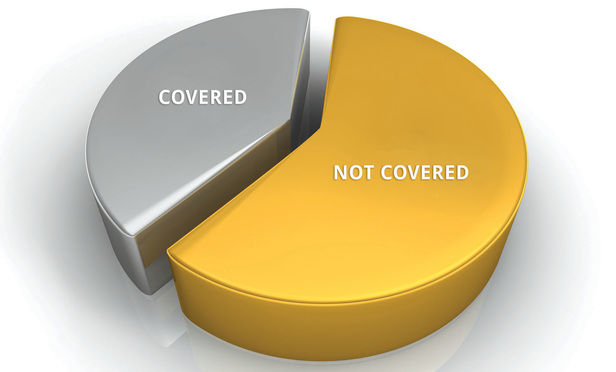

Many financial sector insurance policies that do not contain “duty to defend” obligations on the part of an insurer, have “allocation” clauses. In an allocation agreement, the insurer “makes a deal” with the insured at the time the policy is purchased. This agreement provides that if a claim (lawsuit) arises that has covered and non-covered aspects within it, the insurer will reimburse the insured for legal fees for only the covered claims, not for the non-covered ones. Also, a single lawsuit may name individual and entity defendants who wind up using the same law firm to represent them, yet they are not all covered by the policy. This typically arises in a directors and officers case. In the latter situation, the insurer will likely deny reimbursement of defense expenses for legal work done on behalf of the non-covered persons or entities. These situations result in an “allocation dilemma.”

A typical example of insurance policy language that triggers the “allocation dilemma” is:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]