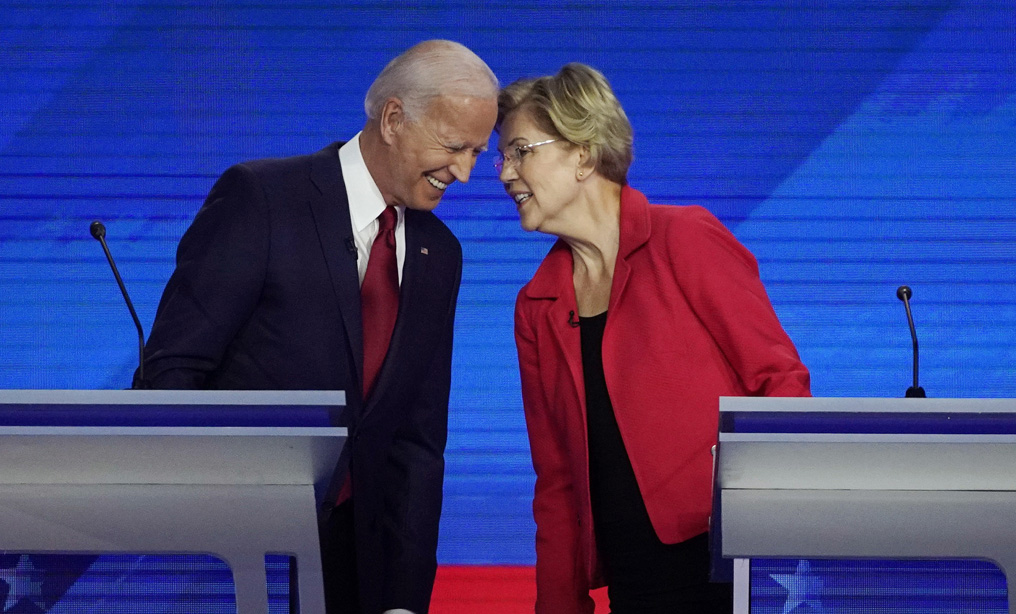

(AP Photo/David J. Phillip, File)

(AP Photo/David J. Phillip, File) The Biden (aka Warren) Plan for Bankruptcy Reform

Joe Biden has adopted the Warren bankruptcy plan to his platform which, if he's elected, will have a huge impact on corporate debt and business practices. This article outlines what's on the table under the Warren plan and how reforms will likely shake out come January if the Democrats win the White House.

September 18, 2020 at 03:02 PM

8 minute read

Bankruptcy reform is not a new topic. In 2005, the credit card industry secured the passage of The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA), which not only transformed consumer bankruptcies, making them more difficult and costly for individuals, but had far-reaching impacts on commercial bankruptcies under Chapter 11, making business reorganizations more challenging. In 2011, the American Bankruptcy Institute (ABI) formed a Commission to Explore Overhauling Chapter 11.

The Commission's recommendations, published after three years and weighing in at 402 pages, was comprehensive. In 2018, the commission's co-chair presented its findings to a Senate judiciary subcommittee. And in 2019, the ABI's Commission on Consumer Bankruptcy unveiled recommendations for making the bankruptcy system more accessible for both financially struggling Americans and the professionals who serve them. And… nothing much has happened since.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Don’t Blow It: 10 Lessons From 10 Years of Nonprofit Whistleblower Policies

9 minute read

Fusion Voting and Its Impact on the Upcoming Election

Law Firms Mentioned

Trending Stories

- 1Morris Nichols Partners to Be Involved With PLI Program

- 2How I Made Practice Group Chair: 'Cultivating a Culture of Mutual Trust Is Essential,' Says Gina Piazza of Tarter Krinsky & Drogin

- 3People in the News—Feb. 3, 2025—Antheil Maslow, Kang Haggerty, Saxton & Stump

- 4Patent Pending ... and Pending ... and Pending? Brace Yourself for Longer Waits

- 5Indian Law Firm Cyril Amarchand Rolls Out AI Strategy, Adopts Suite of AI Tools

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250