What if a Party Refuses to Pay Its Share of the Arbitration Cost Advance?

In their column on International Litigation, Lawrence W. Newman and David Zaslowsky examine a recent case from a federal district court in California addressing this issue.

July 22, 2020 at 12:30 PM

10 minute read

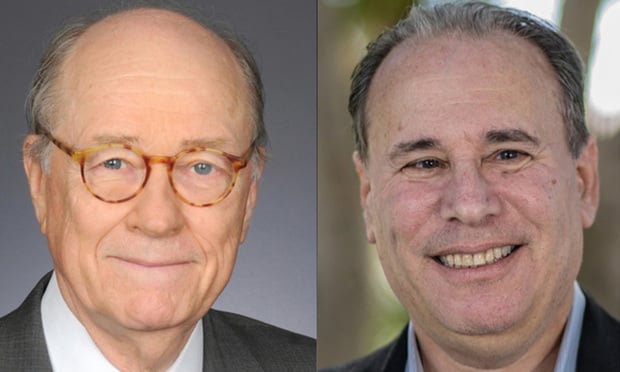

Lawrence W. Newman and David Zaslowsky

Lawrence W. Newman and David Zaslowsky

International arbitrations, unlike proceedings in courts, are paid for the parties. The rules and practices of arbitral institutions ordinarily provide that a respondent must pay its allocated share of advance costs, ordinarily one half. If the respondent does not, the rules prevent the proceedings from going forward unless the claimant pays the respondent's share of advance costs. For example, Article 24(4) of the London Court of International Arbitration ("LCIA") Rules states that "the LCIA Court may direct the other party or parties to effect a substitute payment to allow the arbitration to proceed (subject to any order or award on Arbitration Costs)." Similarly, Article 37(5) of the International Chamber of Commerce ("ICC Rules") provides that "any party shall be free to pay any other party's share of any advance on costs should such other party fail to pay its share."

It makes for a very uncomfortable conversation with a client when they are told that, if they want their arbitration case to continue, they must pay this extra advance. That client most likely already has certain negative feelings against a party that it is being forced to sue, feelings that are only exacerbated with the perception that such party is being allowed to act in a recalcitrant manner without any consequences.

One possible solution to that problem is for the claimant to advance the costs for the respondent and then seek an immediate award from the arbitrators in that amount. In this article we examine a recent case in which a federal district court in California confirmed such a "separate award" by an arbitral tribunal. We also suggest steps that parties might take at the contract-drafting stage to protect against the consequences of having to pay more in order to arbitrate.

The Recent California Case

Trajkovski Invest AB v. I.Am.Plus Electronics, No. 2:20-cv-00152-ODW (C.D. Cal. May 7, 2020), involved an arbitration that Trajkovski and numerous other Swedish investors brought against I.Am.Plus under the arbitration rules of the Stockholm Chamber of Commerce ("SCC"). When I.Am.Plus refused to pay its share of the advance costs, Trajkovski paid them so that the case could continue. Article 51(5) of the SCC Rules provides in relevant part, "[i]f the other party makes the required payment, the Arbitral Tribunal may, at the request of the party, make a separate award for reimbursement of the payment." Trajkovski sought such a separate award, and, after the tribunal gave I.Am.Plus an opportunity to be heard (an opportunity it did not avail itself of), the tribunal issued a separate award for the advance costs totaling 210,700 Euros (the "Separate Award").

The standard that the district court applied in determining whether to confirm the Separate Award so that it could be enforced is that it must have finally and conclusively resolved a discrete issue. Thus, for example, in Hart Surgical v. UltraCision, 244 F.3d 231 (1st Cir. 2001), the parties agreed that the arbitration would be bifurcated into liability and damages phases and submitted all of their evidence on the liability issue. The court concluded that the parties and arbitrators understood that the determination on liability was to be a final award on that issue, and held that the determination was eligible for confirmation and enforcement. Publicis Commun. v. True N. Communs., 206 F.3d 725 (7th Cir. 2000), concerned an "order" by an arbitral panel that ordered one of the parties to turn over tax records to the other side. In refusing to exalt form over substance, the Seventh Circuit held that this was a "final" decision on the issue of the tax records and was therefore enforceable as an award under the New York Convention.

In the I.Am.Plus case, the court held that the Separate Award disposed of the discrete issue of the advance on costs, which was not subject to change, meaning that it was a final interim award that could be enforced. In doing so, the court had to distinguish an earlier case with very similar facts, SensorDynamics AG Entwicklungs-Und Produktionsgesellschaft v. Memsco LLC, 2008 U.S. Dist. LEXIS 126616 (C.D. Ca. Oct. 10, 2008), aff'd 407 Fed. Appx. 201 (9th Cir. 2010). In that case, an ICC tribunal issued an interim award after the claimant paid the share of the advance on costs that respondent had refused to pay. There, the Ninth Circuit held that the interim award could not be confirmed because it was not "final."

The I.Am.Plus court said that one distinction between the two cases was that the award in SensorDynamics provided that the "advance costs are subject to future review and possible adjustment," which made the award non-final. In all likelihood, that was the case in the SCC arbitration as well, because the typical practice in international arbitration is that arbitrators allocate costs in their final award. The lesson is that an interim award concerning a failure to pay advance on costs is more likely to be enforced if the arbitrators have not explicitly stated that they reserve the right to allocate costs at the end, even though they clearly have such a right regardless of whether they so state.

The I.Am.Plus court held that another supposed distinction is that the ICC Rules provide that the advance on costs "may be subject to readjustment at any time during the arbitration." This was, according to the court, in contrast with the SCC Rules, which provide that, once the allocation of advanced costs has been determined, "additional advances" may be necessary "during the course of the arbitration," but there is no contemplation of a "readjustment" or "reallocation" of the previously determined amount. The reader can decide whether this is a distinction with any real difference. In any event, the I.Am.Plus court confirmed the Special Award.

