Rankings Reveal Lackluster Revenue Growth at Several NY Firms in Second Hundred

A number of New York firms in the Second Hundred saw drops in gross revenue or had below-average increases.

May 22, 2019 at 06:32 PM

5 minute read

Photo: Shutterstock.com

Photo: Shutterstock.com

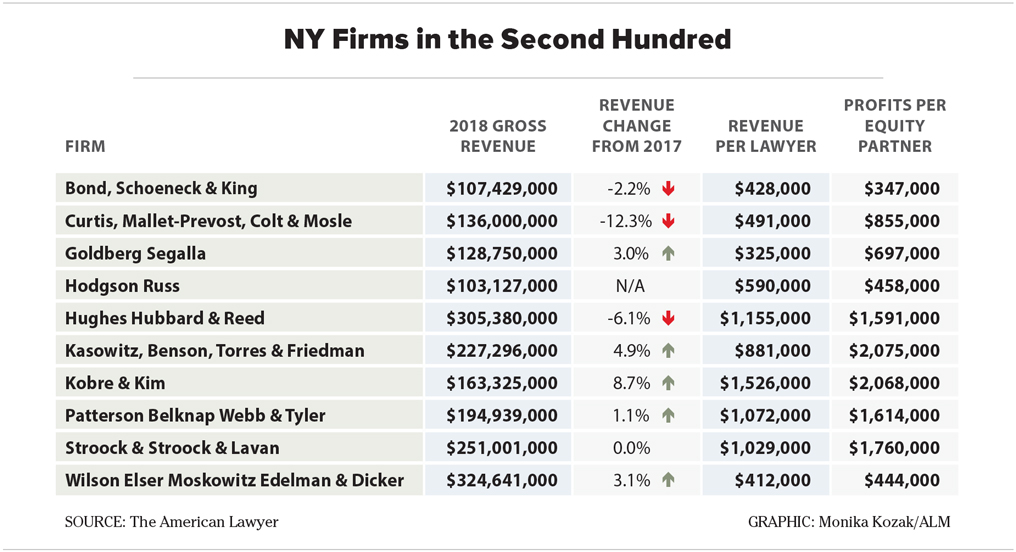

The Am Law 200 rankings, released Wednesday, revealed a wide variation of New York law firm performance last year, especially among Second Hundred firms. Some New York firms in the bottom half of the Am Law 200 climbed the rankings, but several others saw drops in gross revenue or had below-average increases.

Nationwide, revenue at midsize and large firms that make up law firms in the Second Hundred didn't rise as quickly as those of the Am Law 100 from 2017 to 2018, averaging 3.1%, compared with the Am Law 100's 8%.

New York firms were more likely to find themselves among the roughly one-quarter of firms in the Second Hundred whose revenue actually contracted from year to year. Of the 96 firms making repeat appearances on this year's Second Hundred list, just two New York firms were in the top half by revenue growth. Another two were just below the midpoint, and four firms that call the Empire State home had negative or no growth.

The mixed results are a stark contrast to the remarkable financial growth of Wall Street firms and other elite New York firms in the Am Law 100.

Outpacing the industry

Kobre & Kim reported the strongest growth among New York firms in the Second Hundred. While its 8.7% rise in revenue, to $163.3 million, was a far cry from the 49% increase reported the year before, its growth rate still topped the pack for New York firms in the Second Hundred.

Another litigation-focused firm, Kasowitz Benson Torres, also outpaced the average revenue growth of the Second Hundred. Its revenue rose 4.9% to $227.3 million, bumping up the firm four slots to No. 132. Marc Kasowitz, the firm's managing partner, told the Law Journal that his firm continued to draw clients facing bet-the-company litigation.

While the firm lost three experienced real estate transactions partners in New York to Vinson & Elkins earlier this year, Kasowitz said remaining lawyers in the practice have been “extremely busy” and said the group would grow organically, based on client demand. He added that the hiring of Kevin Arquit, an antitrust industry veteran who joined Kasowitz from Weil, has brought “a whole new segment of clients” to the firm.

“There is a fair number of large companies that Kevin has met in connection with the Hart-Scott Rodino [antitrust law] work that he's been doing, so they tend to be very acquisitive,” Kasowitz said. While the firm lacks a large mergers and acquisitions corporate practice, he said Arquit advises clients on antitrust matters in M&A.

Two other firms grew their revenues similar to the average pace of the Second Hundred. Wilson Elser Moskowitz Edelman & Dicker, an insurance defense-focused firm with several offices in New York state, grew revenue by 3.1% to $324.6 million, holding steady at No. 106. And Buffalo-based Goldberg Segalla rose its revenue 3%, to $128.8 million, rising three places to No. 175.

Flat to negative growth

Some firms had a tougher time of it last year. Patterson Belknap Webb & Tyler's revenue rose 1.1%, to over $194.9 million, but it still slipped two places in the Second Hundred, to No. 149. The firm's revenue has risen for each of the past two years, while its head count increased last year from 174 lawyers to 182, leading its revenue per lawyer to fall 3.5% to $1.07 million and profit per equity partner to drop about 3%.

Stroock & Stroock & Lavan's net attorney head count fell by seven and revenue was flat at $251 million. The firm's profit per equity partner continued to rise—by 10%—as part of a multiyear strategy that has seen the firm introduce a formal nonequity partnership tier in recent years.

“We have a smaller firm, but revenue I wouldn't say stayed static—I would say we matched our revenue from last year,” said Jeffrey Keitelman, Stroock co-managing partner. He said profit per equity partner, at $1.76 million, was similar to that seen at some Am Law 50 firms and said that strong revenue-per-lawyer figures were achieved “through better staffing of projects, improved pricing methods and just through working hard.”

Three firms with a major New York state presence saw revenue drops.

Hughes Hubbard & Reed's revenue fell more than 6% while its head count saw a net loss of about 26 lawyers, continuing a revenue and head count slide that had paused from 2016 to 2017.

Gross revenue at Syracuse-founded Bond, Schoeneck & King decreased 2.2% to $107.5 million, as head count was level.

Curtis Mallet-Prevost Colt & Mosle, which has an international presence with its biggest office in New York, saw revenues slide more than 12%, to $136 million.

The Am Law 200 also saw a new entrant from last year: Buffalo-based Hodgson Russ, which ranked No. 195 with more than $103 million in revenue. Meanwhile, Herrick Feinstein, the New York-based firm with its roots in real estate, slipped off the list again this year after having gained a spot in 2018.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

Bankruptcy Judge Clears Path for Recovery in High-Profile Crypto Failure

3 minute read

US Judge Dismisses Lawsuit Brought Under NYC Gender Violence Law, Ruling Claims Barred Under State Measure

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250