Tentative $44M Accord With Weinstein Accusers Seen as Key to Global Settlement, But Some Plaintiffs Lawyers Say No Deal

Robert J. Feinstein, who represents a committee of The Weinstein Co.'s largest creditors, told a Delaware bankruptcy judge that the agreement reached in mediation between Harvey Weinstein, the firm's board members and the New York Attorney General's Office "could be the cornerstone" to reaching an overarching settlement through The Weinstein Co.'s Chapter 11 bankruptcy case.

May 24, 2019 at 05:00 PM

6 minute read

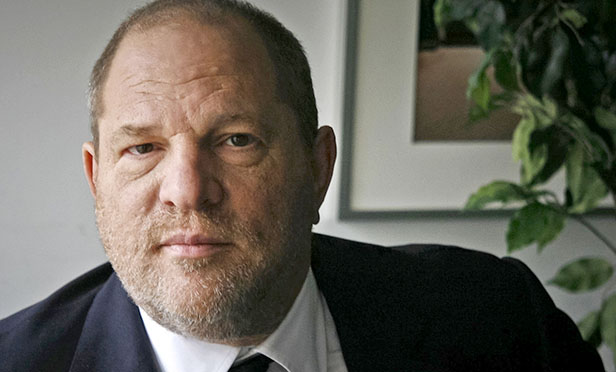

Harvey Weinstein. Photo Credit: John Carucci/AP

Harvey Weinstein. Photo Credit: John Carucci/AP

An attorney for The Weinstein Co.'s creditors said he views a tentative $44 million deal to resolve lawsuits from women who have accused Harvey Weinstein of sexual assault as the potential key to a global settlement of all civil suits against the disgraced Hollywood producer, his former company and its board.

Robert J. Feinstein, who represents a committee of The Weinstein Co.'s largest creditors, told a Delaware bankruptcy judge on Thursday that the agreement reached in mediation between Weinstein, the firm's board members and the New York Attorney General's Office “could be the cornerstone” to reaching an overarching settlement through The Weinstein Co.'s Chapter 11 bankruptcy case.

The sides were expected to formally meet on May 29 to discuss a possible final resolution.

“I think we're poised to get there,” Feinstein told U.S. Bankruptcy Judge Mary F. Walrath at Thursday's hearing. “I can't assure the court that we will, but we're committed to show up next week in the debtors' counsel's office on Wednesday.”

“I think we all owe it to the case, your honor, to get in a room and see if we can use the money that's now becoming available from the mediation to resolve this case in Chapter 11,” he said.

According to news reports published late Thursday evening, the proposed $44 million deal includes $30 million to be allocated to a broad pool of plaintiffs that includes Weinstein's alleged victims, the company's former employees and the firm's creditors. About $14 million would go toward paying the legal fees of Weinstein's associates, including former board members. It would have no bearing on a criminal case Weinstein is facing in Manhattan, which charges him with rape and other sex crimes.

The agreement would have to be approved in various courts where litigation against Weinstein and his former company exists.

Despite assurances from attorneys in the Delaware bankruptcy matter, counsel to at least one of the plaintiffs suing Weinstein in Manhattan federal court said Friday that news of a final settlement was premature.

Attorneys Douglas Wigdor and Kevin Mintzer, who represent actor Wedil David in her claims that Weinstein sexually assaulted her, called the media reports “false,” and said their client had “steadfastly rejected the proposed deal.”

“Sadly, rather than adequately compensate the rape and sexual assault victims of Harvey Weinstein who have pursued viable legal claims that have been brought within the statute of limitations, the proposed deal would provide millions of dollars to the ultra-wealthy directors of the Weinstein Company, such as James Dolan, and their big firm lawyers,” the attorneys stated.

Other plaintiffs pursuing civil actions against Weinstein in Manhattan federal court also took issue with details of the supposed deal providing Weinstein's former board members with $14 million, while the victims and their attorneys were provided only $30 million, according to sources familiar with their thinking.

“Our client does not begrudge any victim who accepts a settlement that she finds acceptable. But she will not participate in a process that is fundamentally flawed and unfair,” Wigdor and Mintzer said in their statement.

A spokesman for Weinstein declined to comment on the attorneys' statement.

The Wall Street Journal was the first to report the deal on Thursday. The parties did not publicly disclose the terms of the agreement at the hearing with Walrath on Thursday, but New York Law Journal on Friday confirmed WSJ's account.

Attorneys for The Weinstein Co. and its creditors did not return calls seeking comment on the case. A spokesman for Weinstein did not provide comment on Friday.

But while the agreement could be a potential vehicle to unlocking a global settlement, it is considered far from a done deal.

The Weinstein Co. has asked Walrath for permission to retain Bernstein Litowitz Berger & Grossmann on a contingency-fee basis to assess potential claims for breaches of fiduciary duty against the firm's former officers and directors, which the company sees as the principal assets still belonging to the estate.

Any global settlement, attorneys said, would include the release of such claims, and the reconstituted board needed to know the viability and value of what it would be giving up, Paul N. Heath, an attorney for The Weinstein Co. argued.

Feinstein, however, said the request, if approved right away, would be a “deal breaker” because it would decrease the amount of recovery available in the case.

“The contingency arrangement is another hand in a pie that's now considerably smaller than people would have liked to have obtained from that mediation,” he said at the hearing.

Walrath did not rule on the motion on Thursday.

The tentative deal, in fact, represented less than half of the $90 million that had been discussed to establish a victims' compensation fund in talks last year between an investor group and former New York Attorney General Eric Schneiderman over a possible deal to buy assets of The Weinstein Co. Those talks, however, fell apart at the last minute over questions of undisclosed debts.

Last May, Walrath approved the $310 million sale of The Weinstein Co. to Dallas-based private equity firm Lantern Capital Partners in a deal that included the assumption of some of the studio's debt. The parties have since been engaged in several rounds of mediation to resolve lawsuits against the company and its former board members.

Adam Harris, an attorney for Bob Weinstein, Harvey Weinstein's brother and the studio's co-founder, said the parties were “very close” last year to reaching a comprehensive settlement, but negotiations ultimately failed, thanks in part to an “ever-changing” litigation landscape in the case.

Talks were jump-started earlier this month, attorneys said, when the company moved to convert the case from a Chapter 11 proceeding to a Chapter 7 case in order to liquidate its assets and resolve the civil suits.

“We now have an economic agreement in principle that's supported by the plaintiffs, the AG's office, the defendants, and all of the insurers, that if approved will provide significant compensation to victims, creditors of the state, and allow the parties to avoid years of costly, time-consuming, and uncertain litigation on all sides,” said Harris, a partner at Schulte Roth & Zabel. “Obviously, that's the definition of what we think is a good settlement.”

The parties are scheduled to appear again in Wilmington on June 4 for a hearing on The Weinstein Co.'s motion to convert the case.

Colby Hamilton contributed to this report.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Spotify GC Steps Down, Opts to 'Step Away From Full-Time Corporate Life'

2 minute read

Goldman Sachs Secures Dismissal of Celebrity Manager's Lawsuit Over Failed Deal

3 minute read

Walt Disney, IBM Denied High Court Review of Old NY Franchise Tax Law

3 minute read

Trending Stories

- 1Fresh lawsuit hits Oregon city at the heart of Supreme Court ruling on homeless encampments

- 2Ex-Kline & Specter Associate Drops Lawsuit Against the Firm

- 3Am Law 100 Lateral Partner Hiring Rose in 2024: Report

- 4The Importance of Federal Rule of Evidence 502 and Its Impact on Privilege

- 5What’s at Stake in Supreme Court Case Over Religious Charter School?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250