'The SEC Has a Big Problem Now' After Broad Whistleblower Protections Curbed

“They've been encouraging people to report internally. Now they have to think twice about that because they're essentially encouraging people to report internally and go into harm's way.”

February 22, 2018 at 01:48 PM

7 minute read

U.S. Securities and Exchange Commission building in Washington, D.C. Credit: Mike Scarcella / NLJ

U.S. Securities and Exchange Commission building in Washington, D.C. Credit: Mike Scarcella / NLJ

When Congress was creating the U.S. Securities and Exchange Commission's program for rewarding whistleblowers, corporations pressed for a requirement that tipsters first report suspected misconduct to their employers. Without that mandate, the companies argued, insiders would go straight to the SEC and ignore the internal reporting systems in which industry had invested millions of dollars.

That requirement was not adopted, but corporations did not walk away from their lobbying push empty-handed. The SEC, since the inception of the whistleblower program in 2010, promoted internal whistleblowing, even incentivizing it by awarding higher bounties to insiders who first take their concerns to their employers.

The securities agency's messaging came despite the fact the law that created the whistleblower program—the Dodd-Frank Act—said tipsters must report “to the commission” in order to receive protections against retaliation. The SEC interpreted that language broadly to extend protections also to employees who only report misconduct internally.

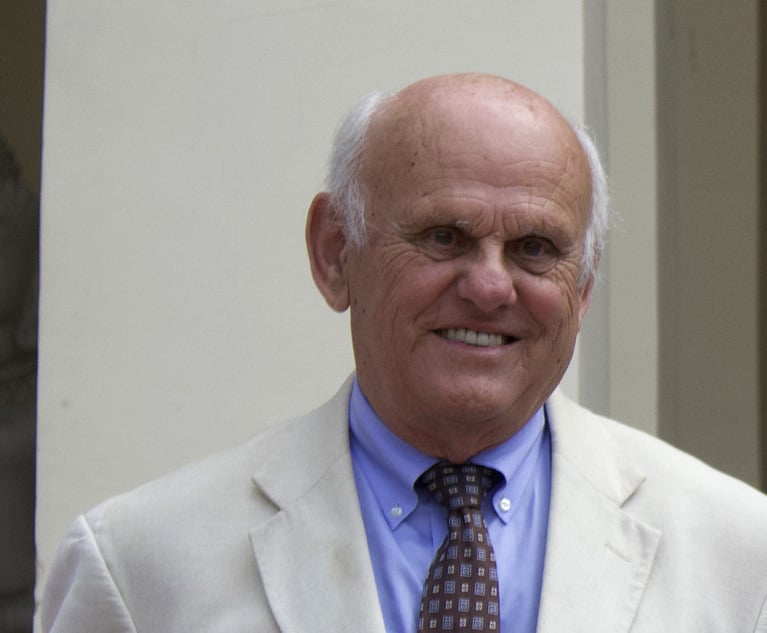

Sean McKessy

Sean McKessyThe U.S. Supreme Court on Wednesday unanimously slapped down the SEC's broad view of anti-retaliation protections, ruling that Dodd-Frank's text clearly affords safeguards against reprisal only to those who contact the commission. Now, the open question for whistleblower and securities industry lawyers is how—or even whether—the SEC continues to promote internal whistleblowing in the new legal landscape.

“I do think that the whistleblower office is going to have to change its messaging. You really need to report to the commission if you don't want to lose one of these protections,” said Phillips & Cohen partner Sean McKessy, who stepped down in 2016 as the chief of the SEC's whistleblower office. “While I was still the head of the whistleblower office, I forewarned that if this issue were resolved the way it ultimately was by the Supreme Court, that the office's messaging would have to change to say you'd be crazy if you don't report to the commission because you lose one of the basic tenets of the whistleblower program.”

Lawyers are also watching to see whether the Supreme Court's decision backfires against the industry. “If internal compliance is ultimately destroyed, in the game of Jenga, this is the block that was pulled out to start the process of completely undermining internal reporting,” McKessy said.

Jane Norberg, head of the SEC whistleblower office, did not respond to a request for comment about the Supreme Court decision.

SEC: “Careful of What You Wish For”

As the public face of the SEC's whistleblower office, Norberg has openly questioned the wisdom of the industry challenge. At conferences with securities industry lawyers, Norberg has said that an industry victory against broad anti-retaliation protections would possibly backfire and drive into the SEC's arms whistleblowers who might otherwise report internally.

