Boosting Revenue Per Lawyer, Archer Grows Revenue With Fewer Lawyers

A healthy 8.9% gain in revenue per lawyer, to $540,000 from $496,000, drove the overall revenue increase for the Haddonfield-based firm.

February 27, 2020 at 02:13 PM

4 minute read

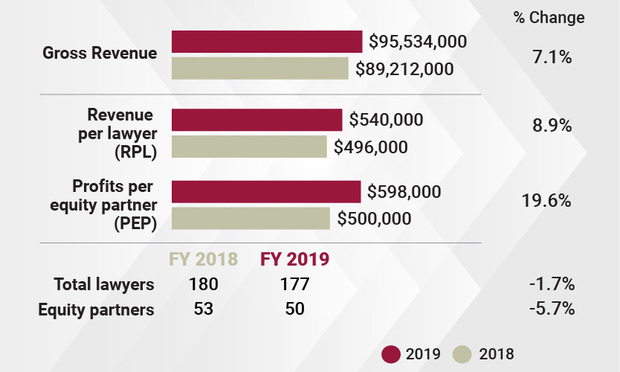

Archer & Greiner, one of New Jersey's largest homegrown firms, posted a 7.1% increase in gross revenue in fiscal 2019, and did it with fewer attorneys.

The year-over-year revenue growth, to $95.5 million from $89.2 million, came as firmwide attorney head count decreased by 1.7%, to 177 from 180.

Thus a healthy 8.9% gain in revenue per lawyer, to $540,000 from $496,000, is what drives the overall revenue increase for the Haddonfield-based firm, whose fiscal year ended last Sept. 30.

"All this was accomplished at a time when we didn't add head count … so [the growth] does include a level of increased activity," firm president Christopher Gibson said in a recent interview. "A lot of firms probably felt a bit of strength in the legal market."

Archer's gross revenue has grown by a little less than 10% over a five-year period, according to historical Law Journal data.

Among the firm's active practices is environmental litigation, including work generated from state-filed natural resources claims, according to Gibson. "We don't sit second to anybody in this state or anywhere else, quite frankly," when it comes to that practice, he said. For example, Archer is representing the PennEast Pipeline Co. in litigation over its proposed natural gas pipeline route.

Gibson additionally pointed to environmental regulation and land use, as well as white-collar defense and bankruptcy, as areas of strength for the firm, which also added to its lobbying subsidiary Archer Public Affairs, including with a new office in Harrisburg, Pennsylvania, in 2019.

The firm last year also added lateral hires in the areas of employment law and ERISA, Gibson also noted. That followed the 2018 addition of a specialty creditors' rights group, and opening of a New York office, via its acquisition of DiConza Traurig Kadish.

The firm's cannabis practice, drawing on labor and employment, transactional and land use practitioners, also has generated work in corporate formation and regulatory areas, he said.

Chris Gibson of Archer & Greiner

Chris Gibson of Archer & Greiner"We seem to be shifting and adding new areas, and we continue to look for … opportunities," Gibson said. "There are always growth areas in the law."

There was a net decrease of three equity partners (to 50 from 53) in fiscal 2019, attributable to retirements, according to Gibson. (The firm has no mandatory retirement age, he noted.)

Profit per equity partner (PEP), meanwhile, increased 19.6%, to $598,000 from $500,000.

The equity partner ranks have grown since Archer's fiscal year ended in the fall. The firm made numerous new partners in the new year, including 12 equity partners, Gibson said.

The new class of equity partners, Gibson said, shows "a commitment particularly to some of these young people who've worked so hard."

"A lot of these younger people are part of a concerted effort by the firm to plan for the future," he added.

Gibson acknowledged that PEP is a competitive metric for law firms, but said he's not concerned about overgrowing the equity partner tier. The key is to focus on practice growth rather than the number of equity shares and their corresponding value, he said.

"Of course you're making equity partners on the basis of multiple factors," he noted.

Last year was eventful in other ways for Archer. In June, longtime firm chairman James Carll stepped down and was replaced by business law partner Deborah Hays, amid other changes to leadership structure. And in late 2018, the firm created a chief diversity officer position and appointed partner Lloyd Freeman, who has done "a fantastic job" since then, Gibson noted in his interview.

Where Archer's $95.5 million in gross revenue for fiscal 2019 positions it for this year's Am Law 200 remains to be seen. With $89.2 million in gross revenue for fiscal 2018, the firm was off the board last year. It made the list in 2013 and 2017. Last year's No. 200 firm, California's Jeffer Mangels Butler & Mitchell, posted $97 million in 2018 revenue.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Send Us Your New Partners for the NJ Law Journal's New Partners Yearbook

1 minute read

New Methods for Clients and Families to Have Their Estate and Legacy Planning Complete

5 minute read

Tensions Run High at Final Hearing Before Manhattan Congestion Pricing Takes Effect

4 minute readLaw Firms Mentioned

Trending Stories

- 1SDNY US Attorney Damian Williams Lands at Paul Weiss

- 2Litigators of the Week: A Knockout Blow to Latest FCC Net Neutrality Rules After ‘Loper Bright’

- 3Litigator of the Week Runners-Up and Shout-Outs

- 4Norton Rose Sues South Africa Government Over Ethnicity Score System

- 5KMPG Wants to Provide Legal Services in the US. Now All Eyes Are on Their Big Four Peers

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250