Planning for the Practice in 2018

The start of a new year presents an ideal opportunity for attorneys to reflect on 2017 and to make plans for what might come in 2018. An important…

January 16, 2018 at 11:58 AM

6 minute read

The start of a new year presents an ideal opportunity for attorneys to reflect on 2017 and to make plans for what might come in 2018. An important part of this process is to assess whether a law firm has adequate contingency plans in place to cover the unexpected, including changes in income, the nature of the firm's practice, and staffing.

In the current climate, many attorneys are choosing to delay retirement, if they retire at all. However, others may choose to leave the practice of law for a variety of reasons and, unfortunately, there are those who, due to death, incapacity, or other health or personal reasons, leave the practice of law unexpectedly. As the boomer generation ages and retirement approaches, the issue of succession planning becomes more important for firms and their attorneys.

Each of these events can have implications that go well beyond simply the end of a business relationship. For attorneys, obligations to clients and courts may not be terminated due to retirement or even incapacity or death. Moreover, potential malpractice claims related to legal services rendered years ago remain a risk long after an attorney has left the firm. The unique fiduciary duties associated with law practices can create challenges associated with the unexpected departure of an attorney.

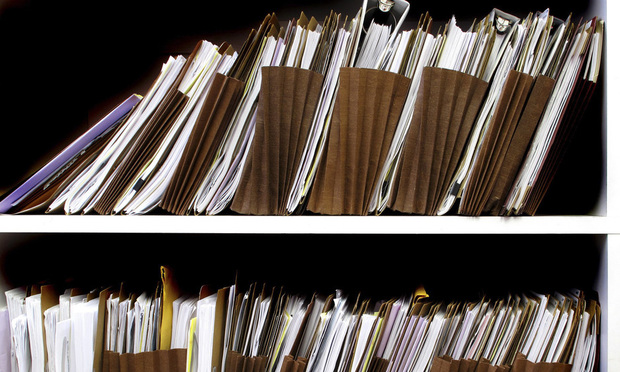

For example, some law practices may not have a plan to address the transition of cases from the departed attorney to others or even who will take the lead in making such decisions. Instead, law firms can be left with an inbox full of emails, a list of contacts that few people know, and a calendar full of commitments.

There are various potential risks associated with a lack of preparation, including lost files and documents, missed deadlines and court appearances, miscommunication with clients, and the inability to access key files and accounts. Each of these risks can lead to a potential malpractice claim.

To help minimize the risks of a claim due to an attorney's unanticipated departure, there are certain steps, including the protocols and procedures outlined below, that law practices may consider taking to prepare for the unexpected.

Consider an Extended-Leave Protocol

A partner who is away from the firm for extended periods of time on account of illness, impairment, or other life events can have the same effect as a permanent departure from the firm. If possible, it can be helpful to prepare for an extended leave is before the circumstances necessitating the leave materialize. This may reduce the risk of making rushed decisions and solutions.

A good starting point to consider is an extended-leave protocol. Such a protocol could be used any time an attorney is unable to actively manage her or his caseload on a full-time basis due to injury, illness, family matters, or other reasons. Each law firm is unique, so firms can evaluate what works best for their respective clients and attorneys. Law firms can establish a length of absence that will trigger the protocol, typically longer than a typical vacation or short medical leave. If the law firm's legal malpractice or disability insurance policy addresses this issue, then those policy terms might provide insight.

In reasonably foreseeable situations that will trigger time away from the office, such as a medical diagnosis or a nondebilitating accident, the impacted attorney can play a role in implementing the extended-leave protocol. Where the leave is unforeseen, another individual may have to take charge.

Because it is not always easy for another attorney to step into the shoes of the attorney on leave, the protocol can provide for the sharing of detailed information with other attorneys, including with respect to open matters, client responsibilities, and deadlines. By using all available resources and implementing a predetermined plan of action, the firm can take steps to ensure that the transition can go as seamlessly as possible.

Key Firm Management Lists

Even if there is a plan in place upon an attorney's departure, sometimes the risk comes from the successor attorney having no idea where to start with a file. Some law firms facing this issue have implemented as part of their emergency protocols the preparation of an attorney practice management packet that includes: (i) a client contact file; (ii) an exportable calendar entry file; (iii) a “cast of characters” and timeline for the file (where applicable); (iv) an ongoing tasks list; and (v) a complete open client/matter list with the name of the employees working on each matter.

If possible, it would be helpful for the attorney to provide information regarding user names and other log-ins for voicemail or email (if not already possessed by the firm). Depending on the practice, it may also be appropriate to provide information for firm-related accounts, such as bank accounts, credit cards, storage facilities and key firm service providers such as vendors and insurers. Finally, this data packet can include the employee's home address, personal email and phone number so she or he may be contacted in the event of an emergency, including an unexpected departure by a firm lawyer. Firms handling this information typically take care to safeguard it as confidential.

While this process is designed to enable the portability of a legal representation, it can also serve as an effective building block for growing a law practice into the future.

Making Plans

Law firms may consider two sources for advising their attorneys and staff of the protocols in the event of an attorney departure. First, law firms can set forth the responsibilities and obligations of both the law practice and the attorney in the partnership agreement or the employment agreement.

Second, an attorney can vest responsibilities relating to her or his law practice in appropriate estate-planning documents. This can include living wills, trusts, and powers of attorney with specific limitations and conditions for use.

With these protocols in place, a law firm can better position itself for adeptly addressing the unexpected in 2018.

Shari L. Klevens is a partner at Dentons and serves on the firm's U.S. Board of Directors. She represents and advises lawyers and insurers on complex claims and is co-chair of Dentons' global insurance sector team. Alanna Clair is a senior managing associate at Dentons and focuses on professional liability defense. Shari and Alanna are co-authors of “The Lawyer's Handbook: Ethics Compliance and Claim Avoidance.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

More Young Lawyers Are Entering Big Law With Mental Health Issues. Are Firms Ready to Accommodate Them?

Trending Stories

- 1Two Wilkinson Stekloff Associates Among Victims of DC Plane Crash

- 2Two More Victims Alleged in New Sean Combs Sex Trafficking Indictment

- 3Jackson Lewis Leaders Discuss Firm's Innovation Efforts, From Prompt-a-Thons to Gen AI Pilots

- 4Trump's DOJ Files Lawsuit Seeking to Block $14B Tech Merger

- 5'No Retributive Actions,' Kash Patel Pledges if Confirmed to FBI

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250