Partner Profits Outpace Revenue at Bracewell in 'Outstanding' 2018

Bracewell hit $300 million in revenue in 2018, while profits per equity partner jumped by 11.3 percent to $1.45 million.

February 25, 2019 at 11:20 AM

4 minute read

Gregory Bopp, Bracewell managing partner.

Gregory Bopp, Bracewell managing partner.

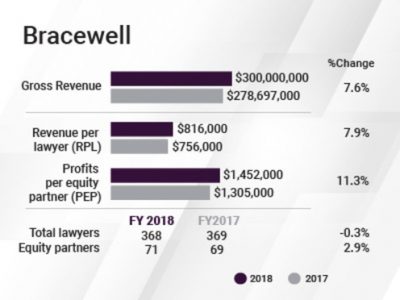

Gross revenue improved by a healthy 7.6 percent at Bracewell in 2018, but profits per equity partner (PEP) were even better, increasing by a noteworthy 11.3 percent.

“2018 was an outstanding year for Bracewell across the entire firm,” said Gregory Bopp, the Houston-based firm's managing partner.

Firmwide revenue hit $300 million in 2018, up from $278.7 million in 2017, and revenue per lawyer came in at $816,000, up 7.9 percent compared with $756,000 the year before.

Net income jumped by 14.5 percent, to $103.1 million compared with $90.1 million the year before, leading to PEP of $1.45 million in 2018, up from $1.31 million in 2017.

Bopp said the firm's energy, infrastructure and finance practices were at “full throttle” during 2018, and other areas including technology, litigation and regulatory also posted very good years.

The firm's makeup was largely the same size in 2018 as the year before, with 368 lawyers, just one less than 2017 when measured on a full-time equivalent basis. The firm had 71 equity partners, just two more than in 2017.

The firm's makeup was largely the same size in 2018 as the year before, with 368 lawyers, just one less than 2017 when measured on a full-time equivalent basis. The firm had 71 equity partners, just two more than in 2017.

However, despite being close to the same size as in the prior year, profits at Bracewell improved in a big way in 2018.

“For us, our strategy is very simple—to build on our strengths in the sectors we are known for,” Bopp said, explaining the boost in the firm's bottom line. That means focusing on the energy, finance, technology and infrastructure sectors, he said, while regulatory and litigation are also important.

“It's just high-quality work—complex transactions, complex disputes for large institutional clients, private equity firms, large financial institutions. It was a great year and I expect it to continue,” he said.

On the transactional side, Bopp said, Bracewell worked on more than a dozen midstream infrastructure projects in the Permian Basin, including its representation of Kinder Morgan on the Gulf Coast Express Pipeline Project and the Permian Highway Pipeline Project. The firm also represented Apache Corp. in transactions related to creation of Altus Midstream Co., and Phillips 66 in the Grey Oak Pipeline project and the South Texas Gateway Terminal joint venture.

Bopp said the firm's renewables, project finance and private equity practices were “as busy as they've ever been,” fueled by infrastructure development in North America.

He said the firm's litigators successfully defended HTC Corp. from a trademark infringement suit tried in federal court in Virginia, and successfully defended Pier 1 Imports Inc. in a securities class action in the Northern District of Texas .

Also, Bopp notes, in a high-profile matter, New York partner Barbara Jones was appointed special master to conduct a privilege review of items seized last year from the home and office of Michael Cohen, President Donald Trump's former attorney. Jones also was tapped to help review the disciplinary policies of the New York City Police Department.

Bopp said the firm's London office, which is purely focused on the energy sector, had an outstanding year, and lawyers worked on significant upstream transactions in Africa, the Middle East and in the North Sea area.

London was one of the locations Bracewell targeted for lateral hiring in 2018. The firm brought on 10 lateral partners during 2018, including a pair of project finance partners from Pillsbury Winthrop Shaw Pittman in New York.

As for 2019, Bopp said the year started well, and demand is strong. “It's looking good,” he said.

Read More:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Eversheds Sutherland Adds Hunton Andrews Energy Lawyer With Cross-Border Experience

3 minute read

After Nearly 2 Decades in the Role, Longtime Haynes and Boone General Counsel Passes the Baton

3 minute read

Bracewell Adds Former Pioneer Natural Resources Lawyer to O&G, Energy Transition Practices

2 minute readTrending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250