Seyfarth Says Ex-Lawyer Who Bribed Judges Tied to Legal Malpractice Suit

Seyfarth said a disbarred lawyer and the boss of an ex-client might bear some fault if the law firm is ultimately found to have committed legal malpractice.

September 10, 2019 at 03:04 PM

4 minute read

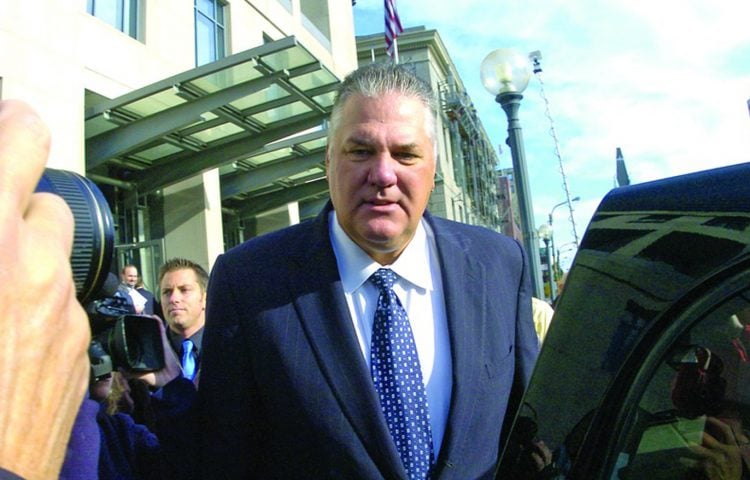

Robert Powell, who was disbarred for his role in the "kids for cash" scandal, is said by Seyfarth Shaw to have given bad advice to a principal of its client in a bankruptcy case. AP Photo/The Citizens' Voice, Mark Moran

Robert Powell, who was disbarred for his role in the "kids for cash" scandal, is said by Seyfarth Shaw to have given bad advice to a principal of its client in a bankruptcy case. AP Photo/The Citizens' Voice, Mark Moran

Seyfarth Shaw has hit back against a former client who sued the firm for legal malpractice, arguing the client's principal is to blame for her losses because she was secretly taking advice from a disbarred lawyer convicted in a bribery scandal.

Seyfarth represented Blue Dog at 399 Inc. in a suit against its landlord. Ultimately, after Seyfarth withdrew, Blue Dog alleged in a malpractice suit that the law firm failed to file expert reports and complete discovery in a timely manner, leading key evidence to be excluded.

The law firm recently lost its request to dismiss Blue Dog's $157 million malpractice claim. But in a new complaint filed Friday in Blue Dog's bankruptcy case in Manhattan, the firm accused Blue Dog principal Elizabeth Slavutsky of taking bad advice from Robert Powell, a convicted felon whose company D&D Funding II LLC had lent Blue Dog money.

Seyfarth describes Powell as a disbarred attorney who bribed judges in a so-called "kids for cash" scandal. In that controversy, two Pennsylvania judges were sentenced to prison for accepting benefits from Powell in exchange for sending a steady stream of juvenile defendants to prisons that Powell had a stake in, ignoring the minor defendants' civil rights in the process. Powell pleaded guilty to non-bribery offenses for his role in the scheme.

"Upon information and belief, at all times relevant herein, Powell performed services … and was an advisor to and a representative of [Blue Dog]," Seyfarth said in Friday court filings. "Upon information and belief, Powell served an 18-month prison sentence after pleading guilty in 2009 to felony counts of failing to report a felony and being an accessory to a conspiracy to commit income tax evasion."

While Seyfarth doesn't say Slavutsky committed wrongdoing by working with Powell and his company, it says she still hasn't paid more than $713,000 in legal fees she was supposed to pay on Blue Dog's behalf. Seyfarth's complaint also included a contribution claim against Slavutsky, Powell and D&D, alleging that they derailed a good settlement that Seyfarth had helped negotiate with Blue Dog's landlord.

Seyfarth argued that the malpractice claims against it should eventually be dismissed, but said that if they aren't, Slavutsky, Powell and D&D—which last year bought majority control of the restaurant company from Slavutsky—should be liable to the extent they are at fault for the malpractice.

According to Seyfarth's complaint in the Southern District of New York bankruptcy court, Slavutsky turned to D&D to provide funds for Blue Dog's dispute with its landlord. At the 2017 mediation where Seyfarth helped her notch a settlement that would allow the restaurant to open, the law firm said, she called Powell to make sure the settlement was OK.

Seyfarth alleges that Powell subsequently advised Slavutsky to renege on the settlement, hire new lawyers and strike a worse deal because it was in his and D&D's interest to do so.

It's not clear how Seyfarth determined that the Powell who has signed off on court papers as a representative of D&D is the same man who was implicated in the kids-for-cash scandal. Joel Haims of Morrison & Foerster, who represents Seyfarth, declined to comment.

Lawyers listed in court records for Blue Dog and D&D, Slavutsky and an agent for D&D didn't immediately respond to comment requests. Powell could not be reached for comment.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Profits Surge Across Big Law Tiers, but Am Law 50 Segmentation Accelerates

4 minute readTrending Stories

- 1Million-Dollar Verdict: Broward Jury Sides With Small Business

- 2'Reluctant to Trust'?: NY Courts Continue to Grapple With Complexities of Jury Diversity

- 3'Careless Execution' of Presidential Pardons Freed Convicted Sex Trafficker, US Judge Laments

- 4Newsmakers: Littler Elevates Dallas Attorney to Shareholder

- 5South Florida Real Estate Lawyers See More Deals Flow, But Concerns Linger

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250