“The ironic part of all of this is that some of the same companies that commented during the rulemaking process about requiring internal reporting or incentivizing internal reporting are some of the very same companies who are in court now challenging an employee's right to bring a whistleblower retaliation lawsuit for reporting the information internally,” Norberg said last year. “So, in my view, this is a little bit of a thorny issue and a case of 'be careful of what you wish for.'”

Jane Norberg, the SEC's whistleblower chief. Credit: Diego M. Radzinschi

Jane Norberg, the SEC's whistleblower chief. Credit: Diego M. RadzinschiIndeed, whistleblower advocates and securities industry attorneys said the Supreme Court's decision could prompt more corporate insiders to contact the SEC with reports of misconduct.

Jordan Thomas, a former SEC enforcement attorney who founded Labaton Sucharow's whistleblower practice, said he expected Wednesday's ruling to lead to an increase in business for the whistleblower bar. But Thomas stressed he does not view the decision as a positive development.

'The SEC Has a Big Problem Now'

“I'm a former law enforcement person. I think law enforcement benefits when you have strong internal reporting and compliance systems,” Thomas said. “This decision, while good for business, is bad for investors because the SEC is losing its first line of defense.”

For whistleblower lawyers, the Supreme Court's decision simplifies the analysis of whether tipsters should contact the SEC, Thomas said. The SEC, on the other hand, faces difficult decisions about how to proceed.

“The SEC has a big problem now. They've been encouraging people to report internally. Now they have to think twice about that because they're essentially encouraging people to report internally and go into harm's way.”

According to the SEC whistleblower office's most recent report to Congress, about 62 percent of award recipients were current or former insiders. Almost 83 percent of those insiders raised their concerns internally “or understood that their supervisor or relevant compliance personnel” knew of the violations before they reported wrongdoing to the SEC, according to the report.

The SEC has awarded more than $179 million to 50 whistleblowers since issuing the first bounty in 2012. Whistleblowers who help the SEC bring successful enforcement actions with sanctions exceeding $1 million can receive between 10 percent and 30 percent of the money collected.

Justice Ruth Bader Ginsburg on Wednesday noted a separate law, the Sarbanes-Oxley Act, protects internal whistleblowers against retaliation. For many whistleblowers, the Dodd-Frank Act is preferable, however, because it gives more time to file a complaint over retaliation and awards double back pay to victorious whistleblowers.

The court's unanimous decision handed a victory to Digital Realty Trust, represented by Williams & Connolly partner Kannon Shanmugam, in its defense against a would-be whistleblower. The tipster, Paul Somers, claimed he was fired for raising concerns internally about accounting irregularities.

The ruling also resolved a split among the federal circuit courts, where the SEC had inserted itself into retaliation cases between companies and former employees to defend the agency's broad view of whistleblower protections. The U.S. Justice Department backed the SEC's push for broad whistleblower protections.

Digital Realty's gain might mean long-term pain for compliance professionals who rely on internal reporting, said Paul Hastings partner Thomas Zaccaro, a former chief trial counsel in the SEC's Pacific regional office.

Companies, he said, want the opportunity to self-investigate reports of wrongdoing and fix any problem before disclosing it to the SEC and receiving credit for doing so. “That dynamic changes once there's more reporting directly to the SEC,” Zaccaro said.

Amar Sarwal, chief legal officer at the Association of Corporate Counsel, said in-house lawyers should take steps to promote internal reporting, which he described as the “lifeblood of compliance systems.”

“What in-house counsel should not do is look at this opinion as a get-out-of-jail-free card,” he said. “You need to make sure your employees don't feel they're going to get fired or disciplined if they come forward with good-faith allegations of misconduct.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Dissenter Blasts 4th Circuit Majority Decision Upholding Meta's Section 230 Defense

5 minute read

Justice 'Weaponization Working Group' Will Examine Officials Who Investigated Trump, US AG Bondi Says

Judge Pauses Deadline for Federal Workers to Accept Trump Resignation Offer

Judge Accuses Trump of Constitutional End Run, Blocks Citizenship Order

3 minute readTrending Stories

- 1States Accuse Trump of Thwarting Court's Funding Restoration Order

- 2Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 3Coral Gables Attorney Busted for Stalking Lawyer

- 4Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

- 5Securities Report Says That 2024 Settlements Passed a Total of $5.2B

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250