Former Housing Authority Director Lacks Standing in Benefits Challenge, Judge Says

"It is HUD's prerogative to enforce the strictures of the [Housing Choice Voucher Program] on [public housing authorities], and it is worth noting that ... the agency has taken no steps to intervene," Judge Robert Kugler said.

December 10, 2019 at 04:04 PM

3 minute read

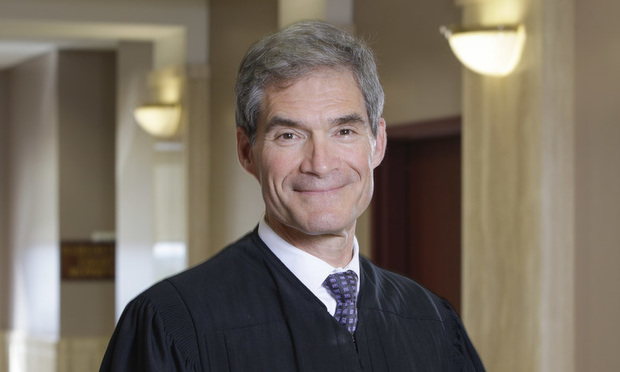

Judge Robert Kugler, U.S. District Court for the District of New Jersey (Photo: Carmen Natale/ALM)

Judge Robert Kugler, U.S. District Court for the District of New Jersey (Photo: Carmen Natale/ALM)

A former executive director of a local housing authority failed in his civil action against the authority over the handling of retirement benefits because only the U.S. Department of Housing and Urban Development would have standing in the case, according to the court.

U.S. District Judge Robert Kugler of the District of New Jersey granted the Pleasantville Housing Authority's and current executive director Vernon Lawrence's motion to dismiss plaintiff Charles Hargrove's case.

The case stemmed from retired PVHA director Hargrove's loss of retiree health benefits, which he discovered when Lawrence told him that the New Jersey State Health Benefits Program would not cover his benefits, according to Kugler's opinion Tuesday.

Ultimately, Hargrove and his wife had to buy private health insurance, since PVHA could only provide "medi-gap" measures, though the defendants claimed they were working on reimbursing the couple. Hargrove's lawsuit soon followed, seeking to hold PVHA responsible for the Hargroves' insurance expenses and alleging breach-of-contract claims.

In Tuesday's opinion, Kugler said the main issue in the case was "whether the PVHA can unilaterally and without HUD approval use federal funds to reimburse Plaintiffs for health insurance premiums sua sponte and without notice to HUD." To determine the Hargroves' standing, the court had to look at whether the plaintiffs suffered an injury in fact that is linked to the defendant's conduct and that can be redressed by judicial action.

"If Plaintiffs simply alleged that Defendants had unilaterally terminated their healthcare benefits, they would almost certainly meet every element of the standing inquiry. But the situation is more complicated," Kugler said.

"While the PVHA can no longer pay for Plaintiffs' coverage through the SHBP, it has consistently stated that it intends to reimburse Plaintiffs for their private insurance and Medicare Part B coverage. Plaintiffs do not contend that defendants are being insincere. Rather, plaintiffs assert that the PVHA may be barred by HUD regulations from reimbursing them for their private insurance coverage.

"The emphasis on 'may be' is deliberate—plaintiffs refuse to definitively state that such reimbursement would violate HUD regulations, instead always hedging their position in some fashion," Kugler wrote.

Ultimately, Kugler said, the authority to pursue such claims is vested in HUD.

"It is HUD's prerogative to enforce the strictures of the [Housing Choice Voucher Program] on [public housing authorities], and it is worth noting that although plaintiffs have put HUD on notice of the PVHA's reimbursement plan, the agency has taken no steps to intervene," Kugler said. "By filing this lawsuit, plaintiffs attempt to usurp HUD's prerogative by forcing defendants to comply with plaintiffs' speculation as to what HUD's regulations require. Plaintiffs are not categorically barred from pursuing this course of action, but they need to demonstrate that injury will befall them if the court does not allow it."

PVHA is represented by Yolanda Melville of Cooper Levenson in Atlantic City. The Hargroves are represented by Matthew Wieliczko of Zeller & Wieliczko in Cherry Hill. Melville did not respond to a request for comment. Wieliczko declined to comment.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Mentioned

Trending Stories

- 1Parties’ Reservation of Rights Defeats Attempt to Enforce Settlement in Principle

- 2ACC CLO Survey Waves Warning Flags for Boards

- 3States Accuse Trump of Thwarting Court's Funding Restoration Order

- 4Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 5Coral Gables Attorney Busted for Stalking Lawyer

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250