Quinn Unloads on Faith Gay: $100 Million for 'Ingratitude' and 'Deception'

John Quinn said he was irritated by Faith Gay's "saccharine" farewell email to her Quinn Emanuel colleagues, and disappointed with "the stealthy way" he accused her of planning to launch her new firm.

February 16, 2018 at 02:52 PM

4 minute read

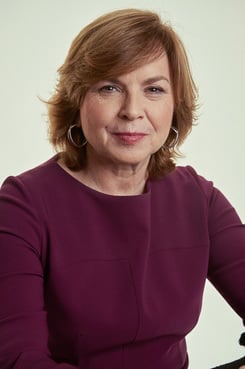

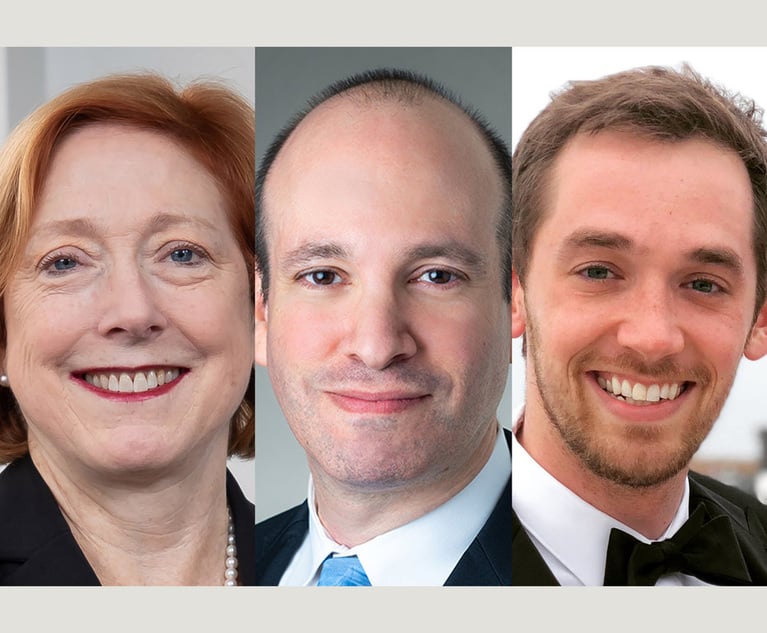

How upset was John Quinn, the managing partner of Quinn Emanuel Urquhart & Sullivan, when New York partners Faith Gay and Philippe Selendy left this month to launch their own firm?

The firm's pre-emptive press release on their departures was one sign that the split was not particularly amicable. But a reply-all email that Quinn sent Gay this week—responding to her farewell message to the firm—spells out his feelings more clearly.

“Faith, I wish I could join in the high minded sentiment you express here. Some day maybe I will be able to. But not yet. At this time I am still perhaps too mindful of other facts,” Quinn wrote, according to Above The Law, which first reported the email. “Such as that you really were not very well known at all when you joined us from White and Case. That during your time with us we supported you in every way we could and, I think, made you a legal star. That during your time with us you were paid well over $100m—far more than you ever dreamed you could earn.”

Quinn also accused Gay of secretly plotting her departure for months, ending his message with a retort to a poem that Gay had cited in her departure memo.

“You are now planning to take as much of our work as possible. And to recruit as many of our attorneys as possible. I can tell you that virtually all of the attorneys you name here are pretty angry with you,” Quinn wrote. “There must be a poem about deception or ingratitude that would be more apposite?”

Gay, who formally launched Selendy & Gay with Selendy and other Quinn Emanuel lawyers on Thursday, was not immediately available to comment.

“Yes, I wrote that and it's all true. I wrote it in response to a lengthy saccharine email that Faith sent to all personnel the night before her departure,” Quinn said in an email on Friday. “I was less disappointed, actually, in the fact that she and others were leaving than in the stealthy way it was done, which was at odds with the close relationship we thought we had and which she professed to still have in her email. And yes I was irritated by her email. In the meantime, our New York practice is booming.”

When asked if he felt similarly stung by Selendy, Quinn again cited Gay's “over the top” email. “I replied to that email, in reaction to that particular email,” he said. “Others wrote goodbye emails, but they weren't similar at all, weren't irritating and didn't motivate me to respond.”

The dust-up comes after the firm in January announced that Gay, the former co-chair of the firm's national trial practice, and Selendy, a star litigator and former head of Quinn Emanuel's securities and structured finance group, would be leaving with a group of colleagues to start their own law firm.

Quinn said in a statement at the time that he and others at the firm respected “our valued colleagues' decision to take their practice to a smaller platform” and didn't believe the partner losses would affect the firm's success in any significant way.

“Our firm has never been stronger and has never had a deeper bench of veteran and next-generation talent,” Quinn said in the January statement.

Selendy and Gay remained mostly quiet in the press afterward, before finally detailing their plans this week in connection with the formal launch on Feb. 15 of Selendy & Gay.

In an interview shortly before the launch, Gay and Selendy told The American Lawyer that their departure wasn't a matter of dissatisfaction with Quinn Emanuel.

“It really has everything to do with wanting to be masters of our own fate,” Gay said at the time. “It's us wanting to create a new kind of law firm, nothing about any displeasure.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

BCLP Enhances Financial Disputes and Investigations Practice With Baker McKenzie Partner

2 minute read

Quiet Retirement Meets Resounding Win: Quinn Emanuel Name Partner Kathleen Sullivan's Vimeo Victory

Can a Law Firm Institutionalize Its Culture? Boies Schiller’s New Chairman Will Try

Trending Stories

- 1'A Death Sentence for TikTok'?: Litigators and Experts Weigh Impact of Potential Ban on Creators and Data Privacy

- 2Bribery Case Against Former Lt. Gov. Brian Benjamin Is Dropped

- 3‘Extremely Disturbing’: AI Firms Face Class Action by ‘Taskers’ Exposed to Traumatic Content

- 4State Appeals Court Revives BraunHagey Lawsuit Alleging $4.2M Unlawful Wire to China

- 5Invoking Trump, AG Bonta Reminds Lawyers of Duties to Noncitizens in Plea Dealing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250