On Modest Revenue Growth, V&E Posts Third Record Year in 2018

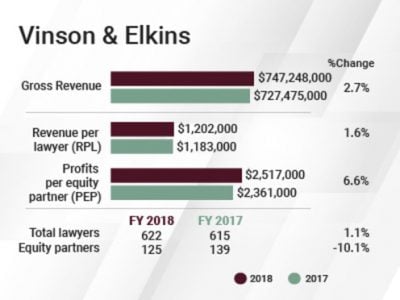

Vinson & Elkins' saw gross revenue increase 2.7 percent, while profits per equity partner were up 6.6 percent.

March 08, 2019 at 04:22 PM

5 minute read

Mark Kelly of Vinson & Elkins.

Mark Kelly of Vinson & Elkins.

Vinson & Elkins posted record results for the third straight year, even as revenue per lawyer (RPL) showed only slight growth, while a smaller partnership enjoyed solid growth in profits per equity partner (PEP).

But Mark Kelly, a partner in Houston who chairs the firm, said he was overall very pleased with the results, because the firm's revenue continued a three-year climb.

“We did well,” Kelly said.

In 2018, V&E's gross revenue hit $747.2 million, up 2.7 percent compared with $727.5 million in 2017, and RPL came in at $1.202 million, an increase of 1.6 percent when compared with $1.183 million the prior year.

Net income declined, at $315.2 million in 2018, a 3.7 percent drop compared with $327.3 million in 2017. But PEP grew 6.6 percent to $2.517 million in 2018, compared with $2.361 million the year before, as the firm had 10.1 percent fewer equity partners.

While V&E did post record revenues for three years running, the 2018 year-over-year growth was not as impressive as in 2017, when revenue increased by 11.3 percent, or in 2016, when revenue came in 4.2 percent higher than the year before.

While V&E did post record revenues for three years running, the 2018 year-over-year growth was not as impressive as in 2017, when revenue increased by 11.3 percent, or in 2016, when revenue came in 4.2 percent higher than the year before.

Kelly said a number of practices logged very strong performance in 2018, but the firm made a significant investment in the private equity and alternative lending space, hiring partners with that focus.

He said the firm's private equity work is in the energy sector, such as representing TPG Capital, a shareholder in Nexeo, in global chemical company Univar of Nexeo for about $2 billion. While the firm is known for its energy-related private equity work, Kelly said, it is also growing the practice in other sectors including infrastructure, transportation and logistics, technology, consulting services and real estate.

Private equity wasn't the only hot practice area in 2018, Kelly said. The firm worked on a number of major M&A projects, both public and private, including its representation of Energy Transfer Partners in its merger with a wholly-owned subsidiary of Energy Transfer Equity. Another was advising RSP Permian when it was acquired by Concho for about $9.5 billion.

Other busy practices, according to Kelly, include finance, international arbitration (which is based in London), appellate, regulatory and restructuring and distressed assets. The firm's litigators are working on a number of lawsuits for upstream energy companies, he said, and defending companies from “shareholder activist” litigation.

“It was quite a year,” Kelly said.

On the downside, Kelly said the energy capital markets practice, particularly with initial public offerings, was “not robust” because of commodity prices. But the firm handled an IPO for New Fortress Energy in early 2019, which could bode well for the practice this year.

Playing the Long Game

V&E focused on expanding in London, New York and Washington, D.C., in 2019, Kelly said, noting that the firm hired lawyers in practices including private equity, antitrust, finance, funds formation and others.

On the expense side, V&E was the first big Texas firm to announce last summer that it would match the Big Law salary increase that pushed starting salaries to $190,000, plus a $5,000 bonus, for first-year lawyers.

The London and Washington, D.C., offices relocated to new space, he said. The firm also renovated its Dallas office and is planning moves in New York and Houston, he said.

In terms of head count, V&E grew slightly, coming in at 622 lawyers in 2018 on a full-time equivalent basis, up 1.1 percent from 615 in 2017. But the firm's equity partner count was 125, a 10.1 percent decline from 139 the prior year. Kelly said the firm has fewer equity partners mostly because of retirements, although some of those lawyers stayed as counsel.

Kelly said 2019 is shaping up well, with a number of deals in the hopper for private equity, infrastructure and technology clients. While energy capital markets has been slow, the firm's REIT (real estate investment trust) practice—which has lawyers concentrated in Richmond, Washington, D.C., and New York—has been picking up.

Kelly said the the firm's partners have “no appetite today” to be a merger candidate, and the firm plans to continue lateral growth in 2019 through the way it usually does it—by hiring “onesies and twosies.”

But long-range growth is also in V&E's sights, he said. The firm expecting a large class of 130 summer associates this year.

Read More:

Deal Wrap: Texas Energy Deals Keep Big Firms Busy This Summer

Three Firms Working on $9.5B Permian Basin Acquisition

Big Texas Firms Expand in London — and It's Not All About Energy

V&E Matches Cravath on Associate Pay, Putting Texas Firms on Notice

Vinson & Elkins Posts Second Consecutive Record Year in 2017

Vinson & Elkins Has 'Best Year Ever' in 2016, Reports Record Financial Results

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

JCPenney Seeks Return of More Than $1.1M From Jackson Walker For Bankruptcy Work

3 minute read

Ex-Appellate Court Judges Launch Boutique Focused on Plaintiffs Appeals

2 minute read

O'Melveny, White & Case, Skadden Beef Up in Texas With Energy, Real Estate Lateral Partner Hires

5 minute read

Chamberlain Hrdlicka Taps a New Leader as Firm Follows Succession Planning Path

3 minute readTrending Stories

- 1Who Is Nicholas J. Ganjei? His Rise to Top Lawyer

- 2Delaware Supreme Court Names Civil Litigator to Serve as New Chief Disciplinary Counsel

- 3Inside Track: Why Relentless Self-Promoters Need Not Apply for GC Posts

- 4Fresh lawsuit hits Oregon city at the heart of Supreme Court ruling on homeless encampments

- 5Ex-Kline & Specter Associate Drops Lawsuit Against the Firm

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250