Cannabis Firms Still See Banking Trouble Despite Growing Legalization, Attorneys Say

A growing number of states are moving toward marijuana legalization, but product providers are still having difficulties in banking and finding protection for intellectual property, said speakers and attendees to a cannabis law panel held Tuesday at the New York State Bar Association's annual meeting.

January 23, 2018 at 05:26 PM

3 minute read

A growing number of states are moving toward marijuana legalization, but product providers are still having difficulties in banking and finding protection for intellectual property, said speakers and attendees to a cannabis law panel held Tuesday at the New York State Bar Association's annual meeting.

While the growth of legal pot may have hit a snag with the recent decision by U.S. Attorney General Jeff Sessions to rescind an Obama-era policy for the federal government not to interfere with marijuana, it is legal for both medical and recreational use in nine states and Washington, D.C., and is legal for other uses in 20 additional states.

Additionally, public opinion on pot has changed rapidly in recent years and, as Noah Potter, who is of counsel to the cannabis law boutique Hoban Law Group, noted at the panel, the U.S. Food and Drug Administration issued a report in 2016 dispelling the long-held “gateway” theory of marijuana use—that it leads users to go on to try more illicit substances.

But despite the spread, most private banks and credit unions are still avoiding the cannabis industry itself as well as turning away would-be investors in the industry, said Aleece Burgio, co-chair of the state bar's Committee on Cannabis Law and assistant general counsel at McGuire Development Co. in Buffalo.

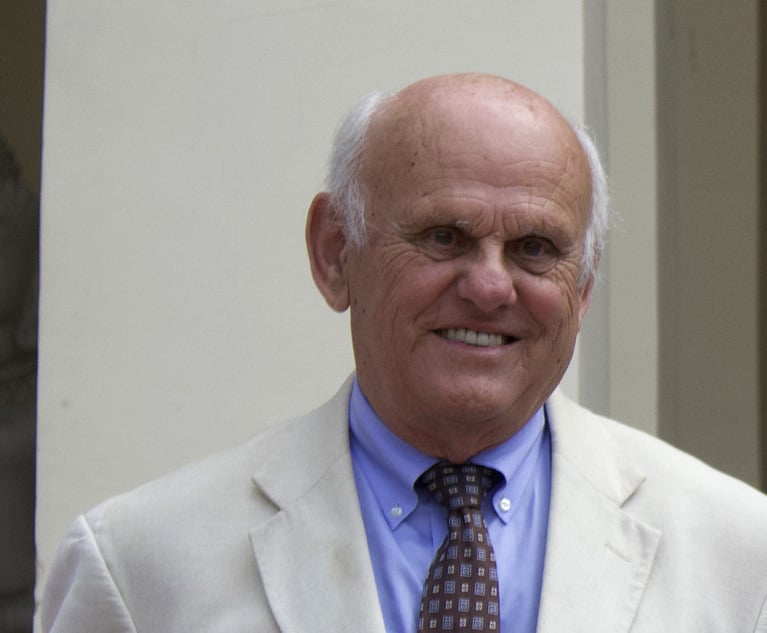

Panelist Jeremy Unruh of PharmaCann. Photo: David Handschuh/NYLJ.

Panelist Jeremy Unruh of PharmaCann. Photo: David Handschuh/NYLJ.Jeremy Unruh, a panelist at the program and chief compliance officer for PharmaCann, an Illinois-based producer that operates four dispensaries and a cultivation facility in New York, likened banking in New York for the cannabis industry to the Pony Express—there is generally one bank in the Buffalo area that will serve the industry, he said, and it costs about $10,000 per month to maintain an account.

Unruh said taxation is also another major issue for the cannabis industry.

Under current federal tax law, marijuana companies—because they are trafficking a product that is classified as a Schedule I drug under the Controlled Substances Act—are prohibited from deducting business expenses from their gross income.

According to the National Cannabis Industry Association, this results in marijuana businesses paying tax rates of 70 percent or more.

“We are taxed just like the 'Miami Vice' drug dealer in the cigarette boat,” Unruh said.

Anthony Meola, a Purchase-based intellectual property attorney for Schmeiser, Olsen & Watts who was in attendance at the program, said that while producers can obtain patents for cannabis strains and production processes, he said the U.S. Patent and Trademark Office continues to refuse to issue trademarks for marijuana-related products. He said common-law trademarks are available, but that they don't apply nationwide, and thus clients are unable to collect licensing fees.

“We are absolutely concerned with the trademark limitations with these products,” Meola said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Bankruptcy Judge Clears Path for Recovery in High-Profile Crypto Failure

3 minute read

US Judge Dismisses Lawsuit Brought Under NYC Gender Violence Law, Ruling Claims Barred Under State Measure

In Resolved Lawsuit, Jim Walden Alleged 'Retaliatory' Silencing by X of His Personal Social Media Account

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute readTrending Stories

- 1Antitrust Partner Plans Move to Davis Polk From Fried Frank

- 2How This Dark Horse Firm Became a Major Player in China

- 3Bar Commission Drops Case Against Paxton—But He Wants More

- 4Pardons and Acceptance: Take It or Leave It?

- 5Gibbons Reps Asylum Seekers in $6M Suit Over 2018 ‘Inhumane’ Immigration Policy

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250