Other Courts Have Confirmed Such Awards

At least one other U.S. court has ruled in the same way as I.Am.Plus. Daum Global Holdings Corp. v. Ybrant Digital Ltd., 2014 U.S. Dist. LEXIS 30031 (S.D.N.Y. Feb. 20, 2014), followed the same fact pattern as the cases already mentioned. It was an ICC arbitration in which, when the claimant was forced to pay the respondent's share of the $500,000 advance on costs, the tribunal issued an award for $250,000. When confirmation was sought, the respondent made the same arguments as in SensorDynamics—that is, that the advance on costs could be readjusted during the case and that the final award might change the allocation on costs. But the court enforced the award, saying that it was "final" because it decided both liability and damages on the advance on costs issue. The court quoted a Second Circuit decision that said "an award which finally and definitely disposes of a separate independent claim may be confirmed although it does not dispose of all the claims that were submitted to arbitration." Id. at *6-7.

As reported in Thomas Rohner and Michael Lazopoulos, Respondent's Refusal to Pay its Share of the Advance on Costs, 29 ASA Bulletin 3 (2011), courts outside the U.S. have likewise enforced awards in similar circumstances. In 2003, the Swiss Federal Supreme Court granted the enforcement of a French partial arbitral award rendered under the ICC Rules for the reimbursement of the advance on costs paid by the claimant on behalf of the defaulting respondent. See Decision 4P.173/2003 of the Swiss Federal Supreme Court (Dec. 8, 2003). Rohner and Lazopoulos report that the same view was taken by the Arbitration Court of St. Petersburg of the Russian Federation in a 2009 decision (Decision A56-63115/2009), where a Swedish claimant sought recognition and enforcement of a partial award rendered under the SCC Rules for the reimbursement of a substituted advance payment. The court held the arbitral decision was "final" and thus enforceable under the New York Convention.

Contractual Responses to the Issue

It is axiomatic that arbitration is a creature of contract and, therefore, it is reasonable to ask whether parties can take steps at the contract-drafting stage that put a party in as favorable a position as it can be in the face of a counter-party's refusal to pay its share of a required advance. Two suggestions come to mind.

The first is relatively straightforward. The arbitration clause can include language such as the following:

Failure by a party to pay its required share of an advance on costs requested by the [identify arbitral institution] shall constitute a breach of this Agreement. Upon a satisfactory showing by a party that has paid the advance for a non-paying party, the arbitrators shall, barring extraordinary circumstances, forthwith enter an award for such amount, plus attorney fees and interest at the rate of [x%] percent per annum.

There are numerous instances in which, even without such a clause, arbitrators have issued awards for failure to pay an advance of costs, as is specifically provided for under the rules of certain arbitral institutions. In the absence of an institutional rule though, the parties, by including such a clause in their agreement, will make it more difficult for arbitrators to accept arguments against the award of such relief. And, at the confirmation stage, because this would be an award for breach of contract, the contractual provision should serve to negate arguments like those relied on by the court in SensorDynamics. In addition, the interest and attorney fees element of the provision could have the effect of pushing a party to pay the advance.

A second approach is much more aggressive and is taken from the clause-builder feature on the website of the American Arbitration Association. It provides:

The parties agree that failure or refusal of a party to pay its required share of the deposits for arbitrator compensation or administrative charges shall constitute a waiver by that party to present evidence or cross-examine witnesses. In such event, the other party shall be required to present evidence and legal argument as the arbitrator(s) may require for the making of an award. Such waiver shall not allow for a default judgment against the non-paying party in the absence of evidence presented as provided for above.

The risks of such a clause are obvious. One of the grounds for refusing enforcement of an award under the New York Convention is if a party is "unable to present his case," an argument that could be made by a party against whom such a clause were enforced. The argument in response would be that this clause meets the classic test for a waiver—that is, the voluntary relinquishment of a known right—meaning that the party was not prevented from presenting his case as much as she voluntarily agreed that she would not present evidence. Moreover, such a clause would likely have an in terrorem effect. How many lawyers would recommend to their client that they risk the possibility of not presenting evidence or cross examining witnesses, as opposed to paying the advance on costs?

Obviously, it is preferable not to have to have the conversation with your client about failure of a counter-party to pay its share of the advance of costs. As shown above, there are steps that can be taken at the clause-drafting stage that can hopefully assist in preventing the need for such a conversation. But, if needed, there is also the option of asking the arbitrators for an interim award with respect to such costs.

Lawrence W. Newman is of counsel and David Zaslowsky is a partner in the New York office of Baker McKenzie. They can be reached at [email protected] and david.zaslowsky@bakermckenzie.com, respectively. The authors thank Erika Van Horne, an associate in the New York office, for her assistance in the preparation of this article.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Decision of the Day: Uber Cannot Be Held Vicariously Liable for Driver's Alleged Negligent Conduct

US Courts Announce Closures in Observance of Jimmy Carter National Mourning Day

2 minute read

Class Certification, Cash-Sweep Cases Among Securities Litigation Trends to Watch in 2025

6 minute readLaw Firms Mentioned

Trending Stories

- 1Decision of the Day: NYPD Officer's Sexual Assault of Informant Occurred Outside Scope of Employment

- 2'Not the President's Personal Lawyer': Lawyers Share Concerns Over How AG Pick Bondi’s Loyalism to Trump May Impact DOJ

- 3US Judge OKs Partial Release of Ex-Special Counsel's Final Report in Election Case

- 4The Demise of Truth and Transparency in Federal Sentencing

- 5Former Phila. Solicitor Sozi Tulante Rejoins Dechert

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250