Bankruptcy Judge Denies Madoff Trustee Summary Judgment in Clawback Suit

U.S. Bankruptcy Judge Stuart M. Bernstein nixed trustee Irving H. Picard's motion for summary judgment on his fraudulent transfer claim to recover transfers from Legacy Capital Ltd.'s account with Bernard L. Madoff Investment Securities that were made within two years of its founder being arrested for securities fraud in 2008.

June 25, 2019 at 06:07 PM

3 minute read

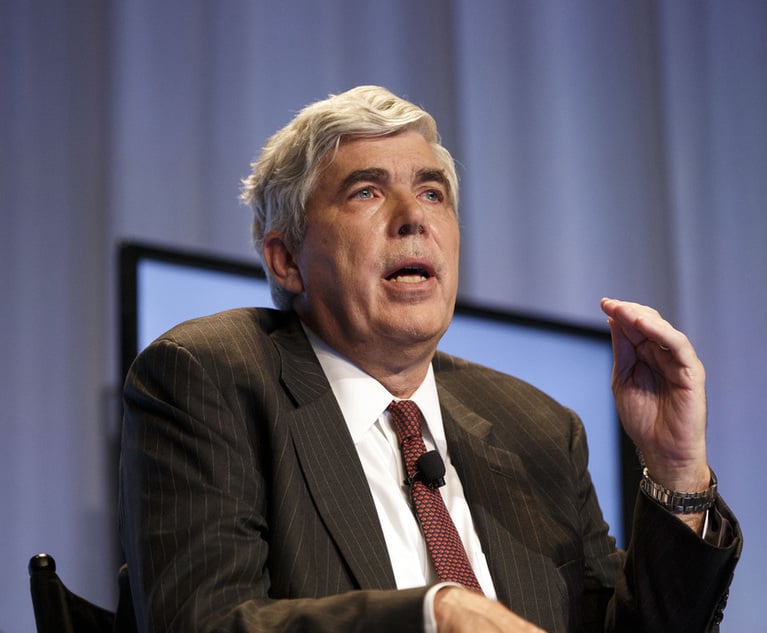

Bernard Madoff being escorted into federal court in New York in 2009. Photo: Jin Lee/Bloomberg News

Bernard Madoff being escorted into federal court in New York in 2009. Photo: Jin Lee/Bloomberg News

A Manhattan federal judge on Tuesday blocked an attempt by the trustee of the Bernie Madoff fund to claw back, ahead of trial, $86 million in allegedly fraudulent transfers an investor had received as part of Madoff's Ponzi scheme.

U.S. Bankruptcy Judge Stuart M. Bernstein of the Southern District of New York nixed trustee Irving H. Picard's motion for summary judgment on his fraudulent transfer claim to recover transfers from Legacy Capital Ltd.'s account with Bernard L. Madoff Investment Securities that were made within two years of its founder being arrested for securities fraud in 2008.

In the ruling, Bernstein said that Picard was entitled to go after the funds because the transactions were clearly part of Madoff's $65 billion Ponzi scheme, considered the largest and longest-running in U.S. history.

However, Bernstein said, important questions remained as to Legacy's defense that it had taken the transfers “for value and good faith.”

“The Trustee has shown that there is no genuine material issue of fact regarding his prima facie case and those facts are deemed established for the purposes of this adversary proceeding. The Trustee's motion for summary judgment is otherwise denied,” he wrote in a 30-page decision.

Tuesday's ruling followed Bernstein's dismissal in 2016 of the bulk of the trustee's $220 million clawback suit against the British Virgin Islands-based investment vehicle and Khronos LLC, which had provided it accounting services. The earlier ruling dismissed all claims against Khronos, and found that Picard could not argue Legacy acted in bad faith because the company didn't have actual knowledge that Madoff was not trading in real securities.

As to value, Bernstein said on Tuesday that differences over the Ponzi scheme's start date and U.S. Treasury bills that Madoff had bought and resold to his customers would have to be resolved on a fuller record at trial.

“These discrepancies and the relationship, if any, between BLMIS's purchase of T-Bills from brokers and the apparent resale of a portion of those purchases to customers like Legacy raise factual issues that the Court cannot resolve on this motion,” Bernstein said.

The trustee's office declined to comment on Tuesday. An attorney for Legacy did not respond to a request for comment.

Madoff pleaded guilty in 2009 to charges of securities fraud, investment adviser fraud, mail fraud, wire fraud, money laundering, making false statements, perjury, making false filings with the U.S. Securities and Exchange Commission and theft from an employee benefit plan. He was sentenced later that year to 150 years in prison.

Picard, a Baker & Hostetler partner, was appointed in 2008 under the Securities Investor Protection Act to serve as trustee for the liquidation of BLMIS. According to the Madoff Trustee Initiative, recoveries and settlements in the case totaled more than $13.4 billion as of June 21.

Picard, as trustee, is represented by David J. Sheehan, Oren J. Warshavsky and Jason S. Oliver of Baker & Hostetler.

Legacy is represented by Nicholas F. Kajon of Stevens & Lee.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Private Equity Giant KKR Refiles SDNY Countersuit in DOJ Premerger Filing Row

3 minute read

Trump Mulls Big Changes to Banking Regulation, Unsettling the Industry

Trending Stories

- 1'Didn't Notice Patient Wasn't Breathing': $13.7M Verdict Against Anesthesiologists

- 2'Astronomical' Interest Rates: $1B Settlement to Resolve Allegations of 'Predatory' Lending Cancels $534M in Small-Business Debts

- 3Senator Plans to Reintroduce Bill to Split 9th Circuit

- 4Law Firms Converge to Defend HIPAA Regulation

- 5Judge Denies Retrial Bid by Ex-U.S. Sen. Menendez Over Evidentiary Error

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250