start of 2018, following a year of consultation with its partners.

March 25, 2019 at 02:33 PM

5 minute read

The original version of this story was published on The American Lawyer

Larren Nashelsky, chairman of Morrison & Foerster.

Larren Nashelsky, chairman of Morrison & Foerster.

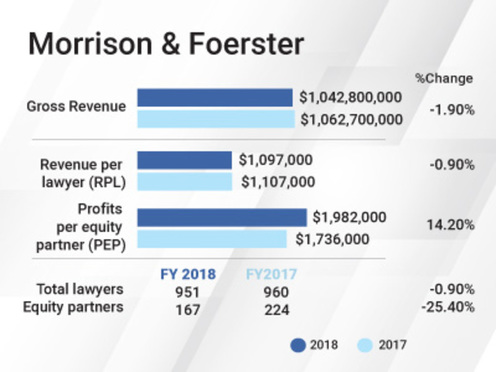

A change in Morrison & Foerster's partner compensation system helped prompt a 14 percent surge in the firm's profits per equity partner in 2018 amid an otherwise flat financial year.

Morrison & Foerster in 2018 faced a tough hurdle trying to replicate a breakout 2017 in which the firm grew by double-digit percentages in revenue, revenue per lawyer and profits per equity partner. Against that tough comparison, revenue at the 951-lawyer firm was down 1.9 percent last year to $1.04 billion and revenue per lawyer was down 0.9 percent at roughly $1.1 million, according to ALM data.

But the firm's PEP surged to just shy of $2 million last year, up from $1.74 million a year prior. The firm's compensation for all partners figure was nearly unchanged, at just over $1.4 million.

The PEP surge in 2018 was the result of a change last year in how the firm compensates its partners, according to a firm statement. That change resulted in far fewer partners receiving more than 50 percent of their compensation from profit draws, The American Lawyer's definition of an equity partner.

“Morrison & Foerster modified its partnership compensation structure at the start of 2018,” said the firm's statement. “The modifications followed a year of consultation with our partners and was made to ensure that the compensation model further advances the strategic needs of the firm.”

As a result of the compensation modifications, the firm's equity partner count fell to 167 from 224—a 25 percent decline. Meanwhile, the firm's nonequity partner ranks swelled 50 percent to 129 from 86. The firm's total partner count, including equity and nonequity partners, fell 4.5 percent.

The firm's adjustment brings its ratio of equity-to-nonequity partners more in-line with Am Law 100 averages. For instance, in 2017, 56.8 percent of all partners in the Am Law 100 were listed as “equity” partners. Morrison & Foerster's equity partners now comprise 56.4 percent of its partnership.

The firm's adjustment brings its ratio of equity-to-nonequity partners more in-line with Am Law 100 averages. For instance, in 2017, 56.8 percent of all partners in the Am Law 100 were listed as “equity” partners. Morrison & Foerster's equity partners now comprise 56.4 percent of its partnership.

Morrison & Foerster has shrunk its equity partner head count six years in a row, according to ALM data.

Despite the drop in equity partnership, Larren Nashelsky, Morrison & Foerster's New York-based chairman, said in an interview the firm had not “de-equitized” partners as part of the compensation review. “There has been no radical change in our partnership,” Nashelsky said. “It is really, over the last few years, strengthening and improving the performance of the partnership and our leverage and profitability.”

Nashelsky said the firm was happy with its 2018 financial performance, the high-stakes matters it handled last year and the 15 lateral partners the firm recruited.

Some key matters included representing Sprint Corp. and its controlling shareholder, SoftBank Group Corp., in the $146 billion merger of Sprint and T-Mobile US Inc.; representing ride-share firm Uber in its highly watched, and ultimately settled, trade secrets case against competitor Waymo; and representing Alibaba Group Holding in its purchase of Ant Financial and the Asian financial giant's $14 billion Series C fundraising.

On the lateral hiring front, Morrison & Foerster last year brought on former Willkie Farr & Gallagher tax partner Anthony Carbone; former director of the U.S. Treasury Department's Office of Foreign Assets Control, John Smith; and Lisa Phelan, a former leader in the antitrust division at the U.S. Department of Justice.

This year, the firm has already hired 19 partners, Nashelsky said, including nine with the launch of a Boston office and three partners in London, where the firm last year saw 26 percent revenue growth.

“We are on a tear in the first few months of 2019,” Nashelsky said.

Morrison & Foerster is still facing a proposed $100 million gender discrimination class-action suit filed in 2018 that alleges “the 'mommy track' is a dead end” at the firm. Three additional plaintiffs joined in an amended complaint in January. The firm has previously denied the allegations in the complaint.

Nashelsky, in the interview, said the firm last year promoted 12 new partners, six of whom were women. Over the past five years, the firm says 48 percent of its partner promotions have been for women. The partnership today is 23 percent women, the firm said.

Nashelsky said the firm was proud of its promotions of women as well as its pro bono work last year. While the firm's nearly $2 million PEP represents a high-water mark for Morrison & Foerster, Nashelsky said the firm wasn't driven by a desire to compete with the nation's most profitable firms.

“We are not in an economic arms race with other firms,” Nashelsky said. “We have a special place at Morrison & Foerster. We take stock of a lot of things when we think about the kind of firm we want to be. Financial performance is one of them. So is giving back. So is excellence in lawyering. So is diversity and inclusion, and so is representing the world's leading companies.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Alston & Bird Adds M&A, Private Equity Team From McDermott in New York

4 minute read

Weil Lures DOJ Antitrust Lawyer, As Government Lateral Moves Pick Up Before Inauguration Day

5 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250