0 results for 'Deutsche Bank'

The National Credit Union Administration has sued a UBS unit for allegedly making misrepresentations in the sale of more than $1 billion in mortgage-backed securities to two credit unions that failed. The suit, filed on Thursday in Kansas federal district court, is the latest by the NCUA against financial institutions that sold mortgage-backed securities to now-defunct corporate credit unions.

Judge Rejects 'Worthless' Deal

A New York federal judge has rejected a shareholder class action settlement and request for $200,000 in plaintiffs' attorney fees, calling the deal virtually worthless to shareholders. The case stemmed from the 1998 purchase of London insurance broker Willis Corroon Group P.L.C. by an investor group led by Kohlberg Kravis Roberts & Co. (KKR).

SPACs: an emerging exit strategy

The struggling initial public offering market and the credit crunch have limited the exit strategies for portfolio companies. A new entrant emerging in this environment is the special purpose acquisition company (SPAC) — an entity whose assets consist entirely of cash and cash equivalents. A SPAC is a publicly traded blank check company, formed for the purpose of effecting a business combination with an unidentified operating business. The merger of a private operating company with a SPAC is a method for the private company to go public. Recent high-profile offerings and offerings underwritten by top-tier investment banks have brought legitimacy to and focus on the SPAC market.View more book results for the query "Deutsche Bank"

On Thursday a federal district court judge in Brownsville, Texas, ordered Grupo Mexico to transfer 260 million shares of a Peruvian mining company to Terrell's client. The take: a cool $6 billion. That's a lot of pesos!

Elizabeth Leaving Washington for Harvard Law (at Least for Now)

Enron Work Sparks Revenue, Partner Profits at Alston & Bird

Meredith [email protected] Bird's 2003 can be summed up in one word: Enron. The felled energy giant paid AB partner R. Neal Batson, the court-appointed examiner for the Enron bankruptcy, and his team of more than 100 lawyers and paralegals roughly $45 million last year.In all, Managing Partner Ben F.Trending Stories

- 1A&O Shearman Adopts 3-Level Lockstep Pay Model Amid Shift to All-Equity Partnership

- 2A RICO Surge Is Underway: Here's How the Allstate Push Might Play Out

- 3The Law Firm Disrupted: Playing the Talent Game to Win

- 4Data-Driven Legal Strategies

- 5Preparing Your Law Firm for 2025: Smart Ways to Embrace AI & Other Technologies

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250

More from ALM

- Morgan & Morgan Class Action Attorneys Detail Pathway to Success Within Cybersecurity and Data Privacy Practice 1 minute read

- Holwell Shuster & Goldberg Partners Leverage 'Hostile' Witnesses to Secure $101 Million Verdict Against Walmart 1 minute read

- Legal Speak at General Counsel Conference Midwest 2024: Mike Andolina, Partner, White & Case 1 minute read

Resources

Strong & Hanni Solves Storage Woes--Learn How You Can, Too

Brought to you by Filevine

Download Now

Meeting the Requirements of California's SB 553: Workplace Violence Prevention

Brought to you by NAVEX Global

Download Now

The Benefits of Outsourcing Beneficial Ownership Information Filing

Brought to you by Wolters Kluwer

Download Now

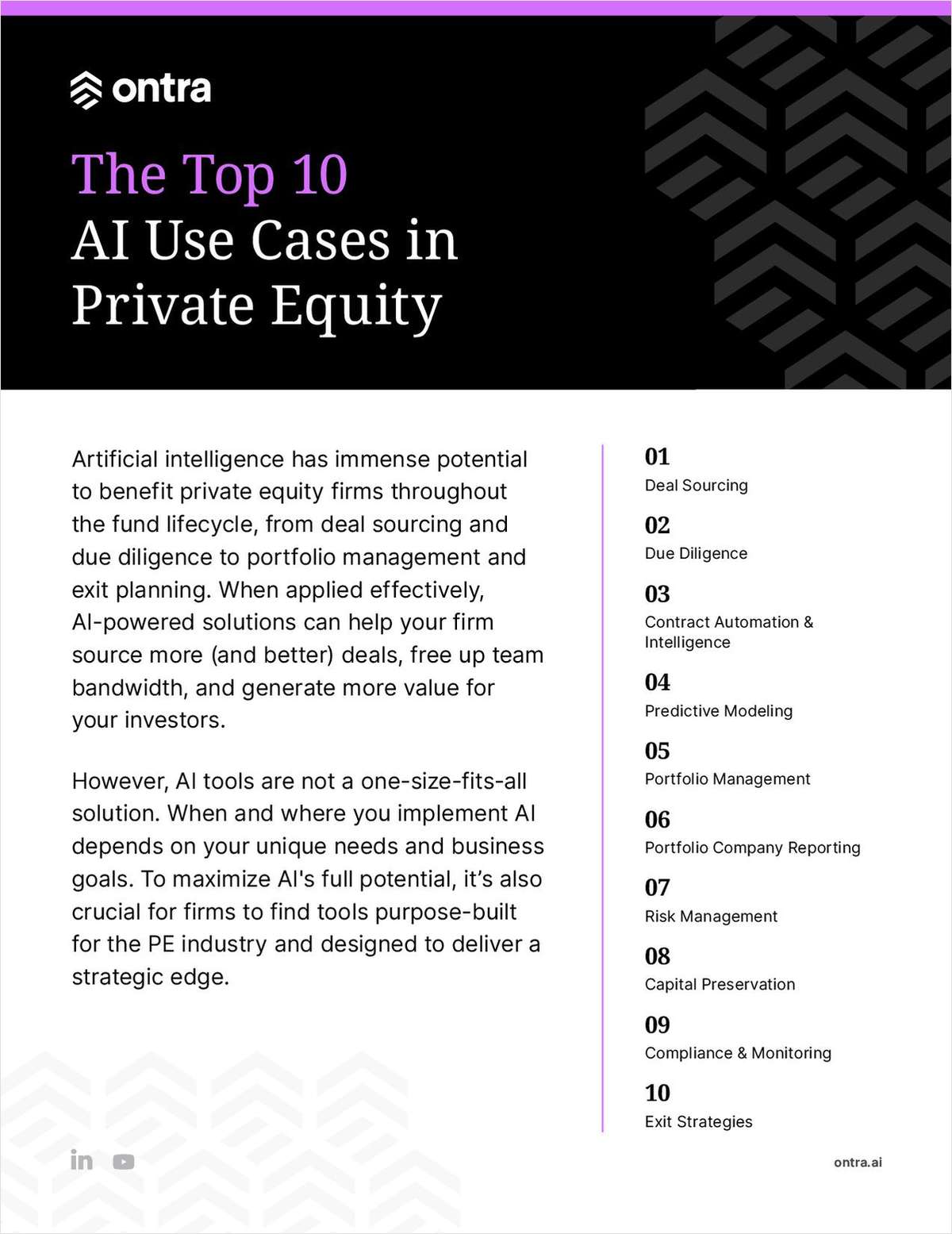

The Top 10 AI Use Cases in Private Equity

Brought to you by Ontra

Download Now