Shearman Sees Revenue Inch Up Amid Strategy to 'Reshape' Business

"You're seeing a drop in hours but an increase in revenue and profitability, which is exactly what we're trying to achieve," said senior partner David Beveridge.

February 28, 2020 at 12:43 PM

6 minute read

Photo: Diego M. Radzinschi/ALM

Photo: Diego M. Radzinschi/ALM

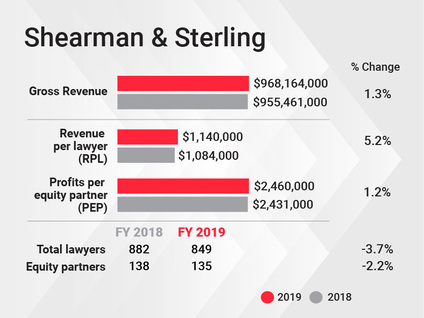

Shearman & Sterling's revenue and profits per equity partner each rose just over 1% last year, as the firm balanced new hires, exits and new office openings amid a renewed focus on U.S. business.

Gross revenue grew 1.3% to $968.16 million, and average profits per equity partner rose 1.2% to $2.46 million. As total lawyer head count declined by nearly 4%, a net loss of about 33 lawyers, the firm's revenue per lawyer grew 5.2% to $1.14 million.

It was a year of "steady, consistent growth," said senior partner David Beveridge. "What we've been doing is reshaping our business to focus on our most profitable practices," growing revenue from corporate and private capital clients, such as hedge funds, private equity and sovereign wealth funds, he said.

Part of that strategy, he said, is increasing the firm's focus on the U.S and having "very measured investment" in offices such as Brazil—where Paul Hastings absorbed nearly all of Shearman's team in São Paulo in the last year—and in Hong Kong, where Shearman saw the exit of at least 10 capital markets-focused lawyers, including a team leader. Still, Beveridge said the firm maintains "market-leading" practices in Latin America and Asia.

Meanwhile, the firm has opened three new offices in Texas in the past two years, including in Houston, Austin and just this year, Dallas, as part of its focus on oil and gas and energy industries.

Meanwhile, the firm has opened three new offices in Texas in the past two years, including in Houston, Austin and just this year, Dallas, as part of its focus on oil and gas and energy industries.

"The U.S. we think is the largest, most profitable legal market, and I think you're seeing most firms focus on that. We're no different," he said, adding the firm is still growing in London, the Middle East and elsewhere.

Shearman lawyers billed fewer hours in 2019 from 2018—about an 8% drop, according to American Lawyer figures—but Beveridge also credited that to a deliberate business pivot. The Hong Kong capital markets practice, for instance, had high hours, "so we lost a number of hours there" but the firm moved toward more profitable areas, he said.

Despite the drop in hours, Shearman achieved a revenue gain through higher realization, he said. "You're seeing a drop in hours but an increase in revenue and profitability, which is exactly what we're trying to achieve," he said.

Speaking on the slower revenue growth in 2019 compared with 2018, Beveridge noted the firm's slew of lateral hires. Last year, Shearman added 15 lateral partners and saw eight internal partner promotions. "We're getting people in with more work. You haven't seen the full benefit of the laterals we've hired yet," he said.

Beveridge declined to detail London office revenue, noting the firm doesn't break it out of firmwide totals. Overall, he said, London "improved year over year" in the amount of practice work and transactions. "It's just had some very strong practices."

Equity Partner Decline

Amid the 1.3% increase in profits per equity partner, the firm saw a net loss of three equity partners, down to 135, and a net gain of nine non-equity partners, up to 74 in the non-equity tier.

Beveridge said the firm didn't de-equitize any partners, dismissing any notion that the firm decreased the number of equity partners to increase profits per partner.

David Beveridge

David BeveridgeHe noted that newly elected partners enter the partnership as non-equity partners in the first year, while retiring partners also step into the tier. "But the shift isn't big enough to indicate anything significant," he said, noting the changes are "how we grow, who retires and who leaves."

Beveridge said the firm introduced non-equity partners years ago to increase flexibility in growing the firm's offices because pricing and profitability across Shearman's offices "are widely different." Still, the firm doesn't limit the size of the equity partnership, noting "it depends on performance."

It's been a busy time for Shearman. The firm re-signed a lease to stay at its longtime Manhattan address at 599 Lexington Ave. for the next two decades

The firm earlier this year opened a Dallas office with several Jones Day lawyers and three Shearman lawyers who transferred from the firm's Houston office, after adding launching in Austin and Houston. Meanwhile, Allen & Overy's U.S. leveraged finance group co-heads, partners Alan Rockwell and Michael Chernick, jumped to Shearman in October, and Renad Younes, from Ashurst, arrived in Shearman's Abu Dhabi office as a partner in early 2019.

The firm has also seen some high profile departures, including Laura Friedrich, who led the firm's investment funds team and moved to Willkie Farr & Gallagher earlier this month; corporate lawyer Brien Wassner, a co-leader of its private capital industry group who moved to Sidley Austin; and Robert Katz, an mergers and acquisitions lawyer who moved to Latham & Watkins.

Beveridge said he's sorry to see partners move on, but he doesn't see the exits affecting the firm's bottom line. The departures, he said, are "a natural rhythm in law firms."

Practice Performance

The firm's practices in corporate, disputes and finance all performed well, Beveridge said.

For instance, in disputes, Shearman secured a victory for SS&C Technologies, a new corporate client, in a lawsuit against Clearwater Analytics alleging the misappropriation of trade secrets and obtained a total dismissal for Bank of Montreal and Bank of Nova Scotia regarding the financial benchmark antitrust litigation.

In corporate matters, Shearman advised on Raytheon's landmark combination with United Technologies; Viacom's merger with CBS, helping create one of the largest multiplatform content companies; and Dow's spinoff from DowDuPont.

In a large cross-border project finance matter, Sherman advised Malaysian national oil company PETRONAS on its $15 billion project financing relating to its joint venture with Saudi Aramco.

In pro bono matters, the firm's lawyers helped in the reunification of detained families and advised Impact Investment Exchange on a new bond fund to create sustainable livelihoods for over 2 million women across Asia.

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Paul Hastings, Recruiting From Davis Polk, Adds Capital Markets Attorney

3 minute read

Neighboring States Have Either Passed or Proposed Climate Superfund Laws—Is Pennsylvania Next?

7 minute readLaw Firms Mentioned

Trending Stories

- 1Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 2Meet the New President of NY's Association of Trial Court Jurists

- 3Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

- 4Freshfields Hires Ex-SEC Corporate Finance Director in Silicon Valley

- 5Meet the SEC's New Interim General Counsel

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250