Bank CEO Charged with Bribery, Embezzlement in Small Business Loan Scheme

Manhattan prosecutors say Noah Bank CEO Edward Shin used his position to have federally backed small business loans issued to businesses he secretly had interests in, through a broker he received kickbacks from.

May 29, 2019 at 03:31 PM

4 minute read

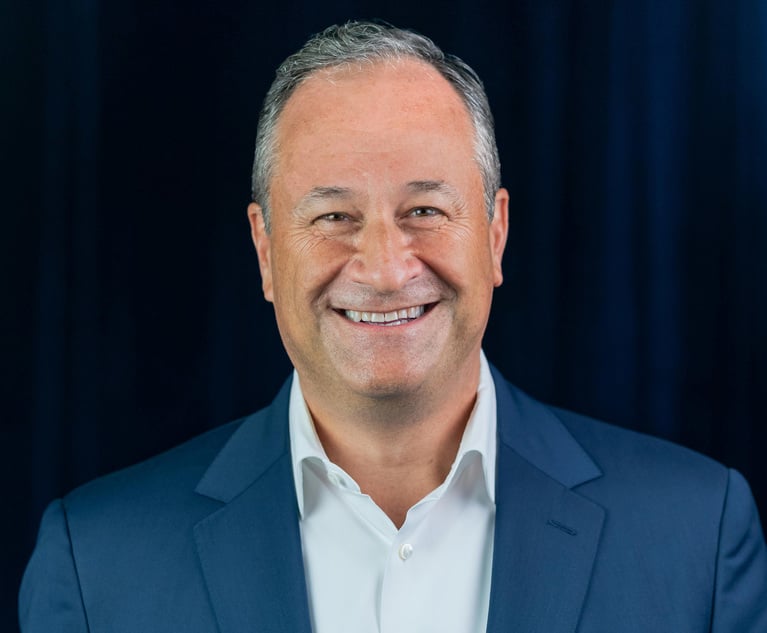

Geoffrey Berman, U.S. attorney for the Southern District of New York. Photo: John Taggart/Bloomberg

Geoffrey Berman, U.S. attorney for the Southern District of New York. Photo: John Taggart/Bloomberg

Noah Bank CEO Edward Shin was arrested and charged by the office of U.S. Attorney Geoffrey Berman of the Southern District of New York for allegedly directing the bank to issue federally backed loans aimed at helping small businesses that went to companies in which Shin had secret interest.

Shin, a Pennsylvania resident whose bank is based in Elkins Park in the Philadelphia suburbs, also allegedly took kickbacks on the commissions for those loans from a third party who did “no legitimate work in the loan process,” Berman said in a statement.

“The Small Business Administration exists to provide funding to those pursuing the American dream through owning their own businesses. Edward Shin is now charged with attempting to corrupt that process for his own personal gain,” the Manhattan U.S. attorney said.

According to the complaint against Shin, Noah Bank made loans guaranteed by the Small Business Administration available to eligible businesses in the New York and New Jersey area. These loans required compliance with SBA regulations and procedures in order to be issued.

Specifically relevant to Shin's case, bank officers were prohibited from receiving any payments related to the loans, and loans were barred from being extended to businesses in which a bank officer held an interest.

According to the U.S. attorney's office, Shin directly violated these rules.

Federal prosecutors claim that, between 2009 and 2012, Shin used his position to ensure he got a piece of the action as the loans went out the door and took secret advantage of those same loans at those businesses receiving them.

Shin allegedly ensured that an unnamed loan broker, identified as a cooperating witness, was in place to handle the SBA-backed loans issued by Noah Bank—even when the loan didn't involve and actual broker. The broker was assured a broker's fee, despite doing no work, which he then split with Shin as a form of illegal kickback, according to the complaint.

SBA-guaranteed loans then flowed to businesses that Shin had an ownership stake in. As the complaint notes, the loan scheme was initially raised through a qui tam False Claims Act complaint filed with the U.S. District Court of the District of New Jersey by Marie Lee in 2013. In the New Jersey filings, Lee is identified as the former chief lending officer for Noah Bank.

As Manhattan prosecutors relate, on at least two occasions Shin had loans directed towards New York-based businesses in which Shin, and in one instance his wife, held interests. Nearly $2 million in loans were secured for the businesses, prosecutors said, with SBA chalking up a more-than $611,000 loss on one of the businesses' defaulted loan. In the other, more than $150,000 was drawn from Shin's wife's account. SBA rules would have barred the loan if the family connection had been revealed.

Brickfield & Donahue name attorney Paul Brickfield represents Shin. He did not respond to a request for comment.

Related:

Michael Avenatti Charged With Fraud, Stealing From Ex-Client Stormy Daniels in New Indictments

Goldman Investors Demand Probe Into Involvement in $4.5B Bribery, Money-Laundering Scandal

Manhattan U.S. Attorney Announces 'First-Ever' N. Korean Sanctions Seizure

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Justice Marguerite Grays Elevated to Co-Chair Panel That Advises on Commercial Division

Distressed M&A: Safe Harbor Protection Extends to Overarching Transfer

Trending Stories

- 1Midsize Firm Bressler Amery Absorbs Austin Boutique, Gaining Four Lawyers

- 2Bill Would Allow Californians to Sue Big Oil for Climate-Linked Wildfires, Floods

- 3LinkedIn Suit Says Millions of Profiles Scraped by Singapore Firm’s Fake Accounts

- 4Supreme Court Agrees to Hear Lawsuit Over FBI Raid at Wrong House

- 5What It Takes to Connect With Millennial Jurors

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250