Gibbons Grows Revenue, Shrinks PPP With New Equity Partner Class

The firm last year made good on plans to promote lawyers to the equity partner tier. PPP as a result decreased 12%, even as the profit margin improved.

April 25, 2019 at 12:41 PM

4 minute read

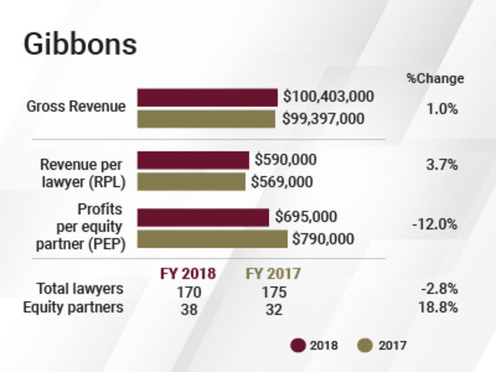

Gibbons of Newark saw degrees of growth in its revenue metrics in fiscal 2018, while profits per equity partner shrank amid a growing number of shares.

The firm last year made good on plans to promote some lawyers to the equity partner tier, which grew to 38 from 32, an increase of 18.8%.

PPP as a result decreased, even as the firm's profit margin improved. The decrease in PEP to $695,000 from $790,000 the prior year represents a 12% change.

Gibbons Fiscal Year Performance

Gibbons Fiscal Year Performance“We have really good, solid young partners who are coming along,” managing partner Patrick Dunican Jr. said, noting practice area expertise and seven-figure books of business as among the group's assets. The new class of equity partners also includes three women, he noted.

Patrick Dunican Jr.

Patrick Dunican Jr.“It was a big class,” but “it's very hard to become an equity partner at Gibbons,” Dunican added. “You have to have sustained business performance.”

He added, of the younger generation of lawyers, “there's no doubt that culturally … they do want a seat at the table. They do want to be recognized for their efforts.”

Gross revenue at the firm increased 1%, to $100.4 million from $99.4 million, while revenue per lawyer rebounded after a dip in fiscal 2017. The $590,000 RPL figure is a 3.7% climb from the prior year's $569,000.

Dunican attributed the revenue improvement in part to more work: Billable hours spiked 4.5 percent in 2018, he said, pointing up environmental litigation and products liability defense for particularly strong performance in 2018.

As for the improvement in the firm's profit margin— by one percentage point, to 26%—Dunican said, “a one-point increase, that's seven figures. That's real money.” He attributed that improvement in part to a 1.2% decrease in operating expenses. “That's just minding the store,” he said, noting that savings from a 2017 lease negotiation hit the books in 2018.

Dunican noted that the firm plans to open an office in the Red Bank area in 2019. That's “to make it easier to some of our Monmouth and Ocean County lawyers,” he said. Remote work is more commonplace now, but “we're never going to dispense with the coming-to-the-office requirement,” he added.

Among Gibbons' other financial metrics:

- With the increase in equity partner count came a decrease in nonequity partner count—to 65 from 74, a 12.2% change.

- Average compensation for all partners, both equity and nonequity, increased 3.4%, to $458,000 from $443,000.

- There was a net decrease of three total partners, to 103 from 106, a 2.8% change.

- The firm's total attorney head count decreased 2.8%, to 170 from 175. “We're a little skinnier in terms of numbers,” Dunican said, “but a lot stronger.”

On the last point, the firm's RPL has increased over the years, though the firm has gotten smaller in terms of gross revenue and total attorney head count. Five years ago, in fiscal 2013, for example, the firm had 201 total lawyers and firmwide gross revenue of $114.5 million, according to historical Law Journal data.

“Every firm can tell the market how great they think they are,” Dunican said. “What Gibbons actually has is household-name lawyers in many different practices.”

Two of those were unfortunately lost in 2018, Dunican noted: John Gibbons Jr., former chief judge of the U.S. Court of Appeals for the Third Circuit—whose name is on the firm—died last December, while commercial litigation partner Michael Quinn, who spent his career at Gibbons, died last September.

“One of the things they represented was extraordinary legal talent,” Dunican said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Look to Gen Z for AI Skills, as 'Data Becomes the Oil of Legal'

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250