Gross Revenue Dips Slightly, PPP Shrinks for Partner-Replenished McElroy Deutsch

"It was a disappointing year because our productivity was up. The billable hours of the average lawyer was up. And the rates were up," managing partner Edward Deutsch said. "But I think everybody's got a problem with slow-paying clients."

March 07, 2018 at 12:04 PM

4 minute read

Fiscal year 2017 for McElroy, Deutsch, Mulvaney & Carpenter generated a gross revenue figure that the firm's leader characterized as “disappointing.”

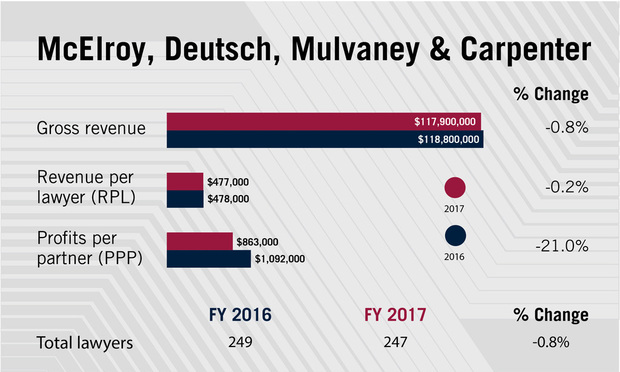

Disappointing but not apparently disastrous: The $117.9 million revenue figure is a 0.8 percent decline, from $118.8 million in fiscal year 2016. That means gross revenue has been essentially flat since 2015, when it was $118.5 million, and is up only about 1.2 percent over a five-year period, from $116.5 million in fiscal year 2012, though the firm has consistently improved its revenue per lawyer over that span.

A second noticeable factor is a sizable jump in equity partner ranks: to 36 from 26, a 38.5 percent spike.

Within the firm, they're referred to as “senior partners,” but age isn't the determining factor in making an equity partner, according to Edward Deutsch, managing partner of the Morristown-based firm.

“Some of them are much younger people, they're just doing a great job and deserved to be recognized,” Deutsch said in an interview.

“We hadn't made any new senior partners in several years, and it was time. We were playing a little bit of catch-up,” he added, noting that the firm's partnership agreement mandates periodic review. “When you have good people and you want to keep them, you have to reward them.”

As for revenue, Deutsch said he expected better, but late 2017 didn't unfold as planned, with “several million dollars promised” from fee-owing clients, but “only part of it came in.”

“It was a disappointing year because our productivity was up. The billable hours of the average lawyer was up. And the rates were up,” he said. “But I think everybody's got a problem with slow-paying clients.”

Some insurance clients, of which the firm has many, are billed quarterly. If the firm sends a large quarterly bill that a client takes 30 days to pay, “you financed that for close to six months,” Deutsch said.

“The bigger problem is cases that you get into and they become much larger cases than anyone intended,” he added. “We had two or three of those this past year.”

For one Connecticut client, who Deutsch said is in the construction industry, though he declined to give a name, a multimillion-dollar settlement was reached but then fell apart, and the client's business failed. That means the final $800,000 in fees the firm is owed is up in the air while the parties await a court's ruling, he said.

Other metrics were steady. In attorney head count, there was a net decrease of two, to 247. Revenue per lawyer (RPL) was practically unchanged, down 0.2 percent, to $477,000 from $478,000.

Profit per equity partner was a different story. With a net gain of 10 in the equity partner ranks, PPP dropped 21 percent, to $863,000 from $1.09 million. Just as equity partner population increased, nonequity partner population predictably decreased—to 79 from 87, a 9.2 percent change.

Firms routinely report having a strictly merit-based compensation system with a handful of nonequity partners who earn more than some equity partners, and McElroy Deutsch fits in this category, according to Deutsch. With the partner ranks changed in 2017, compensation was spread differently, but the PPP figure tells little about what individual partners made, he said.

Insurance practitioners are expected to bill 1,900 hours per year; those in other practices, such as estates and other transactional disciplines, bill at higher rates and have lower benchmarks, Deutsch said.

But generally, “there's no formula,” Deutsch said. “Formulas have killed law firms.”

Deutsch noted that each of the firm's partners, equity and nonequity, get a vote.

In terms of practice areas, commercial litigation and insurance litigation performed well in 2017, while bankruptcy, including creditor- and debtor-side work, was quiet, even in the firm's bankruptcy practice in Delaware, a typically busy market, according to Deutsch.

He echoed what's become a common sentiment among firm leaders in New Jersey and elsewhere who wish to improve their financial metrics: Weeding out lower-margin work.

“We're just not going to take that work anymore,” though “we've kind of grandfathered [in] some of the long-term clients,” and doing a low-rate “favor” for a client who provides a lot of work to the firm is not uncommon, Deutsch said. “Regardless of volume, you have to look at, did we make any money?”

Deutsch said the firm also is examining expenses in all offices, but only so much can be done with that side of the ledger.

“You can't really manage by expenses,” he said. “You really have to manage by revenue.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Election Law Spending Is on the Rise, but Big Firms Have Reasons Not to Cash In

6 minute read

Troutman Pepper Accused of Inattentive Case Management in $59M Malpractice Suit

7 minute readTrending Stories

- 1Gunderson Dettmer Opens Atlanta Office With 3 Partners From Morris Manning

- 2Decision of the Day: Court Holds Accident with Post Driver Was 'Bizarre Occurrence,' Dismisses Action Brought Under Labor Law §240

- 3Judge Recommends Disbarment for Attorney Who Plotted to Hack Judge's Email, Phone

- 4Two Wilkinson Stekloff Associates Among Victims of DC Plane Crash

- 5Two More Victims Alleged in New Sean Combs Sex Trafficking Indictment

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250