Dollar Store Chains Settle With NY AG James Over Sale of Outdated Products

The settlement is the result of an undercover probe by investigators from the Attorney General's Office, which visited stores owned by Dollar General and Dollar Tree over a two-year period to scope out the misconduct.

August 26, 2019 at 03:59 PM

4 minute read

Photo: Mike Mozart/Flick

Photo: Mike Mozart/Flick

Two chains of dollar stores in New York will pay $1.2 million to settle claims from the New York Attorney General's Office that they sold expired or obsolete products to customers, including medicine and motor oil, and failed to follow the state's bottle deposit law.

The settlement is the result of an undercover probe by investigators from the Attorney General's Office, which visited stores owned by Dollar General and Dollar Tree over a two-year period to scope out the misconduct.

New York Attorney General Letitia James said that, aside from the financial settlement, the agreement will ensure that neither chain continues to violate state law.

"It's a tough pill for New Yorkers to swallow that the over-the-counter drugs they were buying may have been expired," James said. "New York consumers have a right to expect that products on store shelves are safe, fresh and suitable for their advertised use."

Investigators found that several Dollar General, Dollar Tree and Family Dollar stores in New York had been selling over-the-counter drugs that were expired by months. It's illegal in New York to sell over-the-counter drugs past the date marked on the product's label.

At Dollar General, investigators also found store-brand motor oil that was obsolete, including oil that hasn't been suitable for most engines for decades, according to the Attorney General's Office. Those products were placed next to other brands that were fine for modern engines and excluded any warning about their use.

While Dollar General conceded Monday that it took immediate action to address medication that was past its expiration date, the company said in a response that it disagreed with investigators about the motor oil.

"We continue to believe that the DG-branded motor oil products at issue meet both the Company's standards for quality and value, but also all applicable federal and state labeling, marketing and placement requirements where they are sold," the company said.

Investigators also found that Dollar Tree and Family Dollar stores were not complying with a section of state law that requires retail stores to accept certain beverage containers for redemption. When they tried to bring compliant bottles to those stores, they were told that the store either didn't accept deposits or needed a proof of purchase, according to the office.

Dollar Tree, which owns Family Dollar, did not immediately return a request for comment Monday.

As part of the settlement, both chains agreed to create a system to track the expiration dates on merchandise delivered to their distribution centers, inspect and restock store shelves regularly, and conduct monthly audits of each store to check for expired products.

Each chain will also be subject to third-party audits at 10% of their stores in New York for at least a year.

Dollar General agreed to pay $1.1 million in restitution, damages, penalties and costs as part of the settlement. Dollar Tree agreed to pay $100,000.

Dollar General was represented by Noreen Kelly, a partner at McGuireWoods. Dollar Tree and Dollar Family were represented by Ronald Blum, a partner at Manatt, Phelps & Phillips.

READ MORE:

New York State Leads New Challenge to 'Public Charge' Rule From Trump Administration

Student Loan Servicer Settles With NY Regulators Over Alleged Licensing Violation

NY AG James Seeks Dismissal or Transfer of Trump Lawsuit to Block Release of State Tax Returns

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

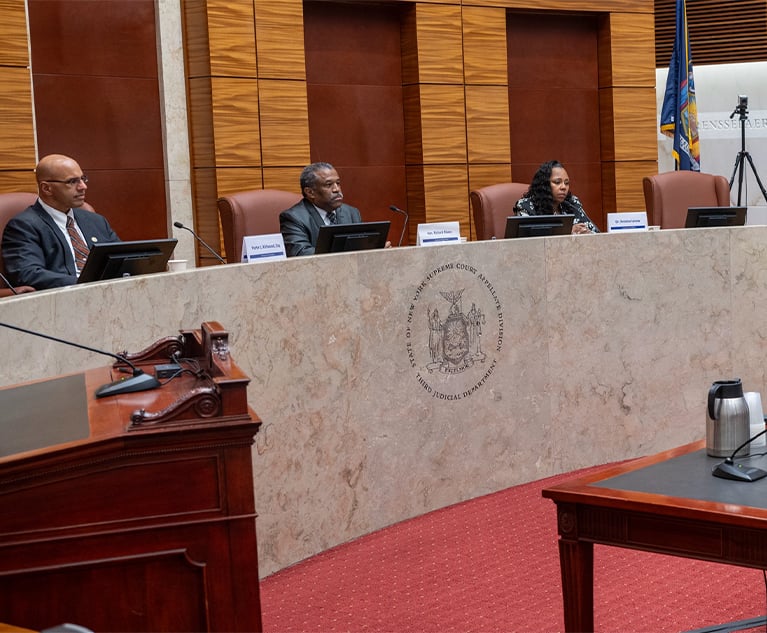

'Reluctant to Trust'?: NY Courts Continue to Grapple With Complexities of Jury Diversity

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250