Fried Frank Extends Growth Streak With Double-Digit Revenue, Profit Gains

Chairman David Greenwald said the firm's litigators had a particularly busy year.

March 16, 2020 at 04:47 PM

4 minute read

Fried Frank's David Greenwald. (Courtesy photo)

Fried Frank's David Greenwald. (Courtesy photo)

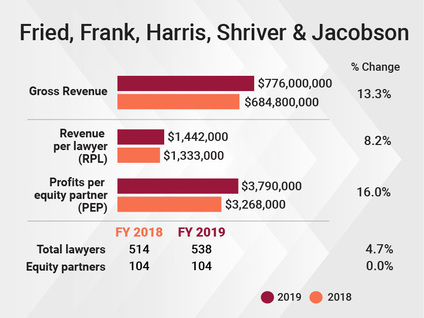

Fried, Frank, Harris, Shriver & Jacobson reported another year of strong results for 2019, hitting record highs in every financial metric while growing its lawyer ranks.

The firm's revenue increased 13.3% to $776 million last year, and profits per equity partner rose 16% to reach $3.79 million across an equity tier whose size held steady at 104 partners. The firm's full-time equivalent head count rose 4.7% to 538, with revenue per lawyer up 8.2% to over $1.4 million.

Firm chairman David Greenwald said the firm had a good year across all its practices, including its corporate lawyers, who bring in about half the firm's revenue, and its litigation and real estate groups, each numbering a bit under 100 lawyers.

"Litigation, in particular, had a stellar year on all metrics," Greenwald said, later adding, "Their growth over the last year was phenomenal. Hours were way up, revenue was way up, they had a terrific year and they're probably, on average, among the hardest working in the firm now," as measured by billable hours per lawyer.

Fried Frank had no net growth in equity partners, while the tally of nonequity partners grew from 35 to 46. Greenwald was reluctant to discuss head count changes, saying, "our strategy is to best serve our clients, and we're going to have the head count and structure of our head count in place that allows us to achieve it."

Fried Frank had no net growth in equity partners, while the tally of nonequity partners grew from 35 to 46. Greenwald was reluctant to discuss head count changes, saying, "our strategy is to best serve our clients, and we're going to have the head count and structure of our head count in place that allows us to achieve it."

Fried Frank doesn't break out its London office's revenue, and Greenwald declined to go into details, saying, "London is a very big contributor to the firm's financial results and it is growing." Average head count in that office was up 17% from fiscal 2019 to fiscal 2020, the highest growth of any of the firm's four offices.

The firm's fiscal 2020, which ran from March 2019 through the end of February 2020, was the latest year of increases in a long hot streak. Greenwald, who took the reins of the firm in 2014, emphasized the longer-term growth: Its 2020 revenue was more than 39% over 2017 levels and more than 66% higher than 2015 levels, with even stronger growth in net income.

Dealmakers at the firm kept busy, with mergers and acquisitions and private equity lawyers representing clients on transactions totaling more than $360 billion in value during the firm's fiscal year, and asset management lawyers advising on fund formations totaling more than $77 billion in 2019. Clients included Tradeweb Markets, which had a $1.2 billion initial public offering in April; and Sinclair, which paid $9.6 billion for a group of regional sports networks that were divested by Disney as part of its 21st Century Fox tie-up.

The firm, with offices in London and Frankfurt, Germany, also did work on major European deals, including London-based asset manager Permira's formation of a seventh buyout fund and over €6 billion in fundraising for BlueBay Asset Management. The firm also advised on the spinoff of BlueBay's private debt business into Arcmont Asset Management.

The firm's real estate lawyers also stayed busy, representing WarnerMedia in the sale and leaseback of 1.5 million square feet at 30 Hudson Yards and helping property giant Brookfield form a $15 billion fund known as BSREP III, which closed in January 2019 and has received commitments from more than 150 limited partners. They also advised on Brookfield's other investment vehicles and business endeavors.

Fried Frank's litigators also helped Sinclair in cases related to its proposed merger with Tribune Media Co. And the firm's Washington presence came in handy for federal contractor Leidos, which hung onto a contract with NASA worth up to $2.9 billion after a competitor filed a protest with the Government Accountability Office, alleging that Leidos was conflicted.

Greenwald, whose current term atop the firm is slated to end in February 2021, said the firm also had a big backlog of unbilled time and accounts receivable going into its next fiscal year, 16% higher than the previous year's. He cautioned in an interview during the week of March 9 that the coronavirus outbreak would impact the firm's financial expectations for this year.

"I'm confident it is going to impact our budget," he said. "The uncertainty is such that people are going to be conservative in budgeting. In terms of hiring, we did our hiring for the summer, next fall, months and months ago, so that's locked and loaded."

Lateral hiring, he added, is continuing, but handshakes are out.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Paul Hastings, Recruiting From Davis Polk, Adds Capital Markets Attorney

3 minute read

Neighboring States Have Either Passed or Proposed Climate Superfund Laws—Is Pennsylvania Next?

7 minute readLaw Firms Mentioned

Trending Stories

- 1We the People?

- 2New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 3No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 4Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 5Meet the New President of NY's Association of Trial Court Jurists

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250