0 results for 'Sullivan Cromwell'

Florida's Employee Pension System Gets Tough on Investor Fraud

Florida's public employee pension system, which, ironically, is overseen by pro-tort reform Republicans, has become the most litigious institutional investor in the country. The Florida State Board of Administration is currently involved in nearly 300 securities fraud suits against companies whose stock it has owned. FSBA head John T. "Tom" Herndon says the actions are warranted by "corporate actions that border on criminal."

Remember the internal e-mail in which a Goldman exec called the Timberwolf CDO "one shitty deal"? The folks at an Australian hedge fund called Basis Yield Alpha sure do: They invested in Timberwolf, and were promptly forced into insolvency. Now, after failed negotiations with Goldman over the investment, Basis has sued, demanding $1 billion in punitive damages.

It's no Siemens, but yesterday the Department of Justice and the SEC announced two more settlements in a Foreign Corrupt Practices Act matter. This time Italian automaker Fiat agreed to pay $17.8 million in penalties, disgorgement of profits, and prejudgment interest for paying illegal kickbacks to the former government of Iraq. The figure is dwarfed by the more than $1 billion that Siemens agreed to pay for its worldwide bribery spree, but it's more evidence of U.S. prosecutors' global reach in this area.

In re: Initial Public Offering Securities Litigation

Rehearing of IPO Class Action Issue Denied; No Reason to Revise Standard for Class Certification

Which Firms Provide the Best Outside Counsel?

The BTI Consulting Group's "Benchmarking Corporate Counsel Management Strategies" report has some late-breaking trend data for GCs, including a look at the law firms that are providing the best outside counsel.The Norwegian oil company Statoil briefly held the record for the biggest FCPA fine when it entered into a deferred prosecution with the Justice Department in 2006. But after three years of good behavior, the company can put that all behind it now.

Wall Street critics were pleased to see JPMorgan admit that a breakdown in controls and leadership caused the losses, but the SEC still came under fire over fine print in the admissions and for letting high-ranking execs off the hook.

It was a big turnaround for mortgage-backed securities investors last year when an appellate court ruled that plaintiffs can assert claims related to securities they never purchased. On Monday Goldman Sachs's lawyers at Gibson Dunn and Boies Schiller lost a bid to turn things back around in the banks' direction.

Trending Stories

- 1The Law Firm Disrupted: Playing the Talent Game to Win

- 2A&O Shearman Adopts 3-Level Lockstep Pay Model Amid Shift to All-Equity Partnership

- 3Preparing Your Law Firm for 2025: Smart Ways to Embrace AI & Other Technologies

- 4BD Settles Thousands of Bard Hernia Mesh Lawsuits

- 5A RICO Surge Is Underway: Here's How the Allstate Push Might Play Out

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250

More from ALM

- Morgan & Morgan Class Action Attorneys Detail Pathway to Success Within Cybersecurity and Data Privacy Practice 1 minute read

- Holwell Shuster & Goldberg Partners Leverage 'Hostile' Witnesses to Secure $101 Million Verdict Against Walmart 1 minute read

- Legal Speak at General Counsel Conference Midwest 2024: Mike Andolina, Partner, White & Case 1 minute read

Resources

Strong & Hanni Solves Storage Woes--Learn How You Can, Too

Brought to you by Filevine

Download Now

Meeting the Requirements of California's SB 553: Workplace Violence Prevention

Brought to you by NAVEX Global

Download Now

The Benefits of Outsourcing Beneficial Ownership Information Filing

Brought to you by Wolters Kluwer

Download Now

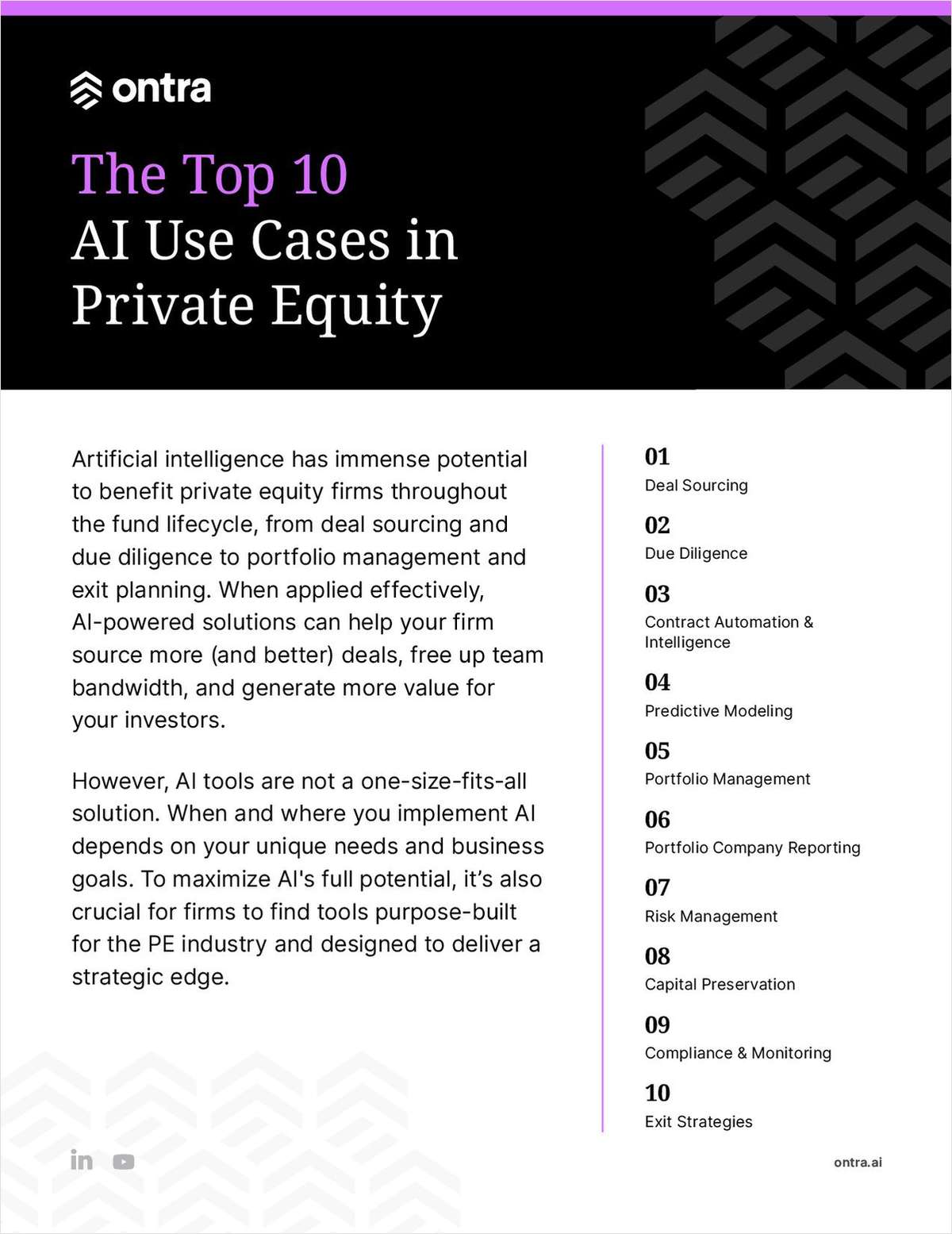

The Top 10 AI Use Cases in Private Equity

Brought to you by Ontra

Download Now