Cahill Gordon Sees Declines Amid Junk Bond Market Slowdown

After a down year, Cahill Gordon's chairman said the firm is considering steps to diversify and expand its footprint.

April 15, 2019 at 04:06 PM

4 minute read

William Hartnett of Cahill Gordon & Reindel.

William Hartnett of Cahill Gordon & Reindel.

A tough year in the high-yield bond market pushed down Cahill Gordon & Reindel's revenue and profits in an otherwise upbeat legal market.

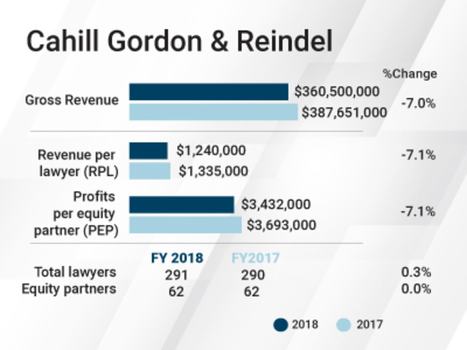

Gross revenue, profits per equity partner and revenue per lawyer at the New York firm each declined about 7 percent last year. Revenue sank to $360.5 million, profits per equity partner lowered to $3.43 million, and revenue per lawyer dropped to $1.24 million. Total lawyer head count, at about 291 lawyers, and equity partner ranks, at 62 partners, stayed level.

“We obviously are not satisfied,” said Cahill Gordon chairman William Hartnett about the firm's financial performance.

The financial slide was due to lower demand in leveraged finance, in particular, high-yield bond work, which the firm is “highly dependent on,” said Hartnett, noting high-yield bond issuances in the U.S. were down about 40 percent last year and there were zero high-yield bond issuances in December.

“The market in high yield had shrunk, and that basically is the entire explanation of our decline,” Hartnett said.

“The market in high yield had shrunk, and that basically is the entire explanation of our decline,” Hartnett said.

Cahill Gordon represents underwriters in high-yield bond offerings, also known as junk bonds, including in analyzing risks and structuring issuances and covenant packages.

According to 2019 first quarter league tables by Bloomberg, Cahill Gordon has overwhelming market share in representing underwriters in U.S. high-yield corporate bonds, with more deal volume than its next three competitors combined, including Davis Polk & Wardwell; Cravath, Swaine & Moore; and Simpson Thacher & Bartlett,

Cahill Gordon was particularly hit by the down market in high-yield bonds compared with other New York firms because of its smaller size and its focus on the area. But Hartnett said the firm has greater confidence about 2019, as the leverage finance market is stronger than last year and the firm is considering steps to diversify.

“We believe last year was somewhat of an anomaly in the leveraged finance market. We have seen it bounce back already in this first quarter, but you don't just write something off as an anomaly,” Hartnett said. “You make sure you're well positioned on a going-forward basis.”

“We are looking at various options to expand the footprint,” Hartnett said, declining to specify further because he said it was too early to explain. ”We're pursuing a couple of options at this point.”

Despite the down year, Hartnett said the firm did not take any cost-cutting measures, such as layoffs or hiring fewer associates. Cahill Gordon had a large summer associate class in 2018, reflecting the firm's confidence in the future, he said.

Other practice areas continued to perform well in 2018, Hartnett said, including litigation, corporate investigation, regulatory advisory work, real estate and tax.

Last year, Cahill Gordon's white-collar team represented Tesla in the SEC enforcement action stemming from CEO Elon Musk's Twitter statements. Cahill Gordon continues to represent Credit Suisse Group AG and its subsidiaries, including in civil litigations and investigations related to alleged manipulation of LIBOR and other reference rates during the financial crisis.

On the corporate side last year, Cahill Gordon advised on $27 billion offerings of new debt financing which funded Comcast's acquisition of U.K.-based Sky, one of the largest high-yield bond sales to date. Cahill was also involved in the $13 billion of financings to back The Blackstone Group's acquisition of a 55 percent stake in Refinitiv, a financial and risk business from Thomson Reuters Corp.

While Cahill Gordon's equity ranks, at 62 partners, didn't change in 2018, the firm had five nonequity partners last year, down from seven in 2017.

Hartnett said it was not a deliberate decision to keep the firm's equity partner figures flat. Associates who deserve to be a partner will be promoted, he said, adding “retirements have matched new partners coming in, it's as simple as that.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Deal Watch: Deals, IPOs Flow as Banking Regulation Is Expected to Get Lighter

11 minute readTrending Stories

- 1Is It Time for Large UK Law Firms to Begin Taking Private Equity Investment?

- 2Federal Judge Pauses Trump Funding Freeze as Democratic AGs Launch Defensive Measure

- 3Class Action Litigator Tapped to Lead Shook, Hardy & Bacon's Houston Office

- 4Arizona Supreme Court Presses Pause on KPMG's Bid to Deliver Legal Services

- 5Bill Would Consolidate Antitrust Enforcement Under DOJ

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250