Med Mal Liability Capped at $250K in Lawsuit Involving Federally Funded Doctor

The U.S. government has lost its bid for immunity in a medical malpractice suit concerning alleged negligence by a surgeon at a federally funded clinic. But a federal judge has ruled the government is entitled to a $250,000 cap on liability in connection with the alleged mishap.

May 14, 2019 at 10:54 AM

4 minute read

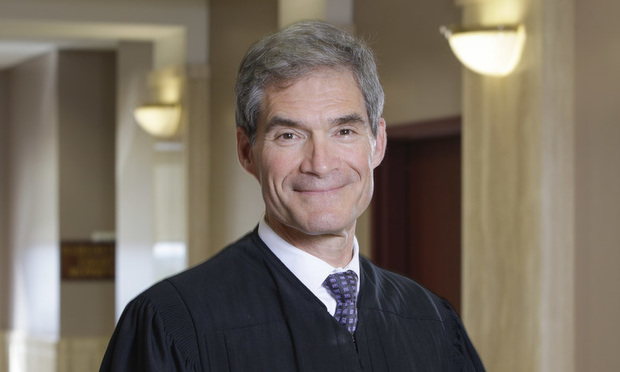

Judge Robert Kugler, U.S. District Court for the District of New Jersey. (Photo: Carmen Natale/ALM)

Judge Robert Kugler, U.S. District Court for the District of New Jersey. (Photo: Carmen Natale/ALM)

The U.S. government has lost its bid for immunity in a medical malpractice suit concerning alleged negligence by a surgeon at a federally funded clinic. But a federal judge has ruled the government is entitled to a $250,000 cap on liability in connection with the alleged mishap.

The suit stems from an emergency cesarean section performed on Melissa Fiori-Lacivita by Ylbe Franco-Palacios, a physician with CompleteCare Health Network. A few days after the surgery, Fiori-Lacivita discovered she had a perforation in her colon and required another operation.

U.S. District Judge Robert Kugler of the District of New Jersey denied the motion by the U.S. government to be dismissed from the suit based on immunity under the New Jersey Charitable Immunity Act. Kugler said CompleteCare derives most of its funding from patient billing and government funding, and receives a minimal amount of charitable contributions. Its funding model undercuts the state Legislature's purpose of granting absolute immunity to charitable organizations, which was to protect against the diversion of charitable funds from the purpose for which they were donated, Kugler said.

But the statutory cap on damages is applicable to CompleteCare because it is “organized exclusively for hospital purposes,” Kugler said. He cited a 2016 ruling from the same court by Senior Judge Joseph Rodriguez, which found that CompleteCare had an exclusively hospital purpose in another medical malpractice case. In the 2016 case, a plaintiff who gave birth to a child with Down syndrome claimed she was not provided prenatal screening for that condition. The ruling in that case also limited damages to $250,000.

Franco-Palacios performed the C-section on Fiori-Lacivita at Inspira Medical Center in Vineland. Fiori-Lacivita, then 34 weeks pregnant, came to Inspira on Jan. 31, 2014, with a complaint of vaginal bleeding. She had received prenatal care from another doctor as a private patient, but Franco-Palacios, in the scope of her employment with CompleteCare, provided OB-GYN coverage to Inspira. Fiori-Lacivita delivered a healthy boy.

CompleteCare, a private nonprofit entity, provides health services regardless of insurance status or ability to pay. Its 19 locations in Southern New Jersey provide health care to medically underserved areas and populations, according to court papers. Medicaid pays 65% of its budget and Medicare provides another 5%.

At issue in the case were the government's claim for absolute immunity for CompleteCare under Section 7 of the New Jersey Charitable Immunity Act, and whether CompleteCare qualifies for a cap on damages under Section 8 of the act. The central question in the case is whether CompleteCare was organized with an “exclusively hospital” or “exclusively charitable” purpose.

Lawyers for Fiori-Lacivita argued persuasively against the government's claim for absolute immunity under Section 7 but offered little to challenge the government's argument for a damages cap under Section 8, Kugler said. The plaintiff's lawyers argued that the government was not entitled to assert an immunity defense because the plaintiff was not a “beneficiary” of CompleteCare's services. They focused on the fact that she received care from a private OB-GYN, Kugler said. But a person is a beneficiary, for purposes of the Charitable Immunity Act, if they are a “direct recipient” of the “good works” performed by the defendant, Kugler said.

But the government is not entitled to charitable immunity because an analysis of CompleteCare's finances does not include a substantial amount of charitable contributions, Kugler said. Less than 1% of CompleteCare's total revenue comes from nongovernmental, private funding, far below levels that New Jersey courts deem substantial, he said.

Also, the damages cap applies because CompleteCare is “organized exclusively for hospital purposes,” Kugler said, citing its wide range of health services, such as counseling, health screening and education and programs for mental health and substance abuse. He cited a 2015 state Supreme Court case, which said a hospital is no longer simply a facility where medical professionals treat patients but a place where members of the community receive emergency care and preventative services.

“We find that CompleteCare is similar to a typical and modern New Jersey hospital and entitles the Government to Section 8 immunity,” Kugler wrote.

Paul daCosta of Snyder, Sarno, D'Aniello, Maceri & daCosta in Roseland, who represents Fiori-Lacivita, could not immediately be reached for comment.

Assistant U.S. Attorneys Anne Taylor and Jessica Rose O'Neill represented the government. A spokesman for their office declined to comment.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

3rd Circuit Strikes Down NLRB’s Monetary Remedies for Fired Starbucks Workers

As Trafficking, Hate Crimes Rise in NJ, State's Federal Delegation Must Weigh in On New UN Proposal

4 minute read

Trending Stories

- 1Courts Grapple With The Corporate Transparency Act

- 2FTC Chair Lina Khan Sues John Deere Over 'Right to Repair,' Infuriates Successor

- 3‘Facebook’s Descent Into Toxic Masculinity’ Prompts Stanford Professor to Drop Meta as Client

- 4Pa. Superior Court: Sorority's Interview Notes Not Shielded From Discovery in Lawsuit Over Student's Death

- 5Kraken’s Chief Legal Officer Exits, Eyes Role in Trump Administration

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250