Courts Do Not Always Defer to Arbitrators

In their International Litigation column, Lawrence W. Newman and David Zaslowsky discuss three recent court decisions from three different countries, each of which offers an example of a court not deferring to an arbitrator."

March 25, 2020 at 12:30 PM

11 minute read

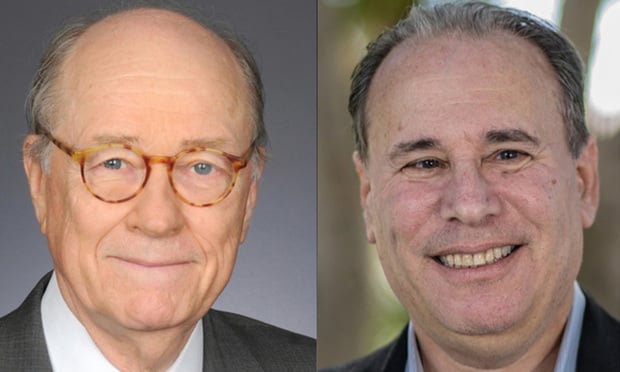

Lawrence W. Newman and David Zaslowsky

Lawrence W. Newman and David Zaslowsky

The notion that courts generally defer to arbitrators is well established around the globe. But there are exceptions. We have discussed in previous columns (1) that courts sometimes refuse to enforce arbitral awards because, though often couched in other terms, they essentially believe that arbitrators strayed too far from the result the courts think is correct, (2) that courts do not always allow arbitrators to decide the issue of whether a dispute is arbitrable, and (3) the court-created ground for refusing to enforce an arbitral award known as "manifest disregard of the law." In this column, we look at three recent decisions on these issues from three different countries.

Award Vacated for Refusing To Hear Witnesses

In CBP v. CBS, [2020] SGHC 23, a decision by a first-instance court in Singapore, the court dealt with a dispute arising out of an agreement to purchase coal, that included an agreement to arbitrate under the Rules of the Singapore Chamber of Maritime Arbitration (SCMA). An arbitration ensued between the buyer and a bank to which the seller's rights had been assigned. The heart of the dispute concerned a meeting that took place in December 2015.

In the proceedings, the arbitrator asked the parties to "review and agree on the necessity of an oral hearing," adding that, should they not be able to agree that the decision "should be based on documents only then, pursuant to SCMA Rule 28, we will schedule a hearing." In its defense, the buyer identified seven witnesses, six of whom had been present at the December meeting. The bank did not agree, contending that there was no necessity for witnesses since the dispute between the parties turned primarily on contract interpretation.

The arbitrator asked the buyer to provide the reasons for the seven witnesses but the buyer said only that a hearing was necessary. The arbitrator next requested "a descriptive basis of what [the buyer] expects to develop with the introduction of the proposed witnesses." In response, the buyer again asserted that "[t]here is a necessity of examining the witnesses." The arbitrator then issued an order that, if there were to be a hearing, he would require a detailed witness statement from each of the witnesses. The buyer responded to that order by referring to SCMA Rule 28.1, which provides:

Unless the parties have agreed on a documents-only arbitration or that no hearing should be held, the Tribunal shall hold a hearing for the presentation of evidence by witnesses, including expert witnesses, or for oral submissions [emphasis added].

According to the buyer, since it did not agree to a documents-only arbitration, an oral hearing was needed for it to present its witness testimony. The arbitrator then told the buyer that, if it did not submit its witness statements, it would be taken to have "waived" its right to present witness evidence in an oral hearing.

The arbitrator subsequently issued an order that, since the parties had not agreed to a documents-only arbitration pursuant to SCMA Rule 28.1, an oral hearing would be held. However, the arbitrator also stated that, pursuant to the same rule, there would be no witnesses heard at the hearing because the buyer had "failed to provide witness statements or any evidence of the substantive value of presenting witnesses." The hearing was conducted by telephone and the buyer failed to participate. The arbitrator ultimately issued an award in favor of the bank. With respect to the December meeting, the arbitrator held that, as a matter of law, there was no basis for the price to be adjusted pursuant to an oral agreement. The buyer then moved in court to set aside the award.

