Lowenstein Revenue Up 14.2 Percent; PPP Jumps 17.9 Percent

Lowenstein Sandler followed a strong 2017 with an even better 2018, with marked increases in firmwide and per-lawyer financial metrics, as well as lawyer head count growth.

February 26, 2019 at 02:43 PM

4 minute read

Lowenstein Sandler followed a strong 2017 with an even better 2018, with marked increases in firmwide and per-lawyer financial metrics, as well as lawyer head count growth.

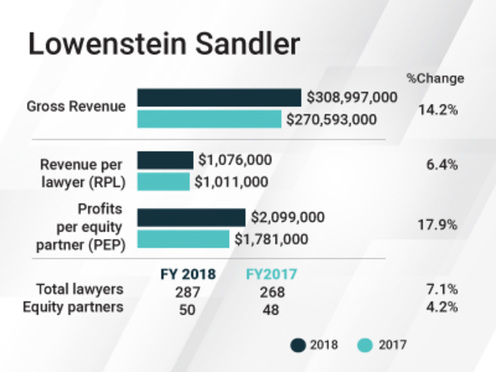

The firm's gross revenue for last year, a shade less than $309 million, represents a 14.2 percent year-over-year improvement, from $270.59 million.

“Up 14 percent only happens for us when all our groups are firing at the same time,” managing partner Gary Wingens said in an interview, noting that practices that normally can be cyclical and complementary—corporate transactional and bankruptcy—were both up in 2018.

“It doesn't happen that often,” Wingens said.

Still, the firm's “terrific” 2018, as Wingens called it, follows a strong 2017, when year-over-year revenue increased 5.5 percent.

Over a five-year period, gross revenue has grown by about 39 percent, from $222.5 million in fiscal 2013, according to Law Journal data.

According to the firm, revenue growth over a 10-year period is 73 percent.

Gary Wingens

Gary WingensFor 2018, a net gain of 19 lawyers—a 7.1 percent increase—coupled with a 6.4 percent increase in revenue per lawyer, to $1.08 million from $1.01 million, fed the overall revenue jump.

Wingens credited recent lateral adds, chiefly in the growing white-collar litigation practice, with driving the improvements in revenue metrics. Former state Attorney General Christopher Porrino rejoined the firm in January 2018 and has brought in business since, and numerous others from government practice have followed. And Anne Milgram, also a former New Jersey attorney general, who joined Lowenstein in 2017, “landed the largest internal investigation that we did last year,” Wingens noted. She led the probe into allegations of sexual misconduct within the NBA's Dallas Mavericks.

The firm also launched an international trade practice out of its Washington, D.C., office late last year with a four-lawyer group from Baker, Donelson, Bearman, Caldwell & Berkowitz. That was “a practice area that we previously didn't have much depth in,” but trade issues were cropping up with increasing frequency in the course of transactional matters, especially those involving private equity clients, Wingens said.

All told, 2018 was the first year of significant net head count growth at Lowenstein in some time.

Lowenstein Sandler Financials

Lowenstein Sandler FinancialsThe firm pointed to several deals on the transactional side that it said boosted financials in 2018, including handling initial public offerings for medical technology company Motus GI Holdings Inc. and biopharmaceutical company Provention Bio, and advising technology firm Integral Ad Science among others in M&A deals.

Profitability improvements came as well in 2018. Profits per equity partner nearly reached $2.1 million, an increase of 17.9 percent over fiscal 2017's $1.78 million PPP figure. Lowenstein annually appears in the second hundred of the Am Law 200 based on gross revenue rankings, but its $2.1 million PPP figure puts it well above the overall PPP average for Am Law 100 firms in 2017, which was $1.77 million, according to last year's survey.

Wingens said Lowenstein's two-point improvement in profit margin, to 34 percent, is attributable to more work. About 18 percent of the firm's 2018 revenue came on alternative fee arrangements, but hours billed nevertheless increased across practice groups, by 13 percent in total.

“This business is still largely a rate-time-hours kind of business,” Wingens said. “When lawyers are working harder, it does drop to the bottom line.”

It's the second straight year of impressive growth in PPP, as the firm posted a 12.9 percent year-over-year gain in that metric for 2017.

Wingens said the firm is ”pleased but not complacent.” It will continue to “focus on sectors that are transforming the U.S. economy,” representing investment, life sciences and technology clients, while continuing to build its litigation practice, he added.

“We very much saw 2018 as the best year since the onset of the recession in terms of growth across our practice areas,” he said, but ”we are aware that we are in the late stages of an economic expansion that could turn on us.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Look to Gen Z for AI Skills, as 'Data Becomes the Oil of Legal'

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250