Texas Appeals Court Tosses Bridal Shop's Ebola Scare Claim For Lack of Expert Report

A Texas court of appeals dismissed a negligence case in which an Ohio bridal shop claimed a Dallas hospital failed to properly respond to an Ebola virus scare after an infected nurse visited the business to try on dresses and ultimately chased away customers.

May 17, 2018 at 03:15 PM

4 minute read

A Texas court of appeals dismissed a negligence case in which an Ohio bridal shop claimed a Dallas hospital failed to properly respond to an Ebola virus scare after an infected nurse visited the business to try on dresses and ultimately chased away customers.

Coming Attractions Bridal and Formal (CABF), an Akron, Ohio bridal shop, sued Texas Health Resources (THR), the owner of Dallas' Presbyterian Hospital, alleging it negligently failed to heed warnings during a 2014 Ebola incident and failed to provide its nurses with the necessary training to prevent the spread of the disease.

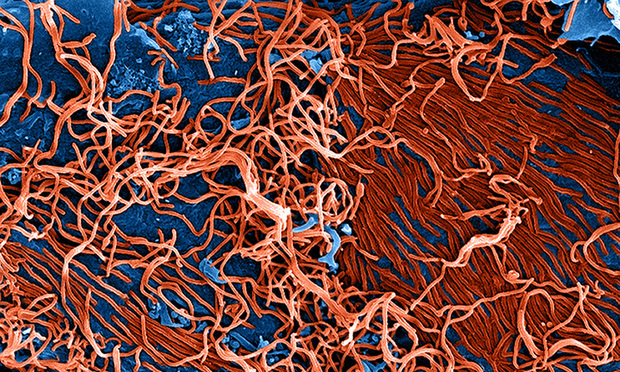

That year, according to the court, a patient with the Ebola virus, Thomas Duncan, was admitted to the Presbyterian Hospital. Amber Vinson, a nurse at the hospital, attended to Duncan until his death, which the first of its kind in the United States. After his death, the hospital assured Vinson and other nurses they were not at risk for Ebola and were free to intermingle with the public, the decision noted.

Vinson subsequently traveled to Ohio, where she visited CABF to select a dress for her upcoming wedding. After she returned to Dallas, she experienced symptoms and was diagnosed with Ebola. Because Vinson shopped at CABF, health authorities in Ohio mandated the store to close for cleaning. When it reopened, CABF was unable to “dispel the perceived Ebola risk and stigma” and the store closed permanently, the suit claimed. Vinson later recovered from the symptoms.

The hospital later filed a motion to dismiss the case under Chapter 74 of the Texas Civil Practice and Remedies Code—a tort reform measure that requires plaintiffs who bring health care liability claims to serve an expert report for each physician or health care provider they sue detailing how each defendant failed to meet a standard of care. If the plaintiff fails to file an expert report, the defendant may file a motion to dismiss the claim with prejudice. It is uncontested that CABF did not serve an expert report on THR, the court noted.

CABF argued that its case does not present a heath care liability claim, and the trial court denied THR's motion to dismiss. The hospital later appealed the decision to Dallas' Fifth Court of Appeals.

In its decision, the Fifth Court found that CABF's claims against the hospital were indeed health care liability claims.

“THR's alleged negligence is based on safety standards uniquely arising from professional duties owed as a health care provider,” wrote Justice Craig Stoddart. “We concluded CABF alleged departures from safety standards that implicate THR's duties as a health care provider.”

Stoddard also shot down CABF's argument that it is not subject to Chapter 74 because it is not a “claimant” under the law, which it contends is defined as a “natural person.”

“Because the common law definition of a person includes an entity such as CABF, we conclude CABF falls within the term claimant as defined in Chapter 74,” Stoddart wrote.

The Fifth Court's decision ultimately dismissed CABF's claims with prejudice because of the failure to file an expert report, remanding the case back to the trial court to determine the hospital's reasonable and necessary attorney fees.

Michelle Robberson, a shareholder in Dallas' Cooper & Scully who represents THR, is happy with the decision.

“We have always believed that the plaintiff's allegations asserted a heath care liability claim against THR,” Robberson said. “We are pleased the court of appeals reached the correct result based on the plain language of the statute and the cases interpreting it.''

Patrick R. Kelly, a Dallas lawyer who represents CABF in the case, said he will appeal the decision to the Texas Supreme Court.

“I respect the court but I think the opinion is off base,” said Kelly, who disagrees with the Fifth Court's finding that his client's case amounted to a health care liability claim.

“It has nothing to do with health care,” Kelly said explaining that his client's claim focused on a “negligent comment by an employer to an employee about whether they could travel or not.”

“This is a unique case,” Kelly said of the decision. “I haven't found one case that says an entity is a claimant under” Chapter 74.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

3 minute read

Supreme Court Reinstates Corporate Disclosure Law Pending Challenge

Trending Stories

- 1No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 2Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 3Meet the New President of NY's Association of Trial Court Jurists

- 4Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

- 5Freshfields Hires Ex-SEC Corporate Finance Director in Silicon Valley

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250