The buyer argued that the arbitrator had committed a breach of the rules of natural justice, namely, the right to have an adequate opportunity to be heard. The issue addressed by the court was whether the language of the above-quoted Rule 28.1 concerning the conduct of an oral hearing in the event that the parties do not agree to a documents-only arbitration permits the arbitrator to decide to dispense with the presentation of witnesses, even when one of the parties insists on the need for witness testimony.

The bank argued that an oral hearing had been held and that the use of the word "or" in Rule 28.1 means that the arbitrator may either hold a hearing for the presentation of evidence or receive oral submissions. The bank also argued that (1) based on several commentaries, there is a "consensus" that a tribunal has the power to refuse or limit the appearance of witnesses giving oral testimony and (2) although the SCMA Rules are silent on whether the arbitrator has the authority to exclude the oral testimony of witnesses, such authority may be inferred from other provisions of the Rules that provide the arbitrator with significant control over the arbitration proceedings.

The court rejected the bank's disjunctive reading. It said that the rule meant that a party must be given the opportunity to present witness testimony if it wishes and, only if neither party so wishes, may the hearing be based only on oral submissions. As for the general authority of arbitrators to limit witnesses, the court relied on a number of articles that said that such power is not unfettered. According to the court, a tribunal should not reject all witnesses simply because it is of the preliminary view that the testimony of the witnesses would be irrelevant. The court then set aside the award.

The court's decision seems questionable. The sources relied on by the court actually support the conclusion that a tribunal may decide whether to hear witnesses after reviewing witness statements, a practice that may be considered de rigueur in international arbitration. The court did not effectively address that issue, nor address the buyer's refusal to provide witness statements or an explanation as to why the witnesses were needed. Furthermore, the buyer's conduct in disobeying the directions of the arbitrator is not the type of conduct that should be encouraged. We question whether other judges would have reached the same result as in this case.

Rejection of 'Kompetenz-Kompetenz'

Independent State of Papua New Guinea (PNG) v. Independent Timbers & Stevedoring Limited (ITSL), SCA No. 187 of 2018 (Supreme Court of Papua New Guinea, Feb. 20, 2020) arose out of an agreement in connection with the development by ITSL of a road project. When a dispute arose, ITSL instituted arbitration proceedings before the Singapore International Arbitration Centre (SIAC).

The state filed a proceeding in a domestic court in PNG seeking a permanent stay of the arbitration proceedings and a declaration that the arbitration clause in the agreement was inoperative and unenforceable. Clause 27.2 of the agreement required the parties to submit disputes between them to the Papua New Guinea Commercial Dispute Centre (PNGCDC) for settlement in arbitration pursuant to the UNCITRAL Arbitration Rules as administered by the PNGCDC. Clause 27.3 provided that if the parties did not agree on a single arbitrator then the arbitrator would be appointed by the Chairman of the PNGCDC, and that the PNGCDC and the arbitrator were to use the SIAC procedures where not inconsistent with the PNGCDC rules or the UNCITRAL Arbitration Rules.

The parties were in fact unable to submit their dispute to the PNGCDC because it no longer existed at the time their dispute arose. The lower court determined that, since the parties had agreed to arbitrate, the national courts did not have jurisdiction over the dispute.

On appeal, the PNG Supreme Court reversed. It noted that the contract included a clause that said the parties agreed to submit to the nonexclusive jurisdiction of the PNG national court for "determination of any matter arising out of this Agreement or the Project which is not a Dispute referable to arbitration under Clause 27… ." Thus, in the view of the court, the parties essentially decided what should happen when, as here, the arbitral institution they agreed on could not hear their dispute. There was no basis, according to the court, for the arbitrator to decide on his own jurisdiction. In so deciding, the PNG court effectively rejected the kompetenz-kompetenz principle that is followed in many jurisdictions and that holds that arbitrators are competent to determine their own jurisdiction.

Remand To Clarify Existence of Manifest Disregard

The last case we discuss is the U.S. Court of Appeals for the Second Circuit's decision in Weiss v. Sallie Mae, 939 F.3d 105 (2d Cir. 2019). In 2008, Weiss incurred student loan debt with Sallie Mae, on which she subsequently defaulted. Starting sometime around September 2011, Sallie Mae began calling Weiss on her cell phone as often as seven or eight times a day in an effort to collect on the debt. In 2013, Weiss brought this action against Sallie Mae under the Telephone Consumer Protection Act (TCPA), 47 U.S.C. §227, for Sallie Mae's unlawful use of an automated telephone dialing system (ATDS). The parties then agreed to arbitrate the matter.

Weiss's claim concerned calls made to a new cell phone number (ending in 6452), for which Weiss had not given her consent to Sallie Mae, but not for calls to an old number that Weiss had given Sallie Mae consent to contact. The arbitrator found that Weiss was a member of the settlement class in a case known as the Arthur case. The Arthur settlement included, as a class member, "any person who received ATDS calls from … Sallie Mae, between October 27, 2005 and September 14, 2010."

Class members had the opportunity to file a "consent revocation" document by Sept. 15, 2012; absent such a filing, "the [auto-dialed] calls would not stop and the borrower's prior consent to give them [sic] would be deemed to have been given." The Arthur settlement agreement included a general release provision under which class members were deemed to have released Sallie Mae for any claims arising out of auto-dialed calls.

Under the plain terms of the settlement to which the arbitrator found Weiss was bound, Weiss was deemed to have waived "any and all" TCPA claims. The arbitrator, however, did not acknowledge the release provision. Instead, he interpreted Weiss's failure to submit a consent revocation pursuant to the Arthur class notice as not only precluding recovery for any calls placed to the 6452 number after the Sept. 15, 2012 deadline, but also as permitting recovery for ATDS calls placed to the 6452 number between Sept. 6, 2011, and Sept. 15, 2012. He thus awarded $108,500 in damages.

The district court vacated the award on grounds of manifest disregard of the law, holding that the explicit, unambiguous terms of the Arthur settlement barred recovery. On appeal, the Second Circuit first noted that, although some circuit courts have held that the manifest disregard doctrine is no longer viable, that is not the case in the Second Circuit. The doctrine is, however, to be narrowly applied, the court said, noting that, under it, interpretation of contract terms is within the province of the arbitrator and is not to be overruled by a court because it disagrees with that interpretation.

According to the Second Circuit, though, because the arbitrator did not mention the release in his decision, it was unable to ascertain from the record whether the arbitrator in fact based his decision on the Arthur settlement agreement and its accompanying class notice or whether he instead discarded the agreement in favor of his own policy preferences.

The Second Circuit noted the "incoherence" of the award and the "tension" between the award and the arbitrator's findings. Id. at 111. But it refused to hold that the manifest disregard threshold had been passed. Thus, rather than affirm the decision to vacate, the court gave the arbitrator a second chance. It remanded the case to the district court with instructions to remand to the arbitrator. The arbitrator was to be instructed "either [1] to interpret and apply the terms of the [Arthur] settlement agreement's general release provision or [2] to explain why that provision does not bar Weiss's claims." Putting aside the issue of functus officio, which the court did not address, the decision is further evidence how, even in those circuits in which the manifest disregard doctrine remains, it is one that the courts apply with restraint.

Lawrence W. Newman is of counsel and David Zaslowsky is a partner in the New York office of Baker McKenzie. They can be reached at [email protected] and [email protected], respectively.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'A Shock to the System’: Some Government Attorneys Are Forced Out, While Others Weigh Job Options

7 minute read

'Serious Legal Errors'?: Rival League May Appeal Following Dismissal of Soccer Antitrust Case

6 minute read

How Some Elite Law Firms Are Growing Equity Partner Ranks Faster Than Others

4 minute read

Law Firms Mentioned

Trending Stories

- 1Judge Pauses Deadline for Federal Workers to Accept Trump Resignation Offer

- 2DeepSeek Isn’t Yet Impacting Legal Tech Development. But That Could Soon Change.

- 3'Landmark' New York Commission Set to Study Overburdened, Under-Resourced Family Courts

- 4Wave of Commercial Real Estate Refinance Could Drown Property Owners

- 5Redeveloping Real Estate After Natural Disasters: Challenges, Strategies and Opportunities

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250