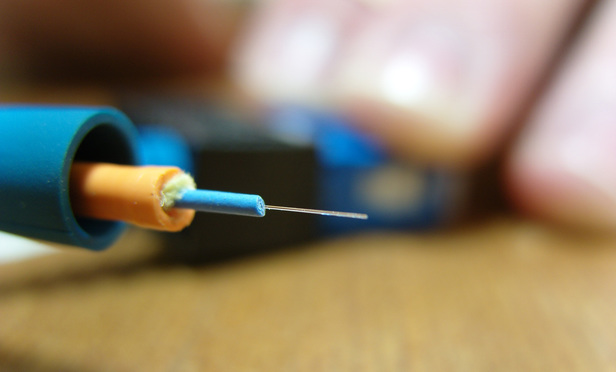

ALBANY – Fiber optic cable is fundamentally different from lines carrying traditional commodities, and New York state property tax assessments on power, natural gas and water piping do not apply, a state appeals court has ruled.

The unanimous decision by the Appellate Division, Third Department, overturned a trial-level judge, who in 2015 had sided with seven municipalities in northeastern New York and their tax assessments on the installations of fiber optic cable made by Level 3 Communications on private rights-of-way.The case turned on whether Real Property Tax Law §102(12)(f), which defines “equipment for the distribution of heat, light, power, gases and liquids” as eligible for property tax assessments, applies to fiber optic cable.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]