Second Circuit Upholds 'Pharma Bro' Martin Shkreli's Fraud Conviction, $7.3M Asset Forfeiture

The New York City-based federal appeals court upholds Martin Shkreli's conviction on securities fraud and conspiracy charges.

July 18, 2019 at 11:15 AM

3 minute read

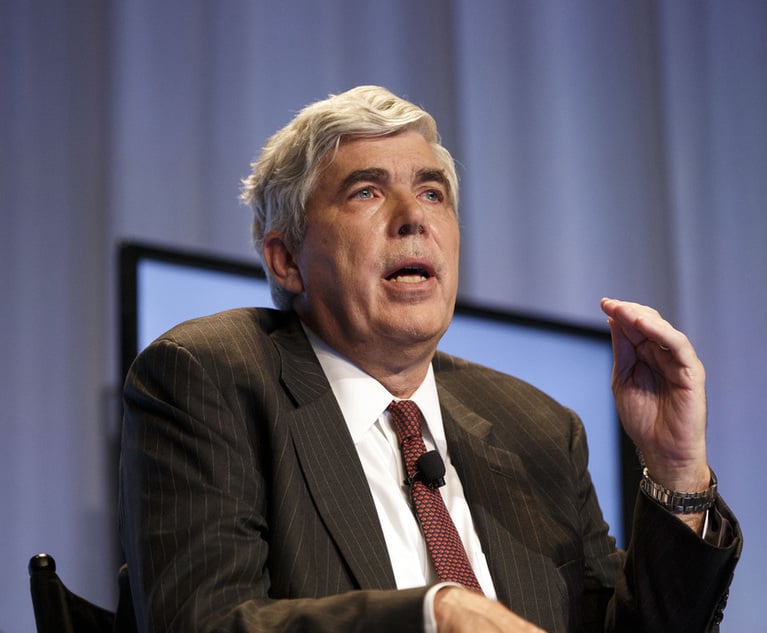

Martin Shkreli (Photo: Diego M. Radzinschi/ALM)

Martin Shkreli (Photo: Diego M. Radzinschi/ALM)

The New York City-based federal appeals court on Thursday morning upheld Martin Shkreli's conviction on securities fraud and conspiracy charges, along with an order requiring him to forfeit $7.3 million to the government.

The U.S. Court of Appeals for the Second Circuit, in a seven-page summary order, rejected claims from the disgraced pharmaceutical executive that the judge in his case had relayed incorrect and confusing jury instructions, leading to a split verdict in 2017 that cleared him of five other counts, including wire fraud.

A Brooklyn federal judge the following April sentenced Shkreli, the former CEO of Turing Pharmaceuticals, to serve seven years in prison, pay a fine and restitution and forfeit more than $7.3 million acquired through what prosecutors said amounted to a Ponzi scheme to defraud investors in his two hedge funds.

A three-judge panel of the appeals court found that the “no ultimate harm” jury instruction that Shkreli disputed had been upheld in multiple securities fraud cases, and its exclusion would have resulted in a “windfall” for Shkreli, who is currently serving out his sentence in Pennsylvania.

Shkreli, who became known as the “Pharma bro” after a contentious hearing where he testified to a congressional committee, had also argued that not all investors in his failed hedge funds had testified at trial, warranting a reduction in his forfeiture, which includes $5 million from his brokerage account, a one-of-a-kind Wu-Tang Clan album and a Pablo Picasso painting.

The appeals court, however, agreed with Department of justice attorneys, who cited the “sheer breadth and depth” of false promises and omissions Shkreli had made to investors.

“We agree with the government that the continuing misrepresentations sent to all investors in the funds (in the form of false performance reports sent out on a regular basis, for example) clearly link Shkreli's ability to retain the invested money to his fraud,” the panel wrote. “As such, we discern no clear error in the district court's factual finding that the money associated with all the investors was traceable to Shkreli's fraud irrespective whether or not the investors testified.”

Read More:

Jury Finds Former Martin Shkreli Attorney Guilty in Stock Scheme

Ex-Shkreli Lawyer Suspended From SEC Following Fraud Conspiracy Conviction

Shkreli Ordered to Forfeit More Than $7.3M for Securities Fraud

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Private Equity Giant KKR Refiles SDNY Countersuit in DOJ Premerger Filing Row

3 minute read

Trump Mulls Big Changes to Banking Regulation, Unsettling the Industry

Trending Stories

- 1'Didn't Notice Patient Wasn't Breathing': $13.7M Verdict Against Anesthesiologists

- 2'Astronomical' Interest Rates: $1B Settlement to Resolve Allegations of 'Predatory' Lending Cancels $534M in Small-Business Debts

- 3Senator Plans to Reintroduce Bill to Split 9th Circuit

- 4Law Firms Converge to Defend HIPAA Regulation

- 5Judge Denies Retrial Bid by Ex-U.S. Sen. Menendez Over Evidentiary Error

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250