“I have witnessed the tremendous impact volunteerism has on American society—on both the people providing social services and the people receiving them. These altruistic interactions often serve a broader purpose: They bond together neighbors and communities in a common cause, and enable us to see and appreciate each other’s humanity … . I firmly believe that everyone in the public and nonprofit sectors has a role to play in fostering volunteerism, and that engagement can pay dividends for all.” Susan Dreyfus, Chair of Leadership 18, a coalition of nonprofit human servicing organizations that collectively serve 87 million people.

The tax law encourages volunteers by allowing them to deduct the unreimbursed expenses they incur in helping charitable organizations. Clients who are itemizers may deduct unreimbursed expenses that they incur incidental to their volunteer work. Reg. §1.170A-1(g). So costs incurred in going from home to the charity’s office (or other places where they render services), phone calls, postage stamps, stationery, and similar out-of-pocket costs are deductible as charitable donations.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

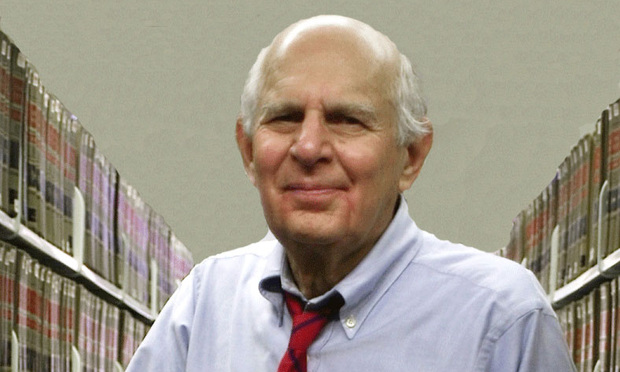

Conrad Teitell

Conrad Teitell