A Year After Merging, Hunton Andrews Kurth Close to Marks at Legacy Firms

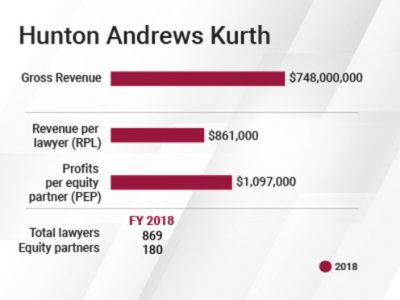

Hunton Andrews Kurth posted revenue of $748 million in its first year, after the merger of Texas firm Andrews Kurth Kenyon and Virginia firm Hunton & Williams.

April 02, 2019 at 05:30 AM

6 minute read

Wally Martinez, managing partner of Hunton Andrews Kurth.

Wally Martinez, managing partner of Hunton Andrews Kurth.

Hunton Andrews Kurth posted revenue of $748 million for 2018, right in line with what firm leaders expected a year ago when Texas firm Andrews Kurth Keynon and Virginia firm Hunton & Williams merged.

Because Hunton Andrews Kurth was formed April 2 of last year, there are no fiscal year 2017 revenue and net income numbers to compare with 2018 results.

But 2018 revenue per lawyer and profits per equity partner at the combined firm landed very close to Hunton & Williams' 2018 results.

The merged firm posted $197.5 million in net income for 2018, according to preliminary numbers. The firm's fiscal year ended March 31.

RPL was $861,000 in 2018, relatively close to legacy firm Hunton & Williams' 2017 RPL of $859,000. And Hunton Andrews Kurth had PEP of $1.097 million in 2018, not far from Hunton & Williams' $1.095 million in 2017.

But the combined firm's numbers fell short of Andrews Kurth's 2017 RPL of $931,000 and PEP of $1.214 million.

“Frankly, given all the expense and time and disruption involved in a merger, this in my mind is terrific,” Hunton Andrews Kurth managing partner Wally Martinez said.

Martinez said one-time expenses of the merger totaled about $9 million and included the costs of consolidating lawyers in a few cities where each legacy firm had an office, moving to the same technology and phone systems, and eliminating some debt that Andrews Kurth had incurred in its 2016 acquisition of about 55 lawyers from New York intellectual property firm Kenyon & Kenyon.

Following the creation of Hunton Andrews Kurth, legacy Andrews Kurth lawyers moved to legacy Hunton offices in New York and Washington, D.C., Martinez said, and the opposite happened in Dallas and Houston.

Because of the consolidation, the firm paid one-time expenses associated with leases on the duplicate offices, as well as expansion and remodeling costs to accommodate all of the lawyers.

“It was important to bring the people physically together in those markets where we share offices,” Martinez said. By 2020, the firm will be done with those extra lease expenses, he added.

But beyond physical things, Martinez said the firm also dealt with other “healthy disruptions” over the year related to the goal of uniting everyone, such as more partner meetings, travel across offices, conference calls and client visits.

The work is paying off, Martinez said, in many ways. He said Andrews Kurth brought a long list of oil and gas clients to the firm, and legacy Hunton cybersecurity lawyers have been able to cross-sell to those clients. Additionally, the capital markets practices from the two firms have joined together well, he said.

Right before the big merger, Hunton announced it would launch a Boston office with a group of 14 lawyers from litigation boutique Manion Gaynor & Manning. That group joined the firm on the same day that Hunton and Andrews Kurth combined, and Martinez said lawyers in the Boston group have been working closely with litigation colleagues in Houston.

“These are the things you hope for, that you don't expect,” he said.

Martinez said some other pleasant surprises included synergies between the tax practices at the firm.

He said the firm had plans for everything related to partner-to-partner integration. But what encourages Martinez is how lawyers have connected, particularly over the last six months. He said he is unaware of a single fight over which lawyer is listed as the coordinating attorney on a matter.

Hunton Andrews Kurth also made some significant lateral hires over the last year, Martinez said. They include energy regulatory partners Myles Reynolds and Tab Urbantke who joined the firm's energy and infrastructure team in Dallas last summer from Vinson & Elkins; partner Erin Fonte in Austin, who joined in February from Dykema Gossett to co-lead the firm's financial institutions corporate and regulatory practice; and finance lawyer Michael Zinder, who joined as special counsel in New York, coming from Willkie Farr & Gallagher.

The firm's new fiscal year just started April 1, and Martinez said he expects some developments from 2018 will be beneficial to 2019 results. Those matters include a substantial amount of IP work for a significant financial services client and new work in the energy finances space for another significant financial services client.

There's opportunity as well for lawyers in the firm's Miami office to do litigation in Florida for a large oil and gas client. He said in-house lawyers from the client, and a Houston partner who has done work for that client for years, traveled together to meet with litigators in Miami to discuss the work.

Martinez said the legacy firms weren't able to combine financial systems until November. That made more work for some administrators, as they had to run client work through dual conflicts systems, for instance, but it also enabled the firm to more easily track matters where lawyers from both legacy firms were involved. They tracked more than 500 joint matters during that time frame, he said.

“The first six months were of unbelievable change, unbelievable stress, unbelievable time disruption, but the last six months, you've really seen the thing come together as one law firm. Practitioners have discovered each other,” he said.

Read More

It's Official: Andrews Kurth and Hunton & Williams Will Merge

Kenyon Deal Gives Andrews Kurth IP Credibility, NYC Mass

Hunton & Williams Enters Boston With 14-Lawyer Litigation Group

Hunton Andrews Kurth Grabs Two Energy Regulatory Lawyers from Vinson & Elkins

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Conspiracy Suits Against Quinn Emanuel, Roc Nation Moved to Federal District Court

JCPenney Seeks Return of More Than $1.1M From Jackson Walker For Bankruptcy Work

3 minute read

Ex-Appellate Court Judges Launch Boutique Focused on Plaintiffs Appeals

2 minute read

O'Melveny, White & Case, Skadden Beef Up in Texas With Energy, Real Estate Lateral Partner Hires

5 minute readTrending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250