Haynes and Boone Posts Record-Setting 2018 on Modest Gains

Haynes and Boone exceeded $400 million in gross revenue and $1 million in profits per equity partner for the first time in 2018.

February 21, 2019 at 07:26 PM

4 minute read

Timothy Powers, managing partner of Haynes and Boone.

Timothy Powers, managing partner of Haynes and Boone.

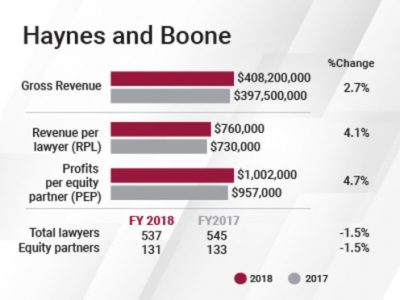

Haynes and Boone burst through significant financial barriers in 2018 as the firm's gross revenue bested the $400 million mark, profits per equity partner (PEP) topped $1 million, and revenue per lawyer (RPL) shot past the no-longer-elusive $750,000 level.

Timothy Powers, the Dallas-based firm's managing partner, said the record year reflects an effort across the firm of “just staying very disciplined in what we are doing.”

Gross revenue was $408.2 million in 2018, up 2.7 percent compared with $397.5 million in 2017. Net income was $131.5 million, a 3.3 percent improvement from $127.2 million the year before.

PEP came in at $1,002,000, up 4.7 percent from $957,000 the year before. And RPL was $760,000, a 4.1 percent increase from $730,000 in 2017. Powers said the firm had been working for the last three years toward passing the $750,000 RPL mark.

“It was a great year from our perspective. We thought we had a lot of great accomplishments. Productivity and demand did increase across the board,” Powers said.

He pointed to a number of strong practices in 2018 including corporate, M&A, energy, capital funds, finance and real estate. Litigation and appeals picked up in Texas, and lawyers in London had some great arbitration and litigation outcomes, Powers said.

He pointed to a number of strong practices in 2018 including corporate, M&A, energy, capital funds, finance and real estate. Litigation and appeals picked up in Texas, and lawyers in London had some great arbitration and litigation outcomes, Powers said.

The firm shrunk slightly in 2018, with 537 lawyers on a full-time equivalent basis, down 1.5 percent from 545 in 2017. It had 131 equity partners, down 1.5 percent, or two partners. But the firm had 106 nonequity partners, up 4.9 percent, or five lawyers, from the prior year.

Powers said Haynes and Boone in 2018 focused its lateral hiring on existing strengths in energy, financial services—which also includes real estate and restructuring—technology and private equity, and targeted markets in Houston, London and New York.

The firm is also opportunistically looking at growth in the health care and life sciences industry, and has been successful in hiring lateral partners with that focus in Texas, New York and California, he said. Geographically, he said, the firm remains focused on its home base in Dallas, while also growing on the East Coast and the West Coast to solidify its recognition as a national firm.

“We've done all of that while still increasing all of our revenue numbers, and even as a smaller firm, made significant investments in technology this year—and more coming,” he said.

Also on the expense side, Powers said the associate salary increase that took effect midyear cost the firm about $4 million. He said associates want fulfilling work and a great work environment, but “you have to provide the money to remain competitive.”

Haynes and Boone has 16 offices, but Powers said the firm will soon announce the opening of an office in Charlotte, North Carolina, to serve two of the firm's top 10 clients—Bank of America and Wells Fargo. That location has been on the firm's radar screen for several years, he said.

Powers said 2019 hasn't started as strongly as the firm would like on the demand side, but collections did very well in January, as revenue the firm had expected to receive in 2018 came in after Jan. 1. He said demand may have slipped in early 2019 because of the impact of the federal government shutdown and trade wars.

But Powers is positive about what's ahead.

“Everybody is still talking about a strong second half of the year,” he said. “It's a little bit of a wait-and-see, but people are still very upbeat.”

He said the firm's practice balance is intentionally about 70 percent business and 30 percent litigation and controversy work.

“That's been great while the business cycle is up. We are looking at our litigation and restructuring practices picking up,” he said.

Read More

Revenue, Income Improve at Haynes and Boone in 2017

Big Texas Firms Expand in London — and It's Not All About Energy

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Foley Partner Wrapping Up Long Legal Career, 29 Years of Chairing MLK Jr. Oratory Competition in Houston

3 minute read

Sunbelt Law Firms Experienced More Moderate Growth Last Year, Alongside Some Job Cuts and Less Merger Interest

4 minute read

Texas-Based Ferguson Braswell Expands in California With 6-Lawyer Team From Orange County Law Firm

2 minute readTrending Stories

- 1Departing Attorneys Sue Their Former Law Firm

- 2Pa. High Court: Concrete Proof Not Needed to Weigh Grounds for Preliminary Injunction Order

- 3'Something Else Is Coming': DOGE Established, but With Limited Scope

- 4Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 5Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250