Andrews Kurth Kenyon Posts Drop in Revenue, Profits in 2017

The firm, which will merge with Hunton & Williams in April, attributed the declines to drops in energy capital markets work.

March 23, 2018 at 03:27 PM

4 minute read

Robert Jewell, managing partner of Andrews Kurth Kenyon.

Robert Jewell, managing partner of Andrews Kurth Kenyon.

A slowdown in capital markets work in the energy sector due to slumping oil prices led to a 3 percent decline in gross revenue at Andrews Kurth Kenyon in 2017 and a 24.4 percent drop in net income.

“The energy capital markets really started off well, but pretty well shut down in March when oil prices fell again,” Robert Jewell, managing partner of the Houston-based firm, said about the volume of capital markets work in 2017.

Andrews Kurth Kenyon is officially merging with Hunton & Williams on April 2.

Jewell said the firm's financials in 2017 were also affected by some partner defections during the year. The firm had 147 partners on a full-time-equivalent basis in 2017, compared with 164 in 2016—a 10.4 percent decline. “There's distraction and it takes revenue out of the system,” he said.

In addition, he said Hurricane Harvey, a storm that dumped 51 inches of rain on Houston in late August and caused massive flooding, also affected financials because the Houston business community that sends work to firms was distracted by the storm.

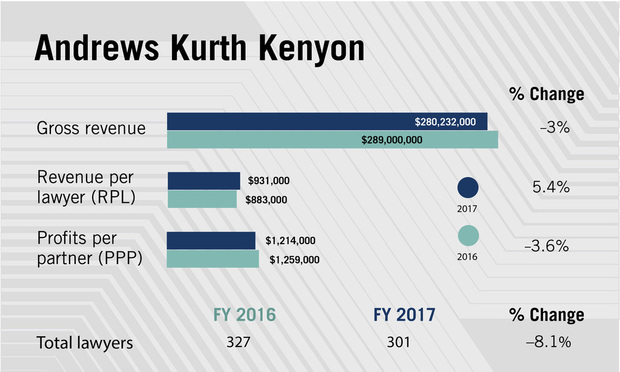

Gross revenue at the firm was $280,232,000 in 2017, compared with $289,000,000 in 2016, and net income came in at $69,589,000 in 2017, compared with $92,000,000 the prior year.

Gross revenue at the firm was $280,232,000 in 2017, compared with $289,000,000 in 2016, and net income came in at $69,589,000 in 2017, compared with $92,000,000 the prior year.

Revenue per lawyer at Andrews Kurth was $931,000 in 2017, up 5.4 percent when compared with $883,000 in 2016, and profits per partner were $1,214,000, down 3.6 percent from $1,259,000 the prior year.

While energy capital markets work was uncharacteristically slow in 2017, Jewell said, litigation was steady, oil and gas was busy and some transactional areas including M&A were also busy during the year. Bankruptcy had a “nice activity level” in 2017 and intellectual property was about the same as in 2016, Jewell said. However, he said, financials were down because capital markets work affects a number of other practices.

The average crude oil spot price was $53.59 a barrel in January 2017 and it dipped to a low of $46.17 in June before improving to $61.19 by December, according to the World Bank commodity markets review. That mid-year dip in 2017 followed a rise that began in early 2016, when oil prices hit a low just below $30 a barrel.

With oil prices higher in 2018, Jewell said the firm's capital markets lawyers are again “really busy” with work in the energy sector.

The firm was hit by lateral partner defections in 2017, including four partners who moved to Jackson Walker offices in Texas, four real estate lawyers who moved to Greenberg Traurig's Dallas office, and four partners who moved to King & Spalding in Houston.

The firm lost a net of 17 partners in 2017 and had only 57 equity partners in 2017, compared with 73 the year before—a 21.9 percent decline. Jewell said the equity partner number was affected by some retirements, departures, and also by the firm's decision to make its equity partner qualification a little stricter in 2017, which pushed a few equity partners into nonequity status. He said the firm evaluates its equity partner qualification, which is based on what a partner brings into the firm, on a yearly basis.

With the merger pending, the partner defections have continued in 2018, with dozens in Texas leaving to join a number of firms. Jewell said the flurry of departures is not surprising because that's a normal result of a big merger. “Hunton is getting the team they wanted…Not that they didn't want other people, but there's lots of competition out there,” he said.

In comparison to 2017, Andrews Kurth posted a 2.7 percent drop in gross revenue in 2016 but net income rose by 2.2 percent as the firm expanded in New York and Washington, D.C. with the addition of 53 lawyers from intellectual property boutique Kenyon & Kenyon.

Jewell said he is focused on closing the merger deal, but he said lawyers from Andrews Kurth and Hunton & Williams have already started to cross-sell and pitch new work together in anticipation of the union.

“Right now I'm trying to make sure we get it closed at the end of the month, but most importantly we are working on integration,” he said.

He said the mood at the firm is positive. “It's almost eerie. Now there's a tangible excitement and optimism,” he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Sunbelt Law Firms Experienced More Moderate Growth Last Year, Alongside Some Job Cuts and Less Merger Interest

4 minute read

Once the LA Fires Are Extinguished, Expect the Litigation to Unfold for Years

5 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250