Paul Weiss Revenue and Profits Slip, Chairman Points to Busy 2020

"Our average profit per partner last year was $4.7 million, so I don't think anyone is going to start a GoFundMe page or hold a telethon for Paul Weiss partners," said chairman Brad Karp.

March 30, 2020 at 03:40 PM

5 minute read

Brad Karp, chairman of Paul, Weiss, Rifkind, Wharton & Garrison. Courtesy photo

Brad Karp, chairman of Paul, Weiss, Rifkind, Wharton & Garrison. Courtesy photo

Paul, Weiss, Rifkind, Wharton & Garrison saw both revenue and profits per partner slide down last year, halting several years of financial growth. But the firm's chairman, Brad Karp, said the firm had a strong start in 2020, and its lawyers are now busy on pro bono efforts and advising clients in response to the pandemic.

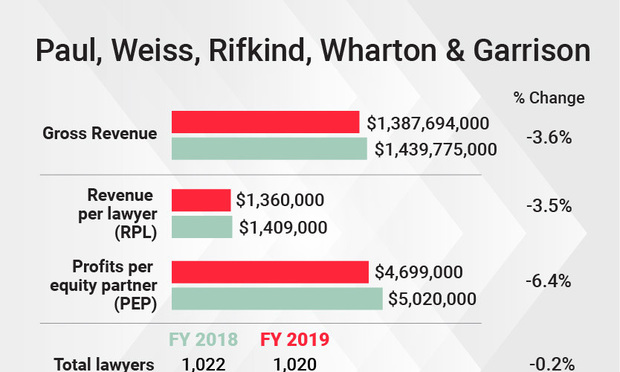

Last year, Paul Weiss' gross revenue fell 3.6% to $1.39 billion last year, and with flat head count around 1,020 lawyers, revenue per lawyer fell at a similar rate to $1.36 million. Average profits per partner fell 6.4% to $4.7 million, amid a 5.5% growth in the firm's equity-only partnership ranks.

In an interview on Thursday, Karp said the firm did well in 2019 and the declines were due to the firm's exceptionally high collection of premium fees in mergers and acquisitions in 2018—"close to $100 million," he said—contrasted with a more normal flow of premiums in 2019. He said collections in early 2020 were unusually good, including two eight-figure premiums.

Through March 25, the firm's billings were up 28%, collections up 19%, net income up 52% and income per share up 63% over last year, he said. "Our average profit per partner last year was $4.7 million, so I don't think anyone is going to start a GoFundMe page or hold a telethon for Paul Weiss partners," he said, noting "it feels somewhat strange for me, and a little off, to talk about our firm's revenue and profitability right now, given the global pandemic."

Paul Weiss YOY financials

Paul Weiss YOY financialsKarp said his focus now is on the coronavirus crisis. He said the firm has been pouring pro bono resources into matching laid-off workers and other hard-hit families with assistance. Paul Weiss also has been helping clients, including corporate boards and senior management, chart a course through the crisis, he said.

Karp said the firm was positioned well to handle clients' long-term legal needs that may result from the pandemic.

"While the courts are largely closed, the prelitigation maneuvering today … feels a lot like it did in 2008, which … led to the largest litigation surge in our firm's history," he said. As the dust settles, he said, "You're going to see a flight to quality … and I very much like how Paul Weiss is positioned."

While Karp cited a systemic decline in litigation and a drop in white-collar and regulatory enforcement under the Trump administration, he said he had "no doubt that litigation and white-collar work will return to more robust levels over time." He said the firm continued to invest in litigation practices in 2019 with hires such as Loretta Lynch, Jeannie Rhee and Kannon Shanmugam.

Asked about what impact the coronavirus might have on the firm's overall budget for 2020 and whether the firm might cut back in areas such as partner draws, Karp highlighted the firm's financial success in the year so far and said no final decisions had been made.

"Obviously, the global COVID-19 pandemic is going to have a significant impact on every major law firm's business over the next several months, if not longer," he said. "It's too early for any of us to evaluate how significant the impact will be. … We haven't made any determinations about partner distributions yet."

Paul Weiss last year handled headline-grabbing matters across its core practice areas — public M&A, private equity, restructuring, litigation and white-collar regulatory defense.

The firm's lawyers worked on major public-company transactions, including CBS Corp.'s merger with Viacom, which has been valued at $28 billion to $40 billion, where Paul Weiss advised a special committee of CBS's board, and Novartis' $9.7 billion acquisition of The Medicines Co., where it represented the target.

The firm last year hired M&A partner Sarah Stasny from Kirkland & Ellis and executive compensation partner Jean McLoughlin from Davis Polk & Wardwell.

In litigation, Paul Weiss represented Carlos Ghosn, helping him cut a deal with the U.S. Securities and Exchange Commission before he ultimately opted to smuggle himself out of Japan. The firm also represented Exxon Mobil in several lawsuits, including the successful defense of a case by the New York attorney general that accused the oil giant of defrauding shareholders about climate change.

The restructuring practice in 2019 was also "extraordinarily busy," Karp said, working for debtors such as resin manufacturing giant Hexion Holdings, canned tuna titan Bumble Bee Foods, and vehicle logistics firm Jack Cooper Ventures. It also represented the California Public Utilities Commission in PG&E's bankruptcy, among other creditor representations.

Karp highlighted the firm's commitment to pro bono cases. Last year, he said, Paul Weiss upped its pro bono work from about 100,000 hours in 2018 to 130,000 hours, working on cases such as the representation of immigrants in family reunification cases and women's health groups in cases over abortion access. The firm is set to deliver even more pro bono work this year, he said.

The 2019 financial figures reported in this article